FTSE 100 rises to near record levels; CMC Markets falls Reuters

(Refiles for fixing table formatting)

(Reuters) – The U.K. rose on Thursday, ending just short of a new record high as investors sought clarity on U.S. President Donald Trump’s trade policy, while shares in traders CMC Markets ( LON: ) and IG Group fell after the results.

The blue-chip index rose 0.2% to 8,565 points, touching an all-time high of 8,584 points on Wednesday. The FTSE 250 mid-cap index weakened by 0.2%.

Stock investors took solace this week as Trump backed away from imposing heavy tariffs on his first day in office and announced big investments in artificial intelligence infrastructure, sending global technology stocks soaring.

The focus is now on economic data, corporate earnings and Trump’s remarks later in the day.

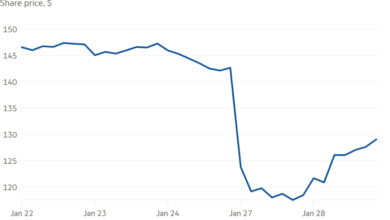

In earnings-led moves, CMC Markets fell 16.7% after the trading platform’s muted forecast fell short of heightened investor expectations following upbeat projections from industry peers.

Peer IG Group fell 6.4% despite the online trading platform posting a 30% rise in first-half profit.

Inchcape ( OTC: ) fell 13.3% after JP Morgan downgraded the auto distributor to “neutral” from “overweight.”

FTSE 100-listed Associated British Foods ( OTC: ) fell around 3% after it reported weak trading in its main UK market in the Christmas quarter and cut its annual sales forecast for its discount fashion store Primark.

Investors, meanwhile, await a series of monetary policy decisions, including the Federal Reserve and European Central Bank next week and the Bank of England (BoE) in early February.

Data last week showed UK inflation unexpectedly slowed last month and core measures of price growth – tracked by the BoE – fell more sharply, firming bets on a rate cut next month.

Traders are predicting an 82% chance of a first quarter point cut on February 6 and have fully priced in at least two rate cuts this year.

An industry survey on Thursday showed that a sharp decline in British factory activity eased only slightly in January, with optimism among manufacturers falling to the lowest level in more than two years.

British Chancellor of the Exchequer Rachel Reeves told Reuters she would announce changes in March if needed to meet the government’s fiscal rules.

| Category | Description ||—————————–|—————- ——————————–|| Related prices | || – UK Stock Market Report | () || – FTSE index | || – techMARK 100 Index | || – FTSE futures | || – Gilded future houses | || – Smallcap Index | || – | || – | || – Market Digest | || – Top 10 by quantity | || – The biggest price winners | || – The highest percentage of winnings | || – The Biggest Losers | || – The highest percentage of losers | || Related news | || – Hot Stocks in UK | () and () || – Wall Street | [.N] || – Report on gilts | [GB/] || – Report on Eurobonds | [GVD/EUR] || – Pan-European Stock Report | () || – Tokyo stocks | () || – HK shares | () || – The Sterling Report | [GBP/] || – Dollar Report | [USD/] || Company prices | || – Directory of companies | || – By sector | || Data on the pan-European market | || – A Quick Guide to European Stocks | || – FTSE Eurotop 300 index | || – DJ STOXX Index | || – Top 10 STOXX sectors | || – Top 10 EUROSTOXX sectors | || – Top 10 Eurotop 300 sectors | || – 25 best European percentages | || – Top 25 European % losers | |