Dollar falls after Trump hints at softer stance on Chinese tariffs

Unlock the White House Watch Bulletin for free

Your guide to what the 2024 US election means for Washington and the world

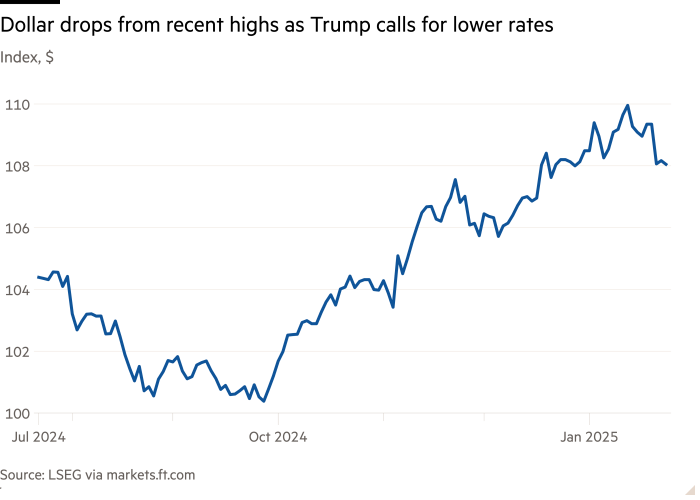

The dollar fell to a 1-month low against a basket of currencies on Friday after US President Donald Trump suggested a potentially softer stance on tariffs against China and called for interest rate cuts.

AND dollar The index fell 0.5 percent to its lowest level since mid-December, after Trump said he would “rather not” hit China with tariffs.

He also said he knows rates “a lot better” than the Federal Reserve and would like to see them “a lot.”

The euro, which has fallen sharply in recent months, jumped 0.7 percent to $1.049, putting it on course for its biggest weekly gain since November, while sterling gained 0.6 percent to $1.243.

“The main driver of the US dollar’s reversal in strength this week was escalating investor fears of global trade disruptions from Trump’s tariff plans,” said Lee Hardman, senior currency strategist at MUFG, adding that those fears “softened further” overnight on Chinese comments.

“At the same time, the correction lower for the US dollar encouraged the decline in the US.” [bond] Yields,” he said, citing Trump’s comments on rates.

The US central bank’s resilience to pressure from the new president is a key theme this year, fund managers say.

“The pressure will be enormous on the Fed,” said Olivier de Larouzière, chief investment officer for global fixed income at BNP Paribas Asset Management.

There are “good reasons” for investors in the coming quarters to start pricing in a 2026 rate hike, he added, so the market will be “closely watching” the Fed’s communications over the coming months to see if Trump’s rhetoric ends.

Trump’s remarks come just days before the Fed’s first policy meeting to be held during his administration.

However, markets have been betting since early October that Trump’s proposals for trade tariffs and tax cuts will boost inflation, pushing the Fed to keep interest rates higher for longer.

The US central bank is expected to keep interest rates at their current level of 4.25 to 4.5 percent, after three consecutive cuts since September. Markets are pricing in a slightly higher chance of an earlier rate cut this year after Trump’s remarks. They are fully priced in by the 0.25 percentage point rate that the Fed cut by July.

Despite the US president’s efforts to steer monetary policy lower, some investors believe the central bank will have limited room for further tapering, with the dollar expected to continue its rally in recent months.

Dan IVASCYN, Chief Investment Officer of Pimco’s 2ntn assets, said the Financial Times This week that the Fed was prepared to keep rates on hold “for the foreseeable future” and could even raise borrowing costs.

According to Brown Brothers Harriman analysts, the Fed has “very little room for further policy easing, which is supportive of the dollar.”

Asian currencies, including the Japanese yen and Indian rupee, strengthened against the dollar after Trump’s comments. China’s offshore yuan gained 0.5 percent to RMB 7.25 to the dollar, its highest level since late November.

In early January, the Chinese currency breached the 7.30 level as traders positioned the impact of tariffs on Chinese exports to weaken the currency, but it has strengthened since Trump’s inauguration.