The dollar falls on reports that Trump will reduce tariff plans

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

The dollar fell on Monday after reports that President-elect Donald Trump’s administration is considering watering down a campaign promise to apply sweeping tariffs on imported goods.

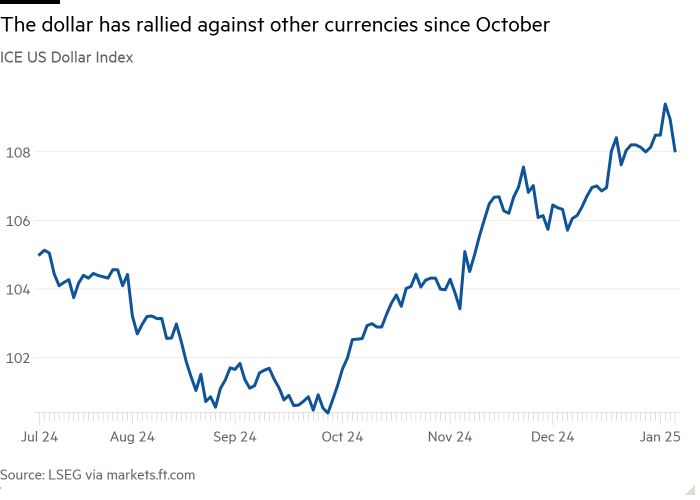

The U.S. dollar index, which tracks the currency against a basket of six peer countries, fell 1 percent in morning trade after The Washington Post reported that the potential tariffs could be limited to critical imports.

In November, Trump promised total customs duties of 10 or 20 percent with all trading partners.

Chris Turner, global head of markets at ING, said the reports had sparked a “relief” in the euro against the dollar, with hopes that carmakers in the region could be spared. Tariffs may also “be less inflationary than first expected,” he added.

Shares of European carmakers, which have been hit in recent months by fears they will be targeted by the Trump administration, rose. The Stoxx Europe 600 Automobiles & Parts index rose 3.7 percent, with BMW increased by almost 6 percent.

The euro rose 1.1 percent against the dollar to $1,042, on track for its best day in more than a year. It was a single currency push to a two-year low due to trade war concerns. The pound, which was the best performing G10 currency against dollar rose 1 percent last year to $1,254.

Monday’s reports “sparked some relief among investors that the initial tariffs won’t be as bad as feared,” prompting “a sharp reversal of the U.S. dollar’s recent gains,” said Lee Hardman, senior currency analyst at MUFG. More focused tariffs would help to “damp down [their] devastating effect,” he added.

U.S. Treasuries, which have sold off in recent months as investors were preoccupied by higher inflation fueled by sweeping tariffs, made little comeback. The yield on the two-year U.S. Treasury note, which moves in line with expected rates, fell 0.02 percentage points to 4.26 percent as the price of debt rose.

The dollar selloff comes after a strong rally in the world’s de facto reserve currency that began in early October, as the market began to assess the growing prospect of a Trump election victory. “The market correctly predicted a Trump victory,” said Jane Foley, senior FX strategist at Rabobank.

Analysts and economists expect Trump’s pro-growth, potentially inflationary policies to limit the number of rate cuts by the US Federal Reserve next year, boosting demand for the dollar against other major currencies. Investors’ bets that the negative impact on eurozone growth will prompt the European Central Bank to cut rates more aggressively contributed to this.

In mid-December, the Fed released economic forecasts that suggested interest rates would fall less in 2025 than previously hoped. Last week, a senior Fed official warned of the threat of a resurgence of inflation in the US after Trump takes power.

Investors expect the US central bank to cut interest rates at least once this year, with a 70 percent chance of a second quarter-point cut. That probability increased slightly on Monday.

Expectations for interest rate cuts by the European Central Bank have eased slightly, with just under four cuts of a quarter point this year.