American economy is moving into a recession

This article is a version of free newsletter for lunch on the spot. Premium subscribers can apply here to deliver the newsletter every Thursday and Sunday. Standard subscribers can upgrade to premium hereor investigate All ft newsletters

Happy Sunday. This week I return to the American economy.

The prospects for the recession in America have grown this week. However, this is not the basic case of analysts for this year. So, holding on to a free lunch on Sunday’s opposite tradition, here’s why the world’s largest economy will succumb to the fall of 2025.

The argument has two components. First, even before US President Donald Trump’s inauguration, the American economy was weaker than many appreciated it. I stated why u a column of opinion In August and in the earlier edition of this newsletter, “Disclosure of American exceptionalism”

Secondly, “Trumponomy” further muffled the prospect of the introduction of the stagflation forces and the risk of the financial market. It’s the focus of today’s newsletter.

Let’s start with consumers. Reminder: High consumption has launched a debt and cost on basic things such as food, housing and health care. Serious credit card conditions reached a 13-year maximum at the end of last year, with steep interest rates more closely to households.

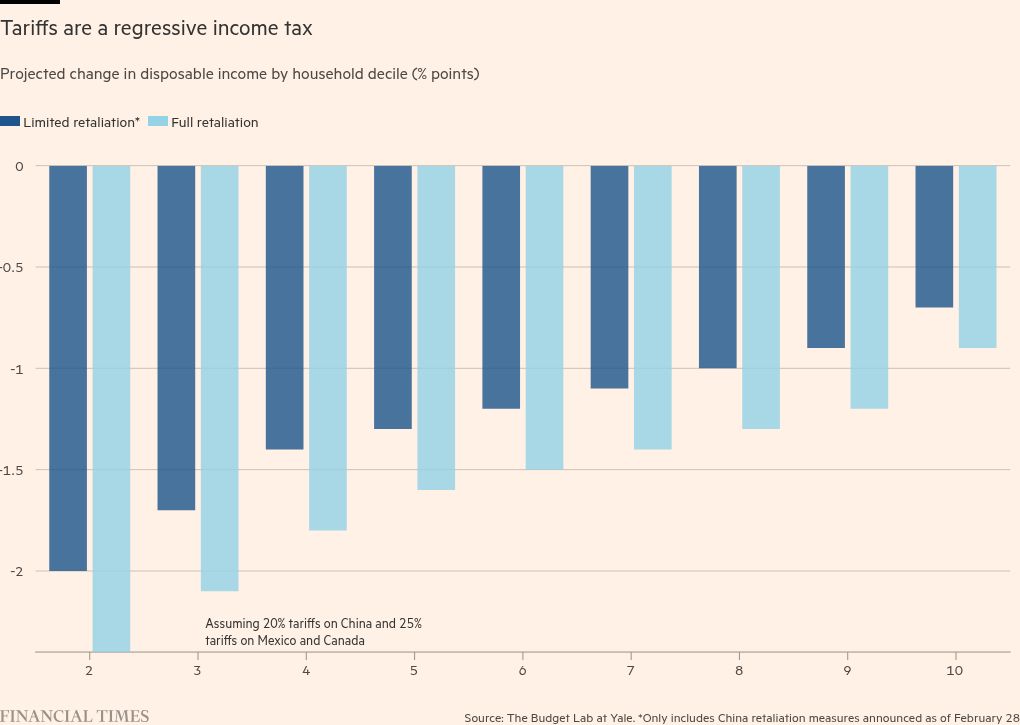

The white house’s agenda will add insult to injuries by reducing taxes on top. The proposed duties on Mexico and Canada (now after a break), plus those already in China, will increase the effective US USA in the highest since 1943, according to Budget Laboratory on Yale. He thinks a higher price level could cost households up to $ 2,000.

This is just a tasting; Further tariffs are expected. And although the president has a sense of pushing deadlines, the impact on feelings is already great.

Confidence fell. Consumer inflation and unemployment expectations have increased. It’s a vicious trifecta. Households are still trying to run by 20 percent, after a pandemic increase in price levels. Significantly, the actual consumption fell in January for the first time in almost two years. Careful consumption behavior is now more likely.

Further, work. Tariff and customs rules, wider capriciousness in creating politics and problematic consumers are a powerful compound. Import duties are set to increase costs, and retaliation of measures will suffocate international sales. But radical insecurity also interferes with the company’s ability to plan and adjust.

The effects are already appearing in business activities. The Analyst Index of Goldman Sachs pointed to contraction in sales, new orders, exports and employment among production and services in February. Consumption Construction – which increased under the Law on Inflation Law and Law on Chips – also slowed down, with Program statuses Unclear under the new administration.

