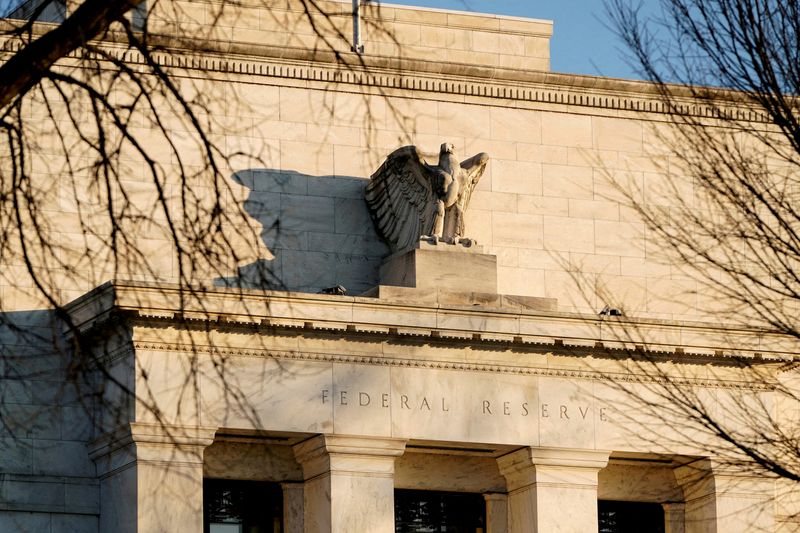

The central bank’s December rate cut took 2024 to a historic level Reuters

Authors Karin Strohecker and Sumanta Sen

LONDON (Reuters) – Major central banks in December made their biggest easing push since the spring 2020 rate-cutting frenzy due to COVID, and the latest moves make the annual easing effort in 2024 the biggest in 15 years as policymakers prepare for uncertain times.

Among the central banks that oversee the 10 most traded currencies, five of the nine that held meetings in December cut interest rates. Central banks in Switzerland and Canada each cut 50 basis points (bps), while the Federal Reserve, the European Central Bank and Sweden’s Riksbank cut their benchmarks by 25 basis points each.

Policymakers in Australia, Norway, Japan and Britain left interest rates unchanged, while New Zealand held no meeting.

The latest moves come before Donald Trump takes over the White House on January 20, with uncertainty over how aggressively the US president-elect will pursue his trade and economic policies keeping markets on edge.

December marked the biggest monthly rate cut by G10 central banks since March 2020, when turmoil over the COVID pandemic rocked global markets. The latest moves brought the total rate cut in 2024 to 825 basis points – the biggest annual easing attempt since 2009.

“2024 was another good year for asset returns as economic growth surprised to the upside and central banks finally started to cut rates,” said Henry Allen, macro strategist at Deutsche Bank (ETR:).

“However, despite the overall good performance, there have been a lot of bumps along the way. It took longer than many expected to lower the rate,” added Allen.

In emerging markets, 14 of a Reuters sample of 18 central banks in emerging economies held rate-setting meetings in December. Turkey posted an attractive 250 bps drop, while Mexico, Colombia, Chile and the Philippines cut rates by 25 bps each.

Meanwhile, Brazil stepped up its tightening cycle, raising its key interest rates by 100 bps.

Movements in emerging markets led to a decline in 2024 to 2,160 basis points with 51 moves – more than double the 945 basis points easing in 2023. In total (EPA:) increases for emerging markets in 2024 were 1,450 bps.

“Significant efforts to contain inflation and stabilize markets have coexisted with energy volatility and contrasting dynamics between advanced and emerging economies, against a backdrop of global transformation,” said Mirabaud’s John Plassard.

“The year that just ended will be one to remember.”