Investors have more choices – but are new offers good?

Thirty years ago, investment management was mostly a boutique business in which fund managers kindly agreed to convey their wisdom to clients in exchange for a major annual fee.

These were great days for stars managers. I interviewed Jeff Vinik back in 1995 and then led the world’s largest mutual fund, Fidelity Magellan. He let me the fund that morning added $ 1 billion. Good news for revenue from Fidelity compensation.

Then a large number of fund management groups were able to earn a decent life and no one dominated the market. True, this was partly because the performance was not far from random. This has acted for the benefit of the manager, because they would always have several funds that surpassed the market. They could attract optimistic clients who hoped, despite the regulatory renunciation of responsibility, the past effect would be a guide for the future.

But all that changed. In the past three decades, the property management industry has been a revolution. The sector that has been proud of with its expertise has become a commodity. I inevitably, funds managers are trying to adapt to this revolution by introducing new products. But although these innovations can look like great opportunities for investors, they can prove themselves to be a trap – together.

The revolution was encouraged by economic reality: clients were gradually awakened by the fact that passive funds, which only accompany the index, give them a cheap, simple method for investing in the main classes of property. In the United States, the passively operated funds grew with only 19 percent of the market in 2010, most of the markets in 2024. The trend is tireless. Morningstar revealed that the cheapest quintil funds in 2023 experienced a net influx of $ 403 billion, while the rest of the sector suffered outflows of $ 336 billion.

This meant that the fees paid by clients fell dramatically. The Morningstar survey revealed that the average annual compensation in the weighted property paid by US investors from 0.87 percent in 2003. At 0.36 percent in 2023. Since the US industry manages about $ 30 in mutual funds and exchange of commercial funds (excluding money market funds and fund compared to 2000 £).

It must be one of the largest and least certified economic gains for consumers in recent history-they are better better in the new regime.

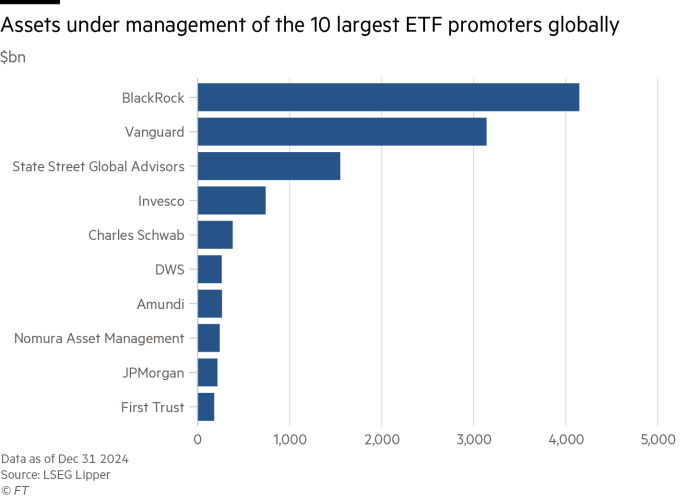

For funds managers, however, the result was Darwini’s struggle in which the survival moved to the cheapest. The monitoring of the index generates the economy of the scale; It doesn’t cost much more to manage a $ 10 billion fund from a $ 1 billion fund. So the industry consolidated. In the world of trading exchange (ETFS), the first three managers (Blackkock, Vanguard and State Street) control nearly two -thirds of all assets, according to Lipper, the financial data service.

The return was inevitable. One of the biggest trends in the industry is to launch Active ETF -oviwhich have higher fees. Active ETFs charge 0.4 percent per year (using the average industrial assets) about three to four times more than a typical passive fund. Goldman Sachs launched Active ETF with a fixed income in February and Cerulli Associates says that 91 percent of ETF managers are planning to develop an active product.

A significant proportion of ETF based on active active active, with about $ 2.76 assets according to Lipper, is in the field of investment based on factors or “smart beta” in industrial jargon. These selects of shares based on a set of financial characteristics. ETF value is selected by stock with high dividend yield or low price in relation to the value of their property. Momentum ETF choosing supplies that have recently increased in price and so on. In a sense, such funds are trying to use the stock insights that traditional funds managers use on the system. The fees for such funds are 0.18 percent per year on average, approximately half of the level charged with other active funds.

These investment styles can seem common sense; In case of stock values, it seems attractive to buy shares that are “cheap”. The problem is that the strategy can less perform long periods. A study from the UBS Global Investment Returns Year in 2024, by academic investment gurua Elroy Dimson, Paul Marsh and Mike Staunton, revealed that in the UK, she has appreciated the supplies of her colleagues of growth from 1987 to 2020. The shift time between the factors looks very difficult, and the academics have found food portfolio with high portfolio.

Therefore, it remains to be seen whether the active ETF will have more likely to surpass the market than their equivalent of the mutual fund. Mathematics makes it unlikely. The index represents the effect of the average investor, before the fee; Therefore, the average fund manager cannot expect that he will be beat after the fee. For a retail investor, buying an active ETF seems like a triumph of hope in experience.

