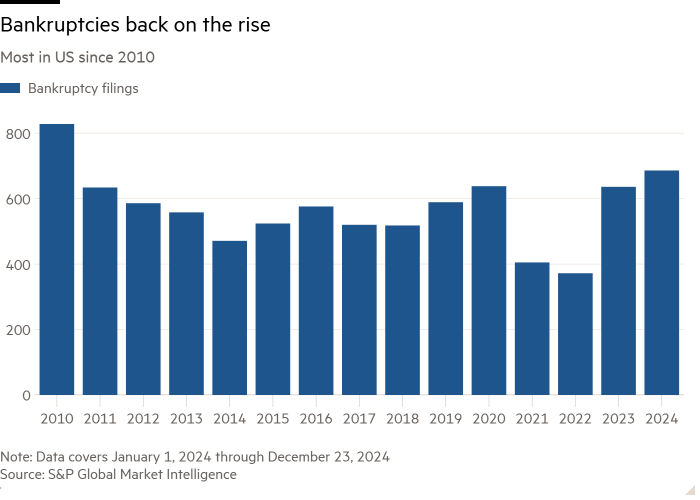

US corporate bankruptcies hit a 14-year high as interest rates take their toll

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

US corporate bankruptcies have reached their highest level since the global financial crisis as higher interest rates and weakened consumer demand punish struggling groups.

At least 686 US companies have applied bankruptcy in 2024, up about 8 percent from 2023 and more than any year since the 828 filings in 2010, according to S&P Global Market Intelligence.

Out-of-court maneuvers to try to stave off bankruptcy also increased last year, outnumbering bankruptcies about two to one, according to Fitch Ratings. As a result, senior lenders to issuers with at least $100 million in total debt experienced their lowest recovery rates since at least 2016.

The collapse of party supplies retailer Party City was typical of the corporate failures of 2024. In late December, it filed for its second bankruptcy in as many years, after exiting Chapter 11 proceedings in October 2023.

Party City said it would close its 700 stores nationwide after struggling “in an extremely challenging environment driven by inflationary cost pressures and consumer spending, among other factors.”

Consumer demand has weakened as the Covid-19 pandemic has weakened, hitting businesses that rely on discretionary consumer spending particularly hard. Other major bankruptcies last year involved a food manufacturer Tupperwarerestaurant chain Red Lobster, Spirit Airlines and beauty retailer Avon Products.

“Persistently high costs of goods and services are weighing on consumer demand,” said Gregory Daco, chief economist at EY. The burden is particularly heavy on families at the lower end of the income spectrum, “but even at the middle and higher end, you see more caution.”

Pressure on businesses and consumers has eased somewhat as the Federal Reserve has begun to cut rates, although officials have indicated they intend to cut by just half a percentage point more in 2025.

Peter Tchir, head of macro strategy at Academy Securities, said there were mitigating factors, including the relatively low spread between rates on riskier corporate borrowing and sovereign debt.

“Obviously, it’s not great that this is happening. But when I think about what could really have a knock-on effect on the broader economy or the banking system, this doesn’t excite me yet,” Tchir said.

There were only 777 bankruptcy filings in 2021 and 2022 combined, when the cost of money was much lower due to the Fed’s rate-cutting program.

That number jumped to 636 in 2023 and continued to rise last year even as rates began to decline in late 2024. At least 30 bankruptcy filings last year had liabilities of at least $1 billion at the time of filing, according to S&P. data.

Historically, there are generally the same number of bankruptcies as out-of-court proceedings to reduce the prospect of insolvency.

Such moves, euphemistically known as liability management exercises, have become more and more often and have grown to represent a large share of U.S. corporate debt obligations in recent years, and that trend will continue into 2024, said Joshua Clark, senior director at Fitch Ratings.

These debt maneuvers are often seen as a last resort to avoid filing for legal protection. However, in many cases, companies go bankrupt anyway if they cannot solve their operational problems.

“Maybe their profitability will go up, or interest rates will go down, or a combination of both, in effect to stave off bankruptcy,” Clark said, adding that such discharges can negatively impact lenders by piling more debt on top of existing liability.

Additional reporting by Amelie Pollard