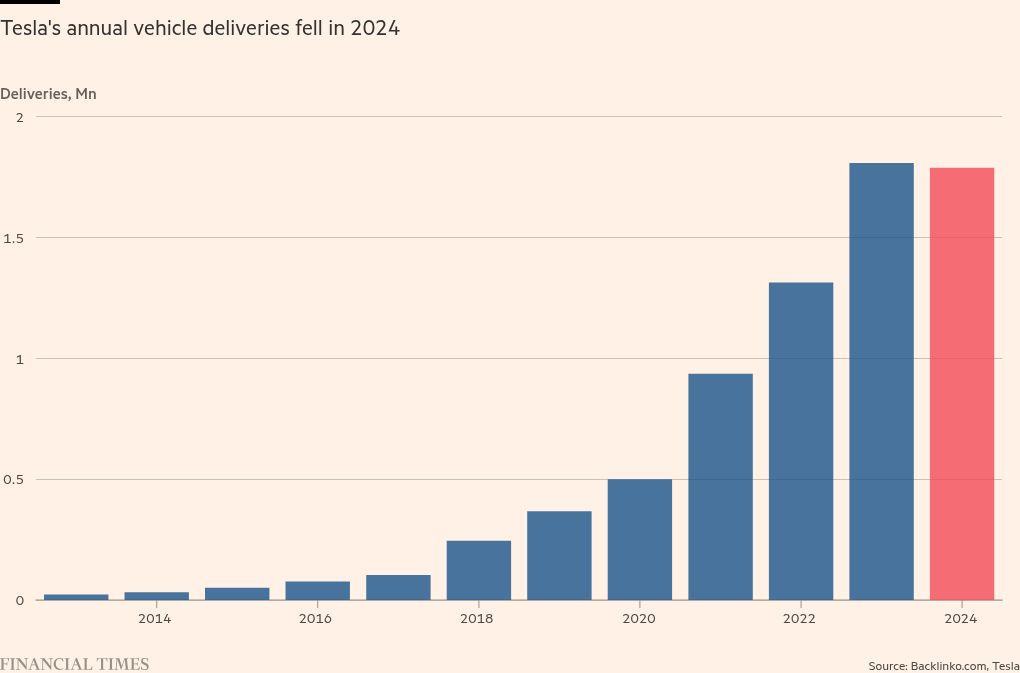

Tesla’s annual deliveries fell for the first time since 2011

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

Tesla’s annual vehicle shipments fell for the first time in more than a decade as the world’s largest electric vehicle maker came under pressure from Chinese competition.

The stock fell more than 6 percent on Thursday as the numbers fueled questions about the sharp rise in sales predicted by CEO Elon Musk.

For the whole year, Tesla delivered 1.79 million vehicles, just below the 1.81 million delivered in 2023 and the first annual decline since 2011, according to Bloomberg data.

On a quarterly basis, the company said Thursday it delivered 495,570 vehicles, up 2.3 percent from the same quarter last year, but below market expectations by more than 500,000.

Despite the annual decline, Tesla still maintained its position as the world’s largest electric vehicle maker as it faced stiff competition from Chinese rival BYD, which reported earlier on Thursday that sold 1.76 million pure electric vehicles in 2024, BYD said it sold a record 4.3 million electric vehicles and hybrids in total, a company record, despite increased pressure from competitors in the domestic market.

Investors expected a strong fourth quarter for Tesla thanks to cost-cutting and discounts on existing vehicles to boost consumer demand.

In October, Tesla reported higher-than-expected quarterly profit and forecast “slight growth” in 2024 deliveries, while Musk predicted that the group’s vehicle sales could increase between 20 percent and 30 percent in 2025.

However, competition from cheaper offerings from Chinese rivals and concerns about slowing growth in electric vehicle sales weighed on the market over the past year.

Tesla was also caught up in the political activism of its CEO. Musk spent more than 250 million dollars to support the successful election campaign of Donald Trump and became one of the closest advisers of the newly elected president. Trump has tasked Musk with co-leading a new Department of Government Efficiency aimed at finding ways to reduce US federal spending.

Tesla shares have risen sharply since the November election as investors saw the benefits of Musk’s close relationship with Trump. But the company also faces political uncertainty with California’s Democratic governor, Gavin Newsom, indicating that Tesla could miss out on lucrative tax breaks the state is considering for electric vehicles.

With its complex supply chain and close business ties to China, Tesla is also unlikely to escape the effects of Trump’s threatened broad tariffs on goods imported into the US.

As he increased his political influence, Musk also pivoted strategically toward autonomous driving, artificial intelligence and robotics, predicting that these technologies would soon be Tesla’s main source of revenue and boost its value.

The company aims to begin production of its self-driving Cybercab before the start of 2027. The model would cost roughly $25,000, when government incentives for electric vehicles are subtracted.

In October, Musk confirmed that Tesla is not developing the much-anticipated affordable $25,000 Model 2. The company told investors in December that it would launch a new model in the first half priced under $30,000 including subsidies or $37,499 without them.