Japanese investors are dumping eurozone bonds at the fastest pace in a decade

Stay informed about free updates

Simply log in to Sovereign bonds Myft Digest – delivered straight to your inbox.

Japanese investors sold Eurozone government debt at the fastest pace in more than a decade, and analysts warned that a move by one of the cornerstone bonds could lead to a sharp selloff in the market.

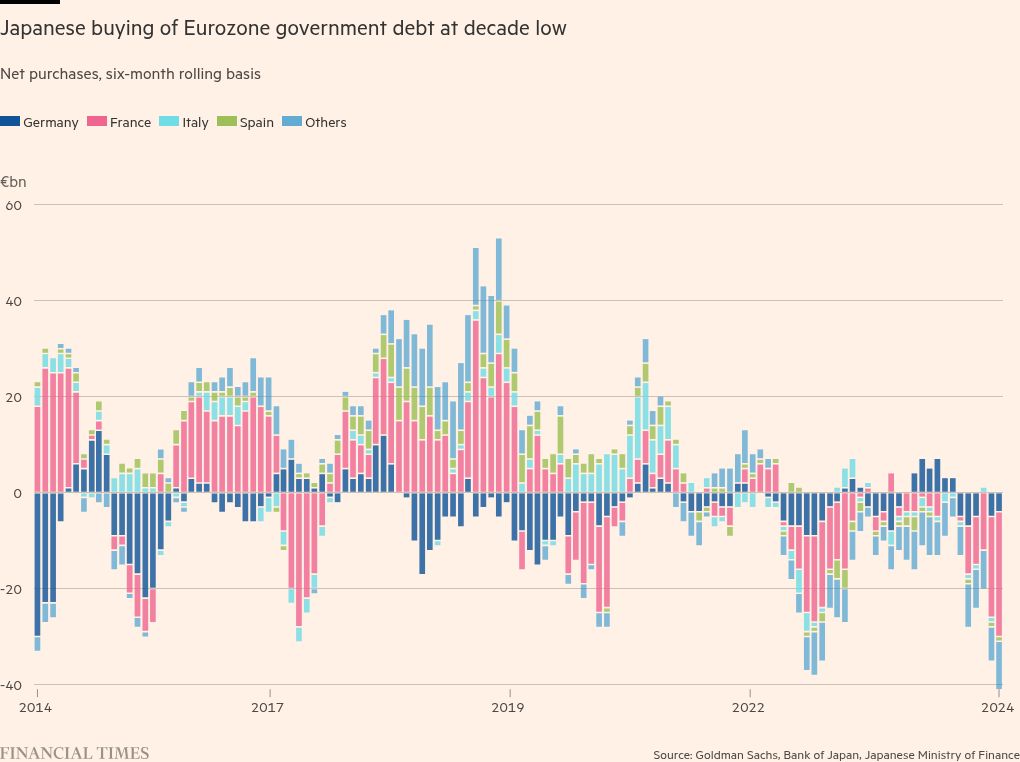

Net sales by Japanese investors increased to 41 billion euros in the six months to November – the latest figures to be published – according to data from Japan’s Finance Ministry and the Bank of Japan, compiled by Goldman Sachs.

The prospect of higher bond yields at home and political upheaval in Europe – including the collapse of Germany’s ruling coalition leading to elections next month, and unrest in France operating under an emergency budget law – accelerated the sell-off, analysts said. French bonds were the most sold in the period at 26 billion euros.

The sale adds further pressure to indebted European governments already facing a spike in borrowing costs, and point out how rising Japanese interest rates After years in negative territory, they are reshaping financial markets around the world.

Japanese investors returning home “are a game changer for Japan and global markets,” said Alain Bokobza, head of global asset allocation at Société Générale.

Although Japanese investors have been net sellers of eurozone bonds for most of the past few years, the pace has picked up in recent months.

Japanese investment flows were a “steady source [European] The hunt for a government bond for a long time,” said Tomasz Wieladek, an economist at Asset Manager T Rowe Price. But markets are now “entering an era of bond vigilance” where “rapid and violent sell-offs” could occur more often.

Gareth Hill, bond fund manager at Royal London Asset Management, said the scenario “has long been a concern for bondholders of European governments, given the historically high holdings [among] Japanese investors “could put pressure on the market.

In addition, the high costs of hedging against swings in the value of the yen have made foreign debt increasingly unattractive. Despite coming off a peak in 2022, when hedging costs are factored in, the 10-year Italian government bond yield for Japanese investors is just over 1 percent, about the same as Japan’s 10-year yield, according to Noriatsu Tanji. chief strategist of Mizuho Securities in Tokyo. He pointed to regional banks in Japan as among the main sellers of European debt.

“Japanese investors have to ask themselves pretty hard how much they should hold foreign bonds,” said Andres Sanchez Balcazar, head of global bonds at Pictet, Europe’s biggest asset manager.

Norinchukin – one of Japan’s biggest institutional investors – said last year it planned to shift more than ¥10tn of foreign bonds this financial year. In November, it posted a loss of about $3 billion in the second quarter after realizing losses in its large holdings of foreign government bonds.

The return of Japanese investors is putting pressure on bond yields, which have already moved higher as the European Central Bank began shrinking its balance sheet following a massive bond-buying program during the coronavirus pandemic, analysts said.

France – which has one of Europe’s deepest bond markets and has historically been a favorite of Japanese investors for the extra yield it offers over benchmark German debt – has seen large Japanese outflows in recent months.

Between June and November, as the political crisis deepened resulting in the fall of Michel Barnier’s government, total outflows of Japanese funds reached 26 billion euros, compared with sales of just 4 billion euros in the same period the previous year.

“There’s no question that for France the customer base has changed,” said Seamus Mac Gorain, head of global pricing at JPMorgan Asset Management.

Over the past 20 years, Japanese investors have become a cornerstone of several bond markets, as ultra-low yields at home have made foreign investments more attractive, including to large investors such as pension funds that need to buy safe debt.

Total holdings of foreign bonds by Japanese institutional investors reached $3 trillion at their peak in late 2020, according to the IMF.

However, as Japanese investors began to seek returns at home, their net purchases of global debt securities have shrunk to just $15 billion in total over the past five years — a far cry from the roughly $500 billion in such purchases they made in the previous five years. , according to calculations by Alex Etro, macro strategist at Exante.

“Whereas Japanese bonds were quite unattractive for domestic investors in the past, they are now more attractive,” JPMorgan’s Gorain said. “It’s a structural change.”