Shares of US construction companies fell on fears of higher rates and Trump’s tariffs

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Shares in U.S. homebuilders fell as fears that interest rates will stay higher for longer add to concerns that President-elect Donald Trump’s potential tariffs and mass deportations will drive up construction costs.

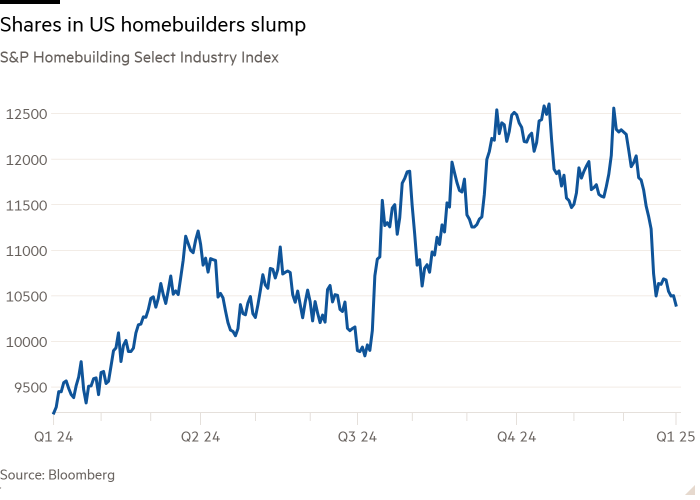

Since Trump won the election in November, the S&P 500 index of home construction has fallen 17.3 percent to its lowest level since July. US steelmakers and home furnishing groups also suffered sell-offs after a two-year post-pandemic boom.

Shares of DR Horton, America’s largest homebuilder, have fallen 17 percent in the two months since Trump’s victory. Housing giants Lennar and PulteGroup lost 21 percent and 15 percent over the same period. The three homebuilders combined lost $76 billion in market value.

The decline marks a sharp reversal from the first three quarters of last year, when shares of home builders rose as new sales rebounded even as interest rates were at their highest level since 2001.

Although the average 30-year mortgage rate remained above 6 percent at the end of last year, consecutive rate cuts by the Federal Reserve since September have given the housing sector a further boost.

But a rising inventory of new and completed homes built after the pandemic has begun to weigh on supply, Reserve Bank of St Louis data show slowdown in the past year in the number of residential units under construction.

Sentiment among investors has particularly deteriorated over the past two months. “It is [Trump’s] politics, rate outlook, rising stocks . . . The situation on the ground has definitely changed compared to the year before,” said Jonathan Woloshin, an analyst at UBS Wealth Management in the US.

Forecasts released by the Fed in mid-December suggested that interest rates will fall less in 2025 than previously expected. Both analysts and companies worry that Trump’s “America First” policy could raise a range of costs, from building materials to access to labor.

Trump has promised to deport millions of migrants. Slightly more than a quarter of the construction workers are immigrants and 13 percent of workers are unauthorizedthe largest share of any sector, according to the US Census Bureau.

In December, Barclays downgraded DR Horton, PulteGroup and KB Home, writing in a note to clients that a combination of tariffs on vital building materials, including steel — as well as immigration restrictions and an increase in housing stock — meant a “lower-interest utopia” for builders. . . it is full of obstacles”.

The construction market “has now hit a ceiling,” said Matthew Bouley, an analyst at Barclays.