Elon Musk X is a lesson in EBITDI and EBIT-Don’t’s

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Accounting is not real life. The dollar of revenue in your annual report is not quite the same as a dollar in the tale. This is mostly fine and often a good thing, from the investor point of view. But sometimes financial numbers can cover up, not illuminate. Elon Musk’s X is the case.

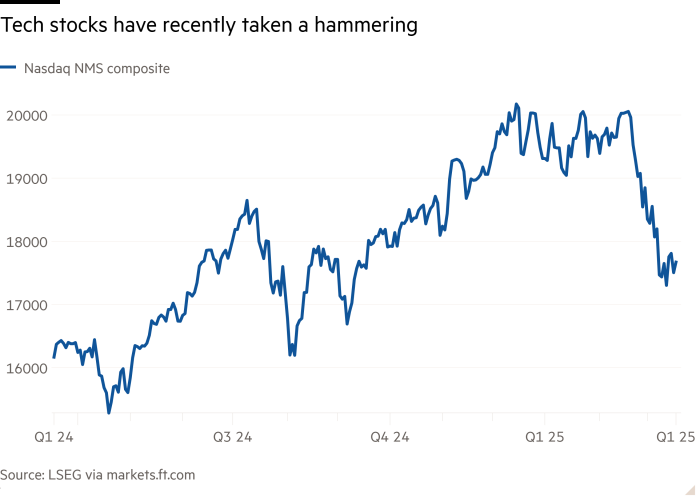

Stocks in the social network recently changed UA to a 44 billion dollars evaluation Including the debt, the same amount that Musk paid to buy it – when it is still called Twitter – 2022. This is a surprise for two reasons. First, technological shares are recently sliding. Second, not too long ago, investors in a non-duty X have written the value of their investment on a fraction of that amount.

How did Musk do that? There are various explanations. One is that today’s X is not the same as yesterday’s Twitter. One change, of course, is intervening the flourishing of artificial intelligence. Musk’s own Ai project, XAIIt could be worth up to $ 75 billion if there is a suggested financing. Investors in X get a slice of that job.

There are also signs of X is better. The company confesses $ 1.2 billion EBITDA, people told the Financial Times, close to the amount of 2021. – Although the income has fallen since then. This can suggest that musk makes x more effective.

Catch: it is said that these eBitda numbers are said “Wildly customized”. This questions the question of whether X’s performance looks better than the less aggressive presentation.

In one sense, it is always a trap with EBITDA, an accounting fabrication designed for smooth lumps and blows. This reflects a simplified view of what is left of revenue after deducting the cost of the company and neglects the investment in things that the company plans to use over time.

But adjustments on top can further trap the image. Companies usually exclude one-time costs-discussing what it means to compensation based on shares. As the technological companies go out to capital to preserve Gotovina and motivate employees, adjustment can be significant.

For companies in Nasdaq the composite index, EBITDA, excluding the compensation on the basis of the shares, would be medium 7 percent higher, based on an analysis of the S&P Capital IQ. The investor who merged Palantir’s Ebitda would find him worse if the pay off the shares set off. Cyber security company Crowdstrica increases approximately ten times; Datadog is more than six.

Since EBITDA is not a standard number, it can be adapted to the occasion. Companies can report their earnings “before” anything, and they do it. Consider eBitdare (real estate costs), eBitdao (options costs) and – awful – eBitdard (research and development).

In the case of X, it remains to be seen what and how wild they are, and the adjustment of EBITDA. Investors who trade their shares that are not on the list are probably sufficiently sophisticated to run their own complex models. One of them Could be a musk himselfBloomberg reported on Tuesday.

This, however, indicates another reason for care to act with estimates: Choose transactions among private investors – like the auctions of fine arts – only a small number of people need to agree. When Twitter was still public, his market capitalization plus $ 40 billion was the result of tens of millions of stock stores a day. As accounting is not real life, for now $ 44 billion is not real money.