Whether the active ETF replace passive funds in the portfolio of investors is another question. It may be that they take the place of actively managed mutual funds instead. This is part of the general shift from mutual funds and according to ETFS in recent years. Michael O’Riordan, founder of Blackwater, advisor, says that “ETF -Etf basically eating lunch of mutual funds at a speed that even an ETF fans would be surprised.” According to Oliver Wyman, advisor, ETF assets rose to 16 percent annually between 2016 and 2022, compared to 5 percent for traditional mutual funds. In the United States, ETF assets grew with only $ 66 billion at the beginning of 2001 at $ 10 at the end of last year. The global asset ETF was more than $ 14. Zachary Evens, analyst of research in Morningstar, says ETF are generally cheaper than mutual funds, are more transparent (in the sense that investors can see their fundamental stakes) and are traded on a daily basis.

Active ETF -Os are not the only alternative for retail investors. ETFs based on the option are using derivatives to offer another type of refund. One group ETF increases the yield in the Fund by selling an option to call for shares in the portfolio. These calls give other investors the right to buy these shares; In turn, ETF generates premium revenue. The effect is to create a capital fund with higher income, but with a limited increase in (if the portfolio shares are increased, calls will be made and ETF will need to sell these securities).

Another type of ETF option is called an interpreter. In these means, managers buy options that give them the right to sell shares at a particular price. This limits the amount ETF may fall. But the purchase puts in money and compensate for that cost, ETF managers sell calls to shares. This also limits the progress of the fund. Thus, buffer funds offer a narrower range of refund, which can be liked with more cautious investors.

How do investors should see this property? The point of investment in the shares is the possibility of long -term refund. A higher income in the short term can be achieved by combining ownership property with government or corporate bonds or deposits. Many investors will already do this. The diverse distribution of property can thus provide a higher yield, together with restrictions on the supplement and lower side of yields offered by ETFs based on the option. And the DIY option for investors can be cheaper. Morningstar data show that the ETF-based fees are varying from 0.66 to 0.82 percent per year, depending on the type of fund, significantly above the costs charged by passive funds.

Perhaps the ETF sector is best seen as a maturation industry in which the basic product is repacked to provide consumers with a much wider choice. Whether this choice is in the best interest of a consumer or manufacturer, it is another matter. Starbucks makes the virtue of its ability to offer a wide range of caffeine drinks. Consumers can order a java chocolate chip Frappuccino with a slap if they want. Whether it is the best value or truly the healthiest option other thing.

One choice that has become less popular lately is the ESG (ecological, social and management) sector, a modern version of what was once called ethical funds. There was a great shift in the US in the US, especially after the election of President Trump. Corporate America tries to lower its emphasis on diversity, equality and inclusion; Probably focus on uniformity, inequality and exclusion. The speed of this turnaround brings in mind the old Groucho Marx Quip: “These are my principles and if you don’t love them, well, I have others.”

Before Trump’s re-elections, the ESG funds in Europe were far more popular than the US. Europe makes up 84 percent of all sustainable funds, compared to only 11 percent in the US. This suggests that the sector will not disappear; Last year, there were $ 54 billion inflows, Lipper states.

There is a respectable case for the claim that ESG funds could surpass in the long run; Companies that damage the environment, do not act non -ethically or poorly manage the downfall of regulators and courts, or be a victim of a change in consumer feelings. And they won other funds in some time periods; For example, in five years until the end of 2023. But they include bets in large sectors; For example, they tend to have energy and overweight in technology and health.

In the last month or so apparently We retreat From its safety dedication to Europe means that there has been a large increase in European defense supplies; Something that most ESG funds, which avoids defense, would not catch. Furthermore, although the benefits of sustainable funds have fallen for a third in the last 10 years, they are still, 0.52 percent, higher than the average active fund.

Another potential new choice for retail investors is a private loan. This is a debt that is not traded in the public market, unlike corporate debt. Most of this debt has issued a private capital company to finance the purchase of companies that make up their portfolio. This debt can be quite amenable and it can bring decent yields; Institutional private credit funds made double -digit yields both in 2021 and 2023.

But this class of assets is illiquid by its nature and therefore one has yet to start the ETF specialized in the sector. Only high -value clients will probably be able to get exposure. And they should be aware of several warnings. The first is that the funds that invest in a private loan tend to issue the same companies for private capital that issue debt; It is a potential conflict of interest. Second, in the case of a recession or permanent increase in interest rates, a private loan, like any other high -yield debt, is likely to experience default values.

The latest report on the global stability of the IMF has warned: “Some medium-sized companies that are borrowed at high interest rates on private credit markets are becoming more tense and resorting to the methods of payments in Natas, effectively delaying interest payments and piles on more debt.” The report also warned that competitive pressure in this sector leads to exacerbation of the insurance method and weaker agreements (where the borrings agree to the financial conditions).

The industry offers many new options to tempt investors from low -budget index funds that begin to dominate the market. Some may like investors seeking diversification in their portfolio. But one rule should never be far from the minds of such investors; Larger yields are not safe, but larger fees are.