UK companies hit with record fines for late submission of invoices

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

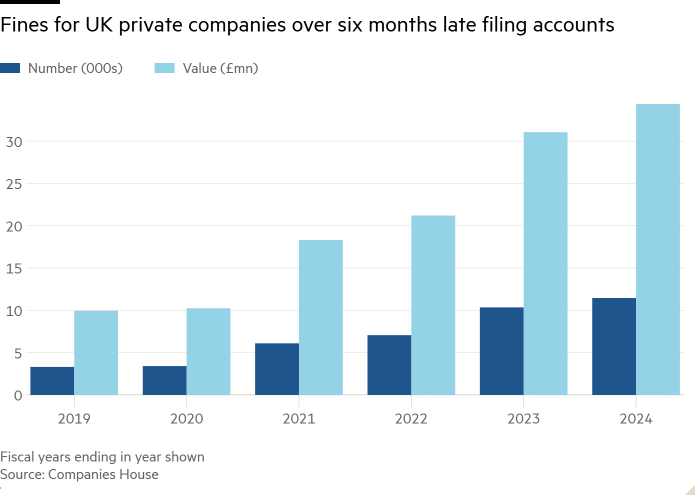

The number of UK companies filing their accounts more than six months late in consecutive years rose last year, pushing fines to record levels as companies struggled to put the pandemic behind them and reassure auditors of their financial health.

Figures produced by Companies House show that a record £34.4m in fines were handed out in 2023/24. to private companies that have seriously overdue applications for two years in a row, up from £10.2m in 2019-20.

The total number of companies fined the maximum £3,000 for repeated submissions more than six months late was 11,463 in 2023-24, compared to 3,418 in 2019-20.

Since the pandemic, companies have been struggling with slower economic growth, high borrowing and energy costs, and rising wages. “Companies struggling post-Covid never really got over it,” said Jonathan Dudley, a partner at accounting firm Crowe.

More companies struggled to prove to auditors that they had the financial strength to stay afloat as a “going concern,” Dudley said, contributing to delays in filing accounts.

Private companies are hit with penalties from Companies House if they file their accounts late, and the money ends up being paid into the Treasury. Penalties range from £150 for those who file within a month of the deadline, to £3,000 for those who file more than six months late in two consecutive financial years.

The number of £150 fines has fallen significantly since the peak in 2021-22, but longer delays have continued to rise.

In total, Companies House collected £785.2m in fines from all private and public companies that filed late accounts from 2018 to 2019, according to a parliamentary question it asked Labor MP Phil Brickell.

Craig Beaumont of the Federation of Small Businesses said: “We know that some small businesses were heavily indebted with commercial debt before the pandemic and [Covid-era] pay back the loans.”

The BBL scheme was launched in May 2020. It targeted the smallest businesses, offering loans of up to £50,000 — or 25 per cent of annual turnover — to help them stay afloat during the pandemic.

Dudley noted that the failure of “ghost companies” set up during the pandemic to receive refunds could explain some of the increase.

Up to £47 billion in reverse loans were issued, with no credit checks required for borrowers. The government has provided a 100 percent guarantee for loans if companies are unable to repay.

The House of Commons Public Accounts Committee estimated in April 2022 that up to £17bn of repaid loans would never be repaid and £4.9bn had been lost to fraud.

Brickell, a member of the All-Party Parliamentary Group on Anti-Corruption and Responsible Taxation, said: “Companies House must ensure that filing deadlines do not continue to be breached to the worrying extent that we are currently seeing.”

A government spokesman said: “This government is committed to protecting the interests of taxpayers, which is why we have appointed a fraud commissioner to oversee spending caused by Covid.

“We will use all possible means to recover public money lost to fraud related to the pandemic.”