California wildfires: VP Harris speaks out over claims for insurance companies

CRMBC CEO and insurance industry expert Kaya Stanley explains that there is no state surplus to cover the catastrophic economic losses associated with the Los Angeles wildfires.

The insurance industry is pulling back after that Vice President Kamala Harris suggested that insurance companies had canceled policies for victims of the California wildfires, calling her claim “false, wrong and dangerous.”

During a press conference regarding the ongoing wildfires on Thursday, Harris said, “Many insurance companies have canceled coverage for many families that have been affected and will be affected, which will only delay or further burden their ability to recover are.”

Vice President Kamala Harris speaks to the media about the federal response to the Los Angeles wildfires at the White House in Washington, DC, on Thursday. (Tasos Katopodis/Getty Images/Getty Images)

“I think that’s an important point to make,” she continued, “and hopefully there’s some way to address that problem, because these families — so many of them — otherwise won’t have the resources to recover in any way, and many of them lost everything.”

CALIFORNIA FIRES: IMPORTANT PHONE NUMBERS FOR LOS ANGELES AREA RESIDENTS AND HOW YOU CAN HELP THEM

David Sampson, president and CEO of the Property Insurance Association of America (APCIA), said FOX Business“It’s false, wrong and dangerous to even insinuate that insurers are abandoning their customers, and it’s especially troubling coming from a former California state official who should know the law.”

He added: “Insurers are committed to protecting the safety of those affected and providing expedited assistance to their policyholders for covered losses.”

Plumes of smoke are seen as a wildfire burns in Pacific Palisades, California on Tuesday. (David Swanson/AFP via Getty Images/Getty Images)

Sampson noted that California law prohibits insurers from canceling a policy during its term, except in very limited exceptions, such as nonpayment of premiums or fraud.

He added: “So the implication that people who have insurance that has been in place since January 7th has been canceled – just to give people that impression and create that fear – is irresponsible, in my view.”

FOX Business has reached out to the White House for comment.

CALIFORNIA’S INSURANCE CRISIS: LIST OF CARRIERS THAT HAVE FLOODED OR REDUCED THE STATE’S COVERAGE

Even before this week’s wildfires hit, California was in the midst of an insurance crisis, with many residents unable to get home insurance because several carriers have limited their exposure in the state or pulled out entirely in recent years due to heavy losses and an inability to adequately raise premiums. or assess risk due to California regulations.

Malibu resident Saphia Hall gives a first-hand account of the catastrophic wildfires in California on ‘Making Money’.

The state’s largest home insurer, State Farm, announced last March that it would not renew about 72,000 home and condo policies over the summer. The company cited inflation, regulatory costs and the increasing risk of disasters as reasons for its decision, and had previously stopped accepting new requests in the state.

CALIFORNIA FIRES COULD COST INSURERS $20 BILLION, THE HIGHEST IN THE STATE’S HISTORY

Several other major insurers, including All State, Farmers and USAA, have also limited new policies in California in recent years as part of an effort to limit their exposure to policies that carry what they see as undue risk as state regulators have allowed them to charge policyholders. . Similar reasons for escalating risk, high repair costs and rising reinsurance premiums were cited in those decisions.

While it is illegal for insurance companies to cancel policies before they expire in California, many homeowners whose policies haven’t been renewed have struggled to get or afford coverage as the number of carriers in the state continues to dwindle.

Homes burn as high winds fuel the Eaton Fire in Pasadena, California, on Tuesday. (David McNew/Getty Images/Getty Images)

Because of this situation, many houses destroyed in the fires that were still going on were not insured.

CLICK HERE TO SET FOX BUSINESS IN CRETE

After the latest wildfires in Southern California, there are some critics blamed by insurance companies because it refused to cover property in fire-prone areas of the state. But Sampson says he has been warning California regulators for years about the vulnerability of the state’s insurance market.

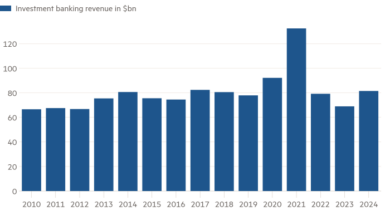

He explained, “Over the last nearly decade, for every dollar of homeowner premium we’ve collected, we’ve paid out $1.09 in claims — and that’s not sustainable.”

Eric Revell of FOX Business contributed to this report.