American stocks lose more soil as jerks grow over tariffs and economy

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Technical shares on Thursday led to a sharp market sales, as the last threat of Donald Trump imposed steep tariffs to import the main commercial partners added to investors’ concerns due to the health of the American economy.

Blue Chip S&P 500 lost 1.6 percent, taking its fall from last Wednesday to 4.2 percent and deleted the annual profit on the market.

Technologically heavy Nasdaq Composite closed 2.8 percent, and Nvidia dropped 8.4 percent even after the chip manufacturer reported overnight about a jump in revenue of almost 80 percent.

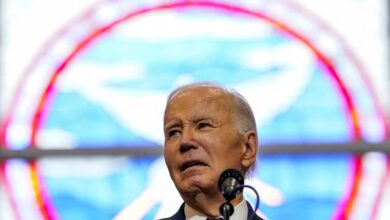

Investors in investors on NVIDIA’s earnings have left the market vulnerable to poor macroeconomic news, according to investors. US President The latest announcement barracks In Chinese, Mexican and Canadian imports, announced on Thursday, they come after the data published in recent days have pointed to a sharp drop in American consumer and business feelings.

“Nvidia did not save the world,” said Mike Zigmont, a trading teammate in Visda Investment Group. “The results were great, but not so great great that everyone wants to buy more stocks.”

“Bears are currently winning in the battle,” he added.

The US shares climbed after Trump’s elections in November, hoping that the new administration will bring economic policy PRO-Business, pushing the S&P 500 to the latest record lately last Wednesday.

But the Index has slipped in recent days, because concerns about the health of the American economy caused by tumultuous economic data began to weigh the mood.

Retail investors, who have so often been buying shares whenever the market is getting involved, suddenly catches “uneasy”, according to Vandatrack, a data company that controls the retail trading flows.

The US Government’s debt sold out while the shares collapse, with a 10-year treasury yield, which inversely ranges prices, which is 0.03 percentage points to 4.28 percent.

Treasury, which are considered to be a safe refuge during the period of volatility in the market, has gathered in recent weeks as an increasing list of data indicating worse appearances for the world’s largest economy.

A dollar power compared to a basket of six other main currencies increased by 0.8 percent.

However, fears from the upcoming economic slowdown have overturned some of the participants in the market.

After a strong ending in 2024, data on poor consumer feelings published over the past week gave “Excessive markets the possibility of correcting,” said Steven Blitz, the main American economist of TS Lombard.

“Trump’s recession? Not so fast,” he added.