Deutsche Bank needs more than one ‘year of calculation’

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

Christian Sewing believes that “predictability and consistency” are very important for Deutsche Bank. German Bank Executive Director is not wrong. Most of the last 15 years, the only thing that is in line with Deutsche was his ability to step on every rake he encountered. But Disappointing annual results Suggest anxiety due to hidden garden accessories.

Sewing well renewed the job Deutsche After decades of excessive expansion and poor management, they left him fighting for survival. His stakes almost doubled from their low point in 2020. But his profit account on Thursday pointed out questions with predictability that helps explain his long -term discount in relation to peers.

On the dilapidated front, one -time costs, including litigation, is deployed to profit, which fell 92 percent in the fourth quarter. The bank also moderated its cost goal for 2025. In the meantime, she emphasized how much Deutsche is still a relying on a potentially unstable trading business.

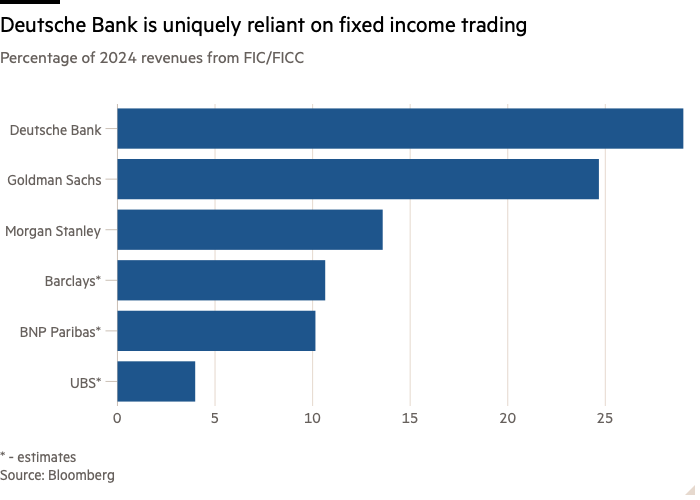

Nearly a third of Deutsche’s revenue comes from a ward with fixed income and currency, known as Fic. This job goes well. The market volatility has helped to encourage demand. Between the new Trump regime in the United States, the Government of the UK is facing budget pressures and the upcoming general elections in Germany, there should be a lot of uncertainty to keep his momentum in 2025.

Investors, however, tend to give only a limited loan for commercial income – which are afraid of being unpredictable and requires more capital than, say, wealth management.

Indeed, Deutsche’s reliance on trading helps to explain why he is still lagging behind most of his European rivals on an estimate of 0.6 times tangible books. UBS, with its huge hand to manage wealth, runs a package 1.5 times.

Deutsche may have given up his efforts to be “European Goldman Sachs.” But in this regard, he has a similar problem with a one -off American rival. Goldman’s relatively excessive relying on the Ficc-S Additional C for the slave-Sailing is the closure of the JAZA evaluation gap with Morgan Stanley, which has a job with great wealth, and JPMORGAN, a retail bank with full service.

Goldman follows access to double paths, trying to build alternative sources of revenue, at the same time convincing investors that trading is not as unstable as they are afraid. Deutsche does the same, emphasizing the share of FIC revenue arising from a loan extension to clients or “financing” that investors consider more stable.

Sewing said on Thursday that 2025 will be Deutsche’s “Calculation Year”, when the bank will be rated at this stage of its efforts. But it will take more than one year before investors can believe that the bank has really become predictable.