Fed uncertainty does not scare the market

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

This article is a version of our careless bulletin on the spot. Premium subscribers can apply here To deliver the newsletter every working day. Standard subscribers can upgrade to premium hereor investigate All ft newsletters

Good morning. New European Defense Fund he says They will only buy weapons from EU sources or from countries with defense agreements with a block. This makes us reasonable from the European view, but, as believers in global capitalism, it is a little despair. Send us e -how and tell us how we should feel: Robert.armstrong@ft.com and aiden.reiter@ft.com.

Fed’s appearance and market response

Yesterday, the market liked what was heard from Jay Powell and the Federal Committee on the Open Market. No one did the wheels, but the supplies, which enjoyed a solid day before the statement and the press conference, climbed further afterwards, although enthusiasm was slightly decaying at the end of the day. Treasury yields fell in dry two years for three base points and then one at each one each. Dovish meeting, then?

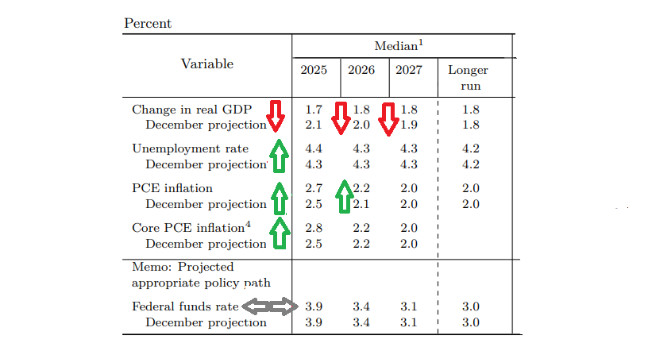

Not really. It’s easy to imagine a world where investors listened to what the bank had to say yesterday and I didn’t like it. Board reduced its prospects for growth Significantly, he increased his chances of unemployment with his hair and ran into his appearance for inflation. Here are medium numbers as shown in the Fed summary, and the arrows have been added to the unburdened:

There is a word for things like this, which is a bad word: stagflation. Not that the Fed predicts a bad Big S case, but still, expectations are wrongly in both sides of the central bank’s term. And the Fed was clear for the reason for this: a sharp drop in the investor, business and sense of consumers to greatly concerned about the care of the Trump administration policies, especially the tariffs.

Yes, the projection of interest rate policy remained the same. But this projection is an average and conceals a shift towards a firmer politics. Cut the three highest and lowest individual assessments and expectation of “central tendencies” for politics exceeded 3.6-4.1 percent to 3.9-4.4 percent. That’s nothing. At a press conference, Powell drew attention to the growing uncertainty of members of the Committee on their projections – uncertainty that is not only higher, but asymmetrical and almost completely on the side of slower growth and greater inflation. Below is the Fed chart of the insecurity of the members of the council on the rate of unemployment (in relation to historical levels) and on which side they set up:

This is all a little spooky. So why a tireless market response? There are several options:

-

The Fed delivered the message that the market had already received. The market knew that politics worries increased the risk of growth and inflation.

-

There was a relief that the Fed didn’t really show his teeth because of the risk of inflation representing the tariffs. Powell took a measured tone, emphasizing that it could be appropriate to look at the prices caused by tariffs until long -term expectations in inflation remained under control. This is not a central bank that wants to choose a fight with the executive branch.

-

The market, desperately due to good news after the bruise, decided to anchor their attention to unchanged projections of interest, to the exclusion of everyone else.

We leave to the readers to decide on their own weight among those three.

End QT

The Fed yesterday surprised the market by announcing the dramatic slowdown of the pace of quantitative splash: a change from a $ 25 billion of value papers to reject the balance sheet every month on just $ 5 billion. It is not surprising that QT is nearing its end; per most measuresWe are close to the goal of the Fed “abundant” but not abundant, bank reserves.

Most forecasts from the end of last year suggested that QT would end up sometime in the first half of the year, probably in June. The picture has changed since then -FOMC meetings from the FOMC meeting showed that the Governors of the Feda were considering interrupting QT earlier than planned, whether there were “swings reserves during the following months associated with the dynamics of the debt ceiling”. Nevertheless, the analysts we spoke with before the meeting suggested that the Sunsating QT would start in May, not March.

Yesterday, Chairman Powell said that slowdown only part of the usual course of QT was not reflecting concern about the upper debt limit. It’s a different message from a meeting notes in January. And such concern would be justified: the debt limit or the limit of what I can now borrow to finance liquid deficits, it was returned earlier this year, after a two -year suspension. Until the debt limit is lifted or restored, the treasure trove cannot issue a net new debt. Instead, he spends his account of $ 414 billion on the Fed.

The clock ticks. Even with new tax revenues, the treasury should have money “sometime this summer, potential August”, according to Brij Khuran from Wellington Management. After that, the treasury will have to take “extraordinary measures“To prevent the US government from not paying.

The Congress is most likely to raise the upper border of the debt before it happens – although it will almost certainly be political tectri. After that, the treasury will have to betray the new debt for the renovation of their cash registers. If that coincided with QT, it would double burden the liquidity of the financial system that the Fed would like to avoid, says Gingrad Dhinggra, the main American strategist at BNP Paribas:

When the treasury suffers its cash balance, it adds liquidity [banking] rustling. But when the treasury renews its cash balance [by issuing more Treasuries]That money goes from the banking system back to the FED for the Treasury. This draws liquidity from the banking system. QT also takes liquidity from the system.

The treasury issued a new debt in 2022 when QT was in full swing. But at that time there were more liquidity and more liquidity sources (such as funds in the reverse redemption program). If the QT and the bang of the new treasury have occurred at the same time, the crumb of liquidity may have been threatened.

Slowing QT is a welcome news for the market. The shares of the price added liquidity. And although the effect of QT and qe on the yields of treasury is probably small, all the other equal end of QT should reduce the treasury a little and the treasury.

We are happy to have taken Powell to his word. But it simply happens that slowing QT will turn off some pressure during what could be tense summer on Capitol and in the financial system. Some Republicans focus on national debt, while most Democrats seek ways to push away against Trump. This increases the risk of fiscal edge while Congress decides what to do with the debt limit. It is best to risk from the table you can.

(Repeat)

One good reading

Ft insurmountable podcast

You can’t get enough unexpected? Listen Our new podcastFor a 15-minute dive on the latest news of markets and financial titles, twice a week. Catch in the past editions of the Bulletin here.