The Procvat of the Slate production is not the gift of Donald Trump

FREE Unlock Bilten White House Watch

Your guide on what American elections 2024 mean for Washington and the world

Bureaucracy reduction, release, eliminating narrow throats – these are all great business policy. They do wonders in the industries that have been restrained by regulations before. But there is little evidence that this was the case with American fossil fuels. This suggests the efforts of President Donald Trump yes accelerate oil and gas projects It will produce leaks, not flood.

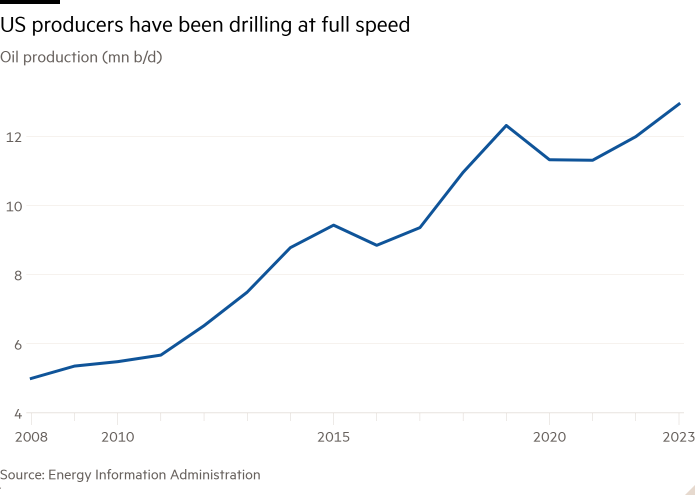

Oil manufacturers for some time “drills, honey, drills”. In 2024. USA oil Average production of 13.2 million barrels per day, making it the largest oil producer in the world. This is two and a half times more than the country produced in 2008.

True, this shabby pace cannot last forever. The industry will add an additional 270,000 barrels a day on average 2025 and 2026, according to the Argus Media consulting house, about a quarter of what she squeezed out in 2023. But this greatly reflects the fact that many of the best areas have already been used. exploited.

Trump’s policies, such as stimulating drilling in US coastal waters, will open new territories. Even if they contain resources that can be used, the time needed to develop a project goes beyond the length of a four -year presidential term. This is not a short -term solution.

Unfortunately for Trump, what braces the flow of oil is not bureaucracy, but low prices. Oil production from American slate formations is relatively expensive. Companies need prices somewhere between $ 60 and 80 per barrel if they want to cover all their costs and pay dividends, according to Christopher Wheaton of Stiphel.

The slate is also very sensitive to the movement of the price of goods because, unlike traditional projects where much of the cost is paid in advance, maintenance of slate production requires constant consumption. For example, a record low price of natural gas in the US 2024 has already caused a drop in production.

This is quite limited by Trump’s maneuvering space, at least with oil. The gas could be slightly more sensitive, given that there is a hope that strong demand, not only from data centers, and re-issuing LNG export permits to increase domestic prices. This would help manufacturers justify a larger offer.

As it stands now, the oil market is hardly supplied with insufficient. AND scattered cinemas translates into poor demand. OPEC+, who wants to stay high, is worried enough to brake an active offer. This means that every increase in oil production in the US is likely to push prices and therefore be short-lived. The only thing that leaks in the oil stain is rhetoric.