Busey set to take over CrossFirst with Fed approval Investing.com

CHAMPAIGN, Ill. – First Busey (NASDAQ: ) Corporation (NASDAQ: BUSE ), parent company of Busey Bank, received Federal Reserve approval to proceed with its acquisition of CrossFirst Bankshares, Inc. (NASDAQ: NASDAQ:), the holding company for CrossFirst Bank. Following stockholder approval on December 20, 2024, the merger is expected to close on March 1, 2025, subject to customary closing conditions and approval by the Illinois Department of Financial and Professional Regulation. CrossFirst, which currently trades at a P/E ratio of 9.86 and is valued at $729 million, is trading below its InvestingPro Fair value, which suggests a potential plus in the business.

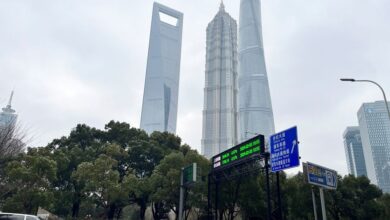

The strategic move aims to expand Busey’s presence in high-growth major metropolitan markets, including Kansas City, Wichita, Dallas/Fort Worth, Denver and Phoenix. “This is another significant milestone in the completion of this transformational business combination,” said Van Dukeman, President and Chief Executive Officer of Busey. CrossFirst brings solid fundamentals to the business, with revenue growth of 7.66% and an overall financial health score of “GOOD” according to InvestingPro analysis. Subscribers can access 6 additional expert tips and comprehensive valuation metrics for both companies.

CrossFirst Bank will initially operate as a separate branch until the planned full integration with Busey Bank, which is expected in late June 2025. This will result in CrossFirst Bank branches moving to Busey Bank locations.

Mike Maddox, CEO, President and CEO of CrossFirst, expressed confidence in the cultural and customer service alignment between the two companies, which he believes will benefit teams, customers and communities.

The partnership is poised to strengthen Busey’s relationships with its commercial banking and wealth management businesses, as well as expand the reach of its payment technology solutions subsidiary, FirsTech, Inc. The combined entity will serve clients from 77 full-service locations in 10 states, boasting approximately $20 billion in assets, $17 billion in deposits, $15 billion in loans and $14 billion in assets under supervision. With two analysts recently revising their earnings estimates for CrossFirst, the timing appears to be favorable for a merger. Access detailed merger analysis and financial projections via of InvestingPro comprehensive research reports available on over 1,400 US stocks.

The merger is expected to significantly improve performance metrics, improve net interest margin and efficiency, which in turn should increase profitability and shareholder returns.

First Busey Corporation, headquartered in Champaign, Illinois, had total assets of $11.99 billion as of September 30, 2024. Busey Bank operates 62 banking centers in various regions. The company was recently recognized by Forbes among the best in the world for 2024 and the best American banks.

CrossFirst Bankshares, Inc., headquartered in Leawood, Kansas, serves a diverse clientele through its multi-state, full-service financial institution, CrossFirst Bank.

This article is based on a press release.

In other recent news, CrossFirst Bankshares, Inc. has amended its Annual Incentive Plan (AIP) following its announced merger with First Busey Corporation, according to a recent SEC filing. The updated AIP, applicable to certain officers, introduces a new structure for evaluating performance targets if there is a change in control during the performance period. After the merger, the surviving corporation will establish new performance goals for the remainder of the performance period.

These revisions are part of a broader merger process with Busey, which is expected to create synergies and cost savings. Shareholders of First Busey Corporation and CrossFirst Bankshares, Inc. approved the merger agreement, marking an important step toward finalizing the transaction.

The CEOs of both companies expressed their belief in the potential benefits of the merger, focusing on improving financial services while preserving the bank’s value in the community. The merger, which is expected to close in 2025, will result in a combined entity operating in 10 states with approximately $20 billion in total assets. This recent development comes amid strong financial results from CrossFirst, showing revenue growth of 7.66%.

This article was generated with the help of AI and reviewed by an editor. See our T&C for more information.