UK launches review of loan fee policy

Stay informed with free updates

Simply log in to British tax myFT summary — delivered straight to your inbox.

The UK government has launched a “loan allowance” review in a bid to “end” a tax evasion row linked to multiple suicides.

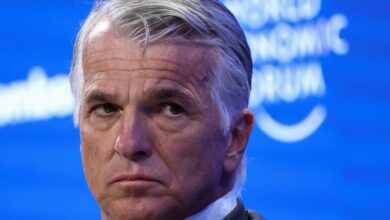

Finance Minister James Murray told the Financial Times that the impetus for the review, announced on Thursday, was to resolve outstanding tax debts linked to tax avoidance schemes.

But he added that the review, which will be led by former HM Revenue and Customs inspector Ray McCann, will also “maintain fairness [to] public purse” and other taxpayers who did not engage in tax evasion.

“Some of the people affected by debt collection find it difficult to imagine a way out of the situation they are in. . . For me, trying to resolve and bring closure to the matter for them is the driving force behind this review,” Murray said in an interview before the announcement.

In 2019, then Conservatively The government introduced a “loan fee” in a bid to crack down on “disguised remuneration” schemes involving workers in a range of sectors receiving loans through offshore trusts that had proliferated over the past two decades.

HMRC has previously stated it is estimated that around 50,000 people were affected by the loan collection and that the beneficiary’s income was “on average twice that of the average UK taxpayer”.

The loan charge originally required those affected to pay tax on up to 20 years’ worth of income in a single financial year, sparking a public outcry and accusations that the government was making unreasonable demands.

The previous Tory administration later eased the policy, halving the 20-year term and making it easier to distribute repayments.

But six years after the launch of the policy, tens of thousands of people have yet to settle their affairs with HMRC. The IRS has reported that the policy has been linked to at least 10 suicides and 13 attempted suicides.

Labor committed to a new independent review of the loan charge before the general election last year. Lord Amyas Morse’s previous report in 2019 was criticized by MPs and campaigners for including officials from the Treasury and HMRC.

Murray said the government had “gone hard” to ensure public confidence in the review, which will last until the summer and will be staffed by civil servants who have no connection or experience working on loan recovery policy. They will work in a separate building from the Treasury.

McCann, a former chairman of the Chartered Institute of Taxation, said he was “delighted to be asked to help find a way” to resolve the dispute.

McCann has previously criticized how HMRC sought to contact debt collectors, noting that “all the people [within the agency] who work on credit schemes could work on customer service”.

In a statement, the government said the review would examine “the barriers preventing those subject to credit recovery from reaching a resolution with HMRC and recommend ways in which they can be encouraged to do so”.

Campaigners who called for a wide-ranging investigation – looking at the role of scheme developers, umbrella companies, recruitment agencies, accountants and tax advisers who recommended the schemes, as well as HMRC – hit out at the publication.

Steve Packham, of the Credit Compensation Action Group, said the proposed review was a “treason” and would “not resolve the matter”.

“We are deeply concerned about the impact on mental health that the publication of this false non-review will have,” he added.

Murray said his meetings with debt collection campaigners last year had alerted him to the impact of the policy and the government wanted the McCann review, to which it will respond by the autumn budget, “to provide a way for affected taxpayers to get a settlement”. .

Despite some calling for an “audit with a different scope”, Murray added that his priority was to “help those people who feel stuck”.