Private equity targets Europe for big buyout deals

Stay informed with free updates

Simply log in to Finances myFT summary — delivered straight to your inbox.

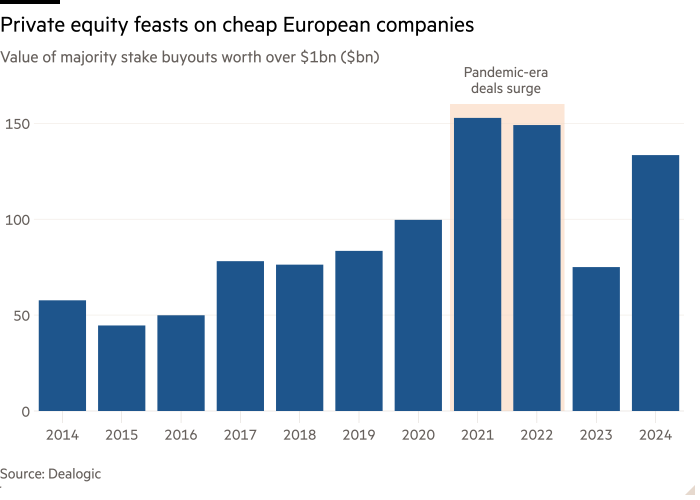

Private equity groups stepped up activity in Europe last year, taking advantage of the continent’s economic woes to snap up large companies at low valuations.

The total value of European sales contracts worth more than a billion dollars rose twice as much as in the rest of the world, according to an analysis of Dealogic data in the Financial Times.

About $133 billion in major deals were made on the continent in 2024, an increase of 78 percent compared to the previous year. That compares with a 29 percent increase in the rest of the world, to $242 billion.

The data is the latest evidence that private equity firms are enjoying Europe’s fortunes cheap companies.

Major transactions included a 6.9 billion dollars consortium agreement for investment platform Hargreaves Lansdown ia A contract worth 5.5 billion dollars Thoma Bravo to acquire UK private cyber security firm Darktrace, and firms including Brookfield agree to take a $3.8bn stake in French renewables developer Neoen.

A challenging economic outlook — with weak growth forecasts, political turmoil and geopolitical threats — and the strength of the US dollar have prompted US private equity funds to target certain countries in Europe, according to Neil Barlow, partner at law firm Clifford Chance.

“Certain more stable economies within Europe, such as the UK, the Nordic countries and Germany [have become] focal point for private equity providers,” he said.

European stock exchanges, including the London Stock Exchange, are struggling with an exodus of companies as companies move their listings to the US or go private with the support of buyout firms.

The value of Europe’s so-called take-private deals involving a majority stake of more than $1 billion jumped 44 percent to $52 billion last year, Dealogic data showed, with 15 such deals compared with 10 a year earlier.

European stocks have traded at lower values than those listed in the US for the past decade. But the gap widened, with the Stoxx Europe 600 now trading at a record discount to the US S&P 500.

However, take-privates accounted for a smaller share of the total value of large buyouts in 2024 than the year before.

There have been several large transactions in which ownership has shifted between different private equity firms or in which the composition of the consortium of private equity owners has changed.

There is an investment branch in December Goldman Sachs Asset Management negotiated a deal worth more than 2 billion euros to buy Dutch drugmaker Synthon from British buyout firm BC Partners.

Earlier in 2024. Swedish buyout group EQT has agreed to sell a stake in the Nord Anglia school business to a consortium of investors who valued the business at $14.5 billion, while EQT retained control.

However, smaller jobs grew faster in the rest of the world compared to Europe. Buyouts of majority stakes worth between $50 million and $1 billion rose just 1 percent in Europe last year, compared with 16 percent in the rest of the world.

Richard Hope of private markets firm Hamilton Lane said it was “no surprise” that the continent saw slower growth than the rest of the world for smaller businesses.

“The volume market in Europe is the sub-1 billion euro space,” he said, adding that the lower end of the market is suffering from “macro headwinds present in the region.”

Alexis Maskell of private equity firm BC Partners said the buyout market in Europe is “both fragmented and very diverse, but… . . you can find market-leading, but relatively under-the-radar, $1 billion-plus companies”, usually “at a discount to US competitors”.

Additional reporting by George Steer