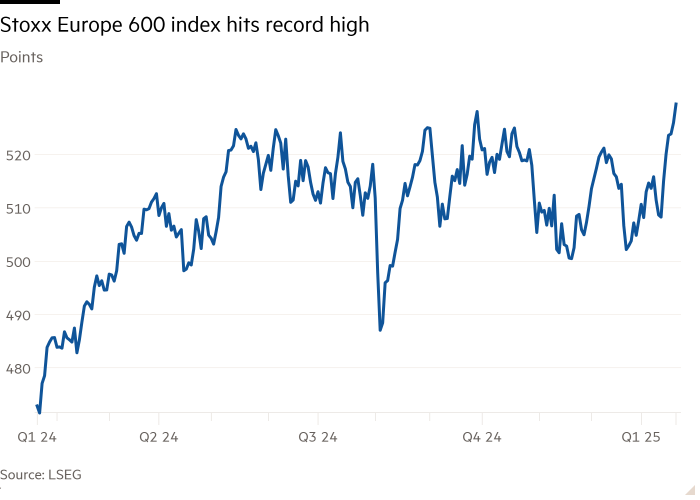

The European Stoxx 600 index reached a record level

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

The Stoxx Europe 600 index hit a record high on Wednesday as fears over US tariffs eased and investors bought cheaper European stocks after strong corporate earnings.

The broad European index rose as much as 0.7 percent to a record 529.88, boosted by gains from some of Europe’s largest companies, such as Danish drugmaker Novo Nordisk and Germany’s Adidas.

Frankfurt’s Dax rose more than 1 percent – also to a new high – led by a 7 percent gain for Adidas after a strong full year from the sports equipment maker.

Luca Paolini, chief strategist at Pictet Asset Management, said that “the risk environment [is] lifting all ships, especially the weakest,” aided by other factors including concerns about little easing of US tariffs.

Despite the threats, new US President Donald Trump has not yet imposed tariffs on goods exported to the US from the bloc.

“There is some relief in the view that Trump is softer than the market thought,” said Emmanuel Cau, an analyst at Barclays.

“The [European] the market is no longer so afraid of Trump because he gives the impression that he is trying to negotiate,” he said.

US futures also pointed to gains on Wall Street after streaming service Netflix beat earnings estimates. S&P and Nasdaq futures rose 0.4 percent and 0.8 percent, respectively.

London’s FTSE 100 also moved further into record territory, up 0.3 percent, boosted by energy and mining stocks.

The highs came after a Bank of America survey of European fund managers this week showed investors increased their allocations to European stocks as fears of high Wall Street valuations grow.

In January, just 19 percent of fund managers were overweight U.S. stocks, down from a record 36 percent the previous month. The change was the biggest rotation from US stocks to Eurozone stocks in almost a decade.

The S&P trades at a forward price-to-earnings ratio of 21 times, while the Stoxx Europe trades at just 13 times.

Trump also said Tuesday that his administration is considering imposing a 10 percent tariff on Chinese imports as early as next month. On Monday, he revealed that he will introduce tariffs for 25 percent against Mexico and Canada already on February 1.