How to kill Fed independence

This article is the version of our Chris Giles on the spot on the Bilten Central Banks. Premium subscribers can apply here To deliver the newsletter every Tuesday. Standard subscribers can upgrade to premium hereor investigate All ft newsletters

Ever since last year’s victory for the election of Donald Trump, the Federal Reserve officials have followed the strategy of adherence to their knitting, together with concessions in areas peripheral from the basic functions of the central bank.

Fed took down pages from its website about diversity, equality and inclusion, which stool Said Jay Powell either “reconcile our policies with executive commands”, withdrawn from International Central Bank International Network for the Green Financial System and prominent refused to comment about the merit of the tariff.

Michael Barr, Vice President of the Fed for Surveillance, announced that he would step down from that role to allow the president to make his own selection and He explained last week He did not want to become a “distraction” that would “put the Fed into crossing”.

As far as big questions are concerned, Powell was unwavering that the president could not legally release him nor members of the Board of Directors and this Central Bank independence in interest American economy.

So far, Trump has called on Fed to reduce interest rates, but he has not tried to mix directly. His side -stroke, Elon Musk, said last week that he wanted to Audit Fed without elaboration. An uncomfortable peace prevails.

In November I am afraid I was too much Sanguin because of Threats of the FedSo, today I look at relevant evidence and ask the question, will Trump want to take control, in order to die independence? The results are not fully convincing.

Staff puts on

The favored method of autocrats around the world is that the central banks crash with the flunkies to make their offers. The standard view is that it will be difficult for the US president. The conditions for the Governor’s Committee Office of the Fed are listed below, and only the places of Adriana Kugler and Jay Powell are empty in the next four years.

AND Federal Reserve Law He states that Governor can only be removed by the president “for reasons”, which means that they would have to commit serious misconduct in power.

Don’t let these facts make you easier.

February 12, Sarah Harris, Acting Lawyer, Wrote to Senator Richard Durbinstating that the Ministry of Justice no longer believes that these provisions are “because of the cause” of the constitutional and the “department will no longer defend its constitutionality.”

She specifically mentioned the Federal Commission for Trade, the National Committee on Working Relations and Members of the Consumer Products’ Safety Commission, but also included in its argument “various independent agencies” that had a “significant executive government”.

This issue is tangentially already in the Supreme Court regarding the shooting of Hampton Dellinger, head of the Office of Special Advisors of the United States. Justices delayed the decision last Friday. More important for the position of the Fed was Trump’s release of Gwynne Wilcox, who was sitting on the National Committee on Working Relations. She also sued.

The Supreme Court has already canceled the “for the cause” for agencies with one person in charge. Legal scientists suggest that there is A good chance In court, there is a majority that would cancel this longtime precedent for multi -member committees of government agencies, giving Trump authority to release members of the Fed Committee.

In a Wonderful paper In the legal position of the Feda, Professor Daniel Tarullo from the Faculty of Law with Harvard, a former member of the Fed Committee, wrote in 2024 that if the Supreme Court would cancel protection against the removal of the cause, “The [Fed’s] The Governor’s Committee would join many other agencies at the intersection of the following constitutional challenges. ”

We do not know if Trump will succeed in court and, if so, whether the FED members will be discharged, but Putsch staff already happens in other federal agencies.

Regional fed weakness

The second weakness in the Fed constitutional position refers to the regional Fed presidents sitting on the Federal Committee for the Open Market.

In order for their position to be the Ustasha, Tarullo claims that they must ultimately be considered “inferior officers” now, because the president did not appoint them and confirm the Senate. This was The view of the office of a legal advisor In 2019, although Tarullo said, “Dostic of this conclusion, it should be done.”

The problem is that setting interest rates is more powerful position than most and certainly more powerful than other inferior officers. Voting against most of the Fed Committee (say in 8-4 voting when most of the Governor’s Board of Directors lost voting, but five voice regional presidents of the Fed on the minority side would expand the boundaries of the constitutional position of inferior officers. The Committee could dismiss inferior officers and encourage their position at a special meeting, but, as Tarullo said, scenarios like these are not “unable to run the central bank.”

This edition is not live right now, but things are changing.

Delegation Directive

The most direct challenge of the Fed authorities would come if Trump decided to challenge his ability to make decisions regardless of his opinion towards the government awarded by Congress.

On its website Fed expresses no doubt that his committee “runs the work of the federal reserve system for promoting goals and fulfillment of the responsibility that the Federal Reserves were awarded by the Federal Reserve Act” and that the “Federal Government Agency reports and is directly responsible for the congress”.

But this view is under the direct threat of Trump’s thanks to the two executive command he signed last week, wanting to submit the authority of the agency under his control. First They stated that “officials who have a huge executive power must control and control the elected president of the people.”

Fed regulatory powers were targeted in order, although there was a carving for monetary policy. But if this executive order survives the inevitable court challenges, the neckline would not be worth much.

This is an area of significant legal insecurity. Congress is allowed within the 90-year precedent of power delegation as long as it gives “”understandable principle”For the agencies they work. AND Another executive order Last Wednesday, they sought to attack it directly, wanting to abolish “regulations based on illegal delegations of legislative power.”

