Great Britain to provide companies with a greater access to excess excess pensions

Be informed about free updates

Simply log in to Pensions Myft Digest – delivered directly to your arrived mail.

Sir Keir Starmer will promise on Tuesday that he will unlock some of the excess of £ 160 billion in corporate pension schemes with defined and benefits, in an effort to enter a rush of money into the British economy and enhance growth.

Great Britain Prime Minister will say to the audience of the executives in the city of London that the limitations of use are pension Vis will be mitigated, a move praised by former conservative chancellor Jeremy Hunt.

StarmarThe decision is intended to launch investment by the company, and at the same time encourages them to take higher risk in their pension investment strategies. “Today’s changes will unlock billions to invest,” Starmer said.

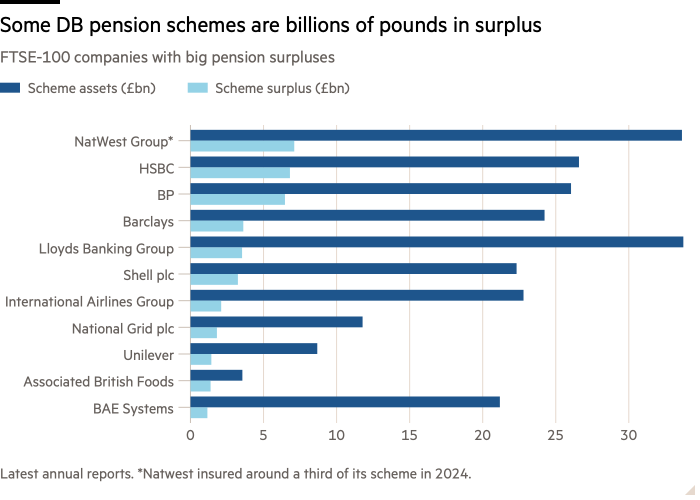

The government estimates that about 3,750 corporate pension schemes are defined and used in excess, which holds 160 billion assets higher than the payment they owe to its members. Less than £ 70 billion can be returned to companies according to current rules. The total assets in the system is 1.2nt £.

“This reform can basically change the way employers look at their pension schemes with defined and endless, turning them out of obligations to indulgence, into a valuable property worth a long period,” said Morten Nilsson, CEO Brightwell, who manages. BT pension scheme, the largest in the FTSE 100. The BT scheme is in deficit.

After a few weeks in which Chancellor Rachel Reeves gave a series of announcements related to growth, Starmer’s move on Tuesday will be a response to critics that he took the last place in the economy.

“In order to achieve a change in the need of our country, it requires nothing less than the diverting of our economy,” Starmer will say to the bosses of Lloyds, Nationwide and Tesca, along with other executives. “He needs creative reform, removal of obstacles and an relentless focus.”

Pension reforms are followed by criticism of some business leaders that Starmer and Reeves have disturbed growth with an increase in the budget of £ 40 billion, the density of new employment laws and gloomy rhetoric.

Hunt floated with pension reforms with a defined benefit in his speech about the castle in the 2023 house, but it ran out of time to deliver them before last year’s elections, which Starmer and Laburd brought them to power.

“Maybe I have my political differences with Rachel Reeves on the increase in business tax, but I strongly welcome the momentum that she put behind the reform of the Mansion house,” Hunt told the Financial Times.

In accordance with Labour plans, DB schemes could change their rules to allow excess extraction where the employer and guardians of the pension scheme agree. Plans would require legislation.

Currently, excess DB scheme can only be accessed where the scheme adopted a resolution by 2016 to retain power, under the 2004 Act, which was adopted by the last Government of Labor. Some schemes had a great deficit and did not bring such resolution.

Viškovs are also available only if they exceed the level needed for the company to sell their scheme to the insurer. The UK pension fund estimates that £ 68 billion of £ 160 billion in total current excess fulfills this threshold.

About £ 180m, the companies approached the excess between 2018 and 2023, according to government estimates last year. Companies are taxed at 25 percent of the surpluses they are receiving.

The levels of funding of pension schemes have been dramatically improved in recent years, as higher yields have increased the expected products on property, reducing the current accounting value of future obligations.

The pension commissioners welcomed the announcement of the Government, provided that the outcomes of the members were protected.

“All guardians really care for the members of the payment scheme, but as a general topic, we would support the release of surpluses in the right circumstances,” said Vassos Vassou, a member of the Council of Professional Pension Custodians.

He noted that in recent years, the companies with large surpluses in their pension schemes have decided to sell themselves with insurance companies in the transactions of scattered annuities called buyers. In the last two years, about 50 billion pension obligations have been sold, according to the WTW consultation.

Some advisers are suspicious that many companies will use the reform of work. “I just don’t think it’s going to be a lot of people who want it – they either want to buy it or just put more money in the scheme until they can’t,” said John Ralfe, an independent pension advisor. He noticed a 25 -hour tax charged on cash taken out of pension excess.

On Monday, Reeves called on Labor MPs to lag behind the growth strategy, with some returnees nervous for the party to damage its environmental credentials and it seems that it is on the part of the consumer’s interests.

“If we understand this right – and I know we will – the reward on offer is immense,” she told the Parliamentary Labor Party. Reeves, who was criticized by the company for appearance to speak of an economy, urged work deputies to be positive. “Now it’s an opportunity to shout about that potential and a brighter future,” she said.

She added, “Over the past six months, as a chancellor, my experience is that the government is used to saying” no. “