Sterling surpasses rivals on stronger economic data

Unlock Bulletin on White House Hour FREE

Your guide for what American choices 2024 means for Washington and the world

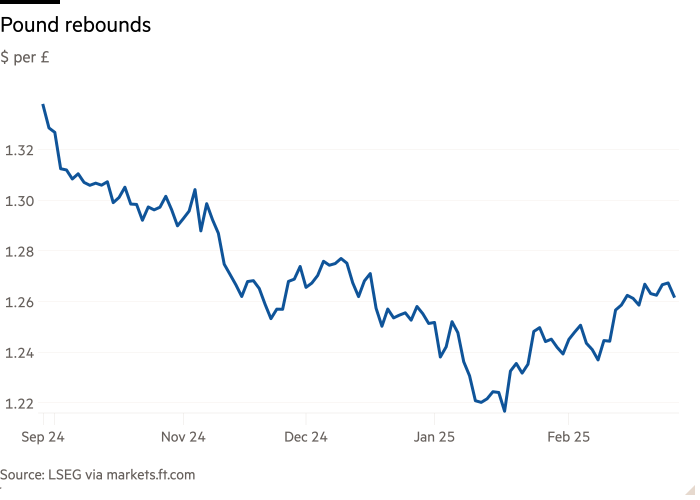

The lesson has recovered strongly compared to the dollar and the euro in recent weeks, because the turn of the so -called Trump store has been affected by the US currency and investors have bet that the UK economy can be better than afraid.

Sterling climbed 1.8 percent in February compared to the dollar, its best month since September, despite losing some terrain on Thursday. This week increased as much as $ 1,2715, after falling below $ 1.21 last month.

Although the inflation remained above the goal, better than the expected retail sale and GDP data provided investors with worried about anemic growth in the UK.

“People were worried about the stagflation, but the growth of that narrative does not seem to be able to present recent data.

The rally was also guided by the “cooling of Trump stores” – with the shooting of the bets to encourage US President Donald Trump to encourage inflation and push the dollar and other property – and “surprisingly positive” economic data in the UK, said Brad Bechtel, a global header of the FX Jeffers.

UK inflation rose up to a 10-month high Of the 3 percent in January, increasing the odds of slower interest reduction than the Bank of England, which helped Sterling support.

Foreign purchases of the ribbon, which give more than American treasures, provided a further tail wind per kilogram, analysts said. Last year, foreign purchases increased to approximately £ 102 billion, which is the highest level ever, according to Boe data.

Many analysts believe that the pound is better located than other G10 currencies to ride from the crowded US trade tariffs, given the greater reliance on the eurozone to export such as a car, which was targeted by a new president.

She has been crazy to strengthen 1 percent compared to the euro so far this month.

Sterling has abolished “warmer” information on inflation and perception that the UK has had less exposure to the threats of US tariffs, said Francesco Pesole, strategist FX ING. But he added that “a peaceful gilded market remains necessary” to strengthen it, alluding to recent sales in the UK Government bonds, which are also a currency jars.

In the meantime, other economists have warned that it is too early to call a significant improvement of the economy in the UK. Public finances swung to a smaller than expected excess in January.

“Things are a little better on the back very, very weak expectations,” said Hetal Meht, head of economic research in St. James.