Tarullo thinks Fed’s double term here is potentially vulnerable because it is a double term of stable prices and Maximum employment can be in conflict and is therefore not an understandable principle. Application of the recent thinking of the Supreme Court here, he wrote: “He proposes[s] Significant, if not the main, problems for the Federal Reserve Act. “

Since Tarullo wrote his position last year, I caught him yesterday to get a look at where the maneuvers left the Fed for the past few days.

Professor Tarullo said there was no doubt that these questions would be litigation, and the case was viewed from Wilcox, which was discharged from NLRB. If its protection against the cause is considered unconstitutional, “each independent agency is called into question.” Fed could have some special arguments why he was different or the NLRB case could be firmly defined, he said (Marked in his work), but the direct finding of the Supreme Court would ask questions about the constitutionality of the Fed Committee.

That was said, Tarullo saw a little desire to attack the Fed from the new administration. “It is in its own interest of the administration, it does not suggest that they will replace Jaya Powell or other governors. They seem to understand it,” he said. But efforts to separate monetary policy from financial regulation in Fed’s tool contain many gray areas such as Fed’s arrangements for borrowing banks and macroprudenial policy, which complicate carving in the first Trump’s executive order.

This could only be until the financial market reaction if Trump decided to hit.

Fait’s destiny

Talking about the things that are lined up for Chop, the Federal Committee for the Open Market inform These days were numbered due to flexible targeting inflation (Fait).

Fait was introduced to the Fed Statement of longer goals and strategy of monetary policy After the 2019-20 examination, he stated that the FED would seek to inflation moderately hot on time “after the period when the inflation lasts permanently below 2 percent”.

In the minutes, officials noticed that the economy had changed a lot since 2020 and that he then wanted to review the elements. The most significant probable change is highlighted “access to the target of inflation moderate above 2 percent after the period persistently below the target inflation.”

Fait is a fate sealed.

What I read and watched

-

Losses Set up on ECB As the interest is paid on bank reserves (for the placement of the interest rate overnight), they are higher than the bond yields purchased in the Quantitative Mitigation Program. Since the losses are not immediately recognized and compensated with new capital as opposed to the UK, the ECB will not pay dividends to its Member States for some time to come

-

Also in Frankfurt Isabel Schnabel, a member of the ECB Executive Board, gave a a Hawkish interview to ft. Complete transcript

-

When will the US bond market rebel against fiscal larges? Is that financial? “That’s, until it’s not,” says Marko Sobel, a former US Treasury Officer, for FT in Great reading It is worth your time

-

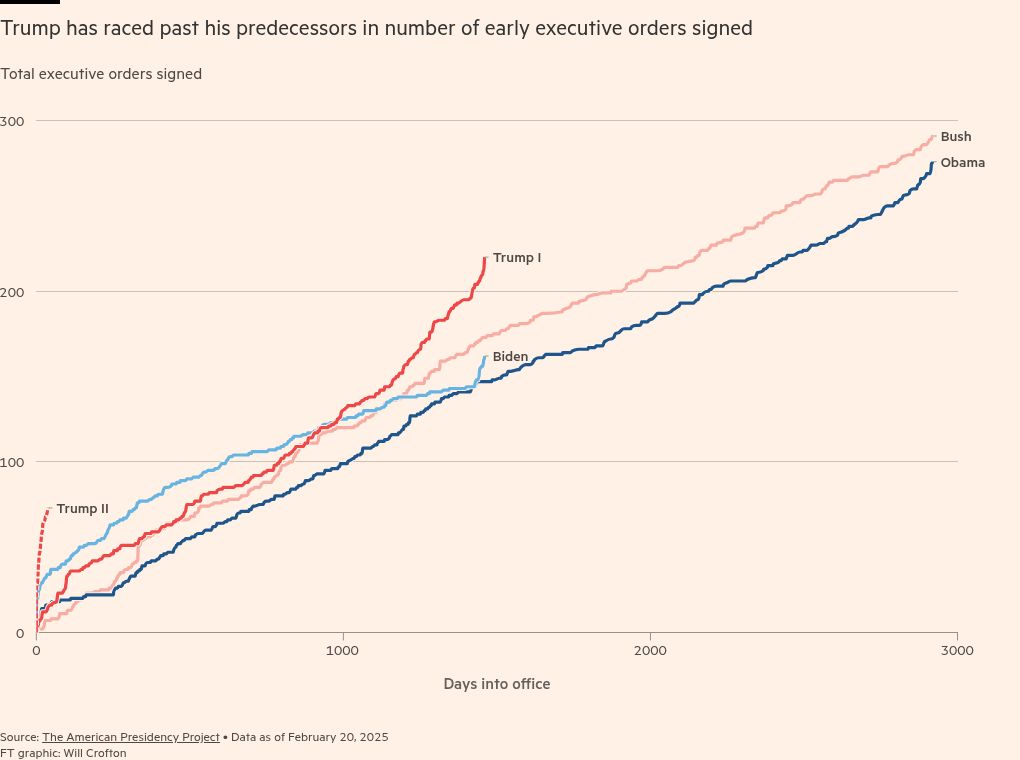

And if you like the scales, see visual feast The first month of the second Presidency of Donald Trump

A chart that is important

Corporate earnings calls are an excellent alternative source of fast information in which companies are distinguished. In recent weeks, the number of penalties associated with corporate risk trade has increased to the US (chart below), as well as in other countries, especially Mexico and Canada.

The caution of business, in the case of trade uncertainty, is one of the big disadvantages for the global economy this year. We will soon see if executive concerns are translated into lower consumption.