Retail investors pour $ 900 million in Nvidia while persecuting the “purchase opportunity”

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

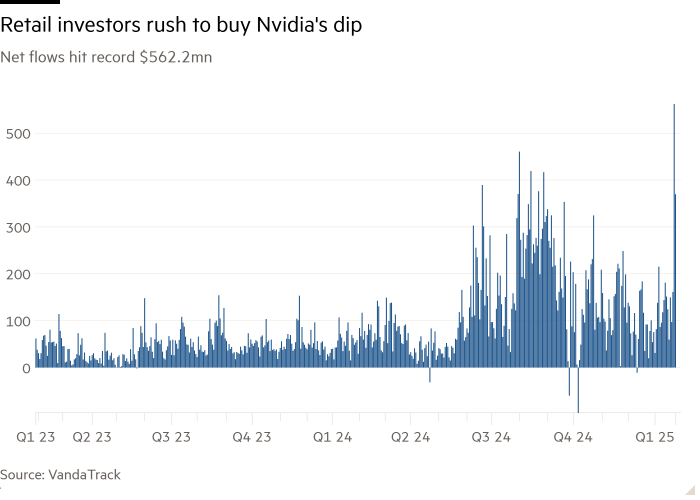

Retail investors have scored more than $ 900 million this week into NVIDIA shares, as individual merchants have rushed to collect artificial intelligence shares that have suffered a strong blow from fear due to Chinese Deepseek.

Retail traders bought a $ 562 million net on Monday, which is a maximum of $ 360 million on Tuesday, Vanatrack Data said.

Hurrician in Nvidia and similar company comes because the Analysts on Wall Street rush to evaluate Deepseek’s claim that he has created a AI model compared to US leaders like Openi at a much lower price will affect consumption for advanced chips. Nvidia spilled nearly $ 600 billion on Monday in a historic sale before returning some of those losses on Tuesday.

Steve Sosnick, a major strategist in interactive brokers, said there was a “stunning” overcoming Nvidia buy on Monday on Monday through sales orders on trading platforms.

“I never remember seeing the imbalance of that size,” he added. “Did the mantra of the active merchant become a” bigger drop, the greater the opportunity “?”

Charles Schwab, the biggest US retailer with a property with a property of $ 10 to $ 10, said he also saw an increased purchase through shares of connected internet trading became its second highest night, behind only US presidential elections on November 5th.

“We saw Nvidia customers.

One user post on the Reddit Discussion Website, a popular forum for individual merchants who will talk about the strategies, called Nvidia’s Fall “Opportunity to Buy a Paradox Jevon”, in a reference to the theory that demand for technology like AI will increase because it becomes cheaper and more efficient and more effective.

“Ai doesn’t slow down, it spreads,” said another user. “[Nvidia] is still the backbone of the industry, and this decline is an opportunity for long -term investors. “

In contrast, Hedge funds that built huge positions in Nvidia were among the largest sellers of the company’s shares on Monday, the market participants claim.

“Most of the flows were classic only long [hedge fund] Customers who sell in the move, “said Charlie Mcelligott, a strategist of Nomuri derivatives. He estimated that Nvidia made up about 10 percent of all American monetary shares on Monday.