Corporate prospects also muffled. Capes indicator has fallen on contraction territory. It has historically signaled slowing down.

Employment plans for small businesses are also thinning, according to the latest NFIB survey. AND The challenger tracker Planned job reductions jumped in February, stunning 245 percent.

Reminder: Before Trump entered, many have overrated to which extent the American “strong” labor market has supported the dynamism of the private sector. Government, health care and social assistance consists of two thirds of new jobs created from the beginning of 2023 (and half of 151,000 non-compullasting salaries added in February). Immigration has also increased employment growth from pandemic.

Then come the goals of the new administration. In addition to the impact of the uncertainty of politics on the private sector, Evercore Isi estimates that the efforts to reduce the costs in the public sector of Elon Musk could shave a total of half a million US jobs this year. In an extreme scenario, which could reach more than 1.4 million.

The planned control of unfathomable immigrants, which make up at least 5 percent of the workforce, will add job loss.

Then this administration prompted the risk of stock markets larger.

Before Trump entered, the S&P 500 was already at historically high multipine value and levels of concentration-market capitalization of the largest 10 companies for several decades.

But the markets were also underestimated by how much the president would go with their daily policy order, which is appropriate to the recent correction in the US stock market to the level of election.

Last year, analysts suggested that stretched S&P 500 estimates were not overly worrying, as they reflected greater estimates of earnings and the promise of artificial intelligence. But optimism about earnings will now work. Sales and investment plans are darkened by uncertainty, in AI and otherwise. Many US companies make significant amounts abroad, Trump could keep trade wars against. In other words, stock prices have room for decline.

If the president really “just started” with his plans, his tolerance for further weakness on the stock market could be quite high. However, the threat of falling market has real economic implications: the household share of owned as the share of their total assets is in the record.

Finally, the wider financial risks seem more likely (even if their likelihood is still low) and could encourage the financial conditions.

Matt King, founder of Satori Insights, indicates potential triggers who could reverse the American status of a “safe refuge” (in which flights to safety are associated with a stronger dollar and lower treasury yields). “A combination of concern about fiscal irresponsibility, nourished independence and some extreme proposals. . . As part of the mar-a-status agreement, he could only do a trick, “he said.

Administration plans to connect deficit with tariff revenue (especially if they stop the start), and the so -called government efficiency department are very questionable. The cost of borrowing now is already high; Fiscal lightness adds yields. Demand in the American Treasury faces other potential winds, such as the upcoming increase in the German Bund issuance. It is now easier to imagine that now they become caught in a vicious cycle of larger yields and larger debt projections.

Then there are the risks that Trump’s plans rely on: institutionalization of cryptocurrencies, accidental financial deregulation and potential manipulation of dollars.

Markets do not know how Price uncertaintyJust like when Trump was last in power. A fast price of political risks could stimulate the dynamics of sale in bond markets and capital. This can then initiate liquidity problems.

It is also not clear as the Fed react. Considering the underrated signs of cooling economy last year, interest rates were too restrictive by entering Trump’s second term.

Now the prices are in the posture pattern. The odds of growth weakening increase the expectations for reducing. But with inflation expectations growing and recent memories of high prices growth, the Fed could lean against a cautious side and keep high rates. In this case, the prospect of growth would be further dimmed. Indeed, the compromise of inflation is harder for the Fed to evaluate, increasing the risk of error.

Uprising? Many analysts reduce their prognosis for GDP for this quarter, guided by companies that make imports in the expectation of tariffs. Most expect it to rest in the second quarter (although Trump’s stopping tariffs will continue to stimulate stock). Even then, with slowing activities and feelings, increasing financial risks and less than dynamic economy, it is difficult to see what could lift mood and encourage growth.

Maybe Trump’s tax reduction measures and deregulation? First, they have yet to start. Second, they will be compensated for by the elements of anti-Rast of his policy. Tax reduction will increase profit, but the ability to do anything with gains will be limited by uncertainty and higher import costs. The reduction of bureaucracy can support investments, but monitoring different new tariffs and carving regions is a huge additional regulatory burden.

It is possible that the fall can be avoided. But that would require Trump significantly to alleviate his plans for imports and restraint his style of cracking from the house. What is that?

Refutation? Thoughts? Send me a message on freelunch@ft.com or on x @tejparikh90.

Food for thinking

Here’s a reminder of why a free lunch at Sunday’s Analysis is worth the counter-consensus. Recent calls addressed to European sharesWho,, German economy and China He seems to be traced.