US metal prices rose large premiums in front of Tariff Donald Trump

Unlock Bulletin on White House Hour FREE

Your guide for what American choices 2024 means for Washington and the world

Merchants in the United States pay much higher copper prices, aluminum and steel from their European counterparts as they rush to buy metals in front of Tariff President Donald Trump.

On Sunday, Trump He said he would impose 25 percent of tariffs on all imports of steel and aluminum. He also threatened to apply the impacts to the imported copper.

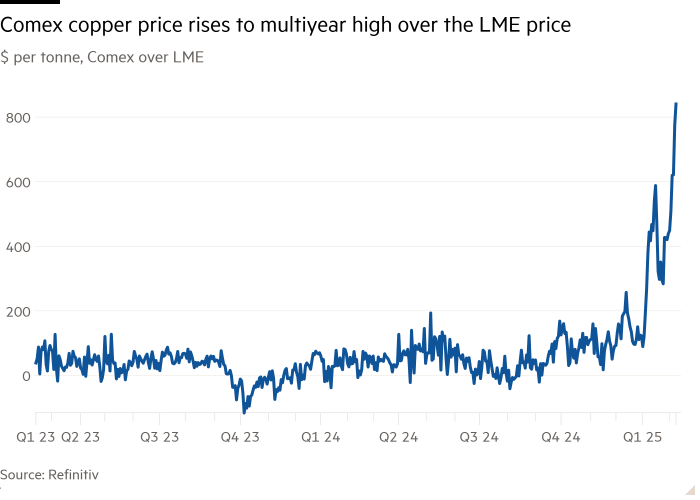

Supervision tariffs They created an unusually wide transatlantic gap in prices, with a premium for the reference values of New York Comex Bakar Futures expanded to more than $ 800 in tonne compared to the price in London, which is the highest level of at least early 2020. Comex Copper rose by 2 percent on Monday and just over $ 10,000 in Toni.

High American premiums reflect the “distorted” market, Tom Price said, an analyst from Panmura Liberum, reflecting fears for “starving supply”, not more common reason for increased demand.

“Now in the short term I cannot switch to any other source,” he said, so customers “compete with each other to catch up with metal.”

The larger US premium is a reflection of “expectations that prices will be higher in the future as a result of tariff,” said Daria Efanova, a research leader at Sucden Financial. “Prices for this before you actually hit.”

Trump was expected to give more details about potential tariffs later on Monday, potentially, including whether there could be exemptions, as approved when he charged Tariff in Metal in the first term of the President.

After his previous turns on the tariffs against Canada and Mexico, analysts say that many traders are waiting for more clarity, with some avoiding busy positions until politics get clearer.

“Insecurity creates Skittish,” said Al Munro, an analyst from Marex. “This creates a lack of investment. You just sit there and you don’t do anything.”

Copper is widely used in electrical equipment such as wiring and engines, while aluminum is an easy material used in a series of industries, including the car and air sector.

Copper is taken to Comex warehouses on the so -called “paid duties”, which means that all taxes must be paid before the metal enters the objects. This means that food would not affect delivery before entering into force of tariffs would not affect.

Comex’s copper sections jumped last year and this year increased. “People want to protect themselves from the sea to pay the price of copper plus tariffs,” said William Adams, head of Base Metals research in Fastmarkets.

Prices of steel and precious metals such as silver and gold have also grown to large premiums in the US, as merchants are rushing to ensure access to physical metals on the eve of any potential tariffs coming.

Potential tariffs on steel and aluminum are likely to have a particularly major impact on the Canadian aluminum topionice, which supply about 44 percent of US aluminum needs.