Britons have the ‘lowest appetite’ for stock market investing in the G7

Britons have the least appetite among their G7 peers for investing in the stock market, according to a new study which found that personal wealth in the UK is mostly tied up in housing, pensions and cash.

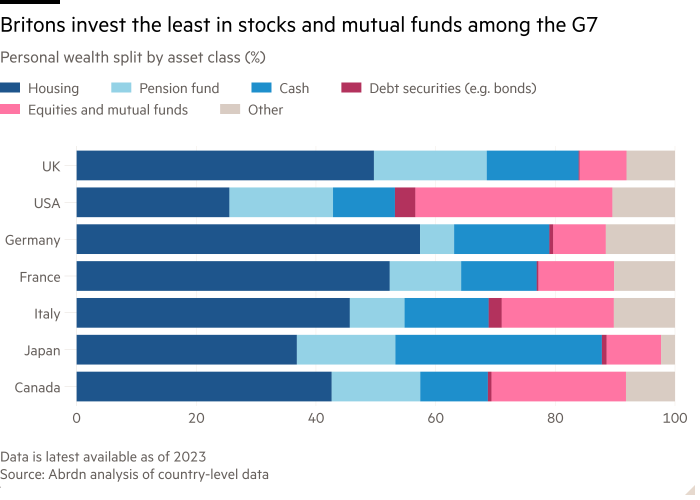

Savers in the UK invested just 8 per cent of their wealth directly in shares and mutual funds, compared with 33 per cent in the US and an average of 14 per cent in the remaining five G7 countries, according to an analysis of national accounts by Abrdn.

The asset manager has repeatedly called on the government to encourage share ownership to help tackle what it sees as a retirement crisis. There are “questions about how far [the UK government] can support an aging population. . . and pension funds will increasingly fall short of what people need,” said Xavier Meyer, CEO of Abrdn’s investment business.

“Personal savings and investment will have to increase to cover this shortfall,” said Meyer, who suggested Britain could look to other G7 countries for inspiration. “Taking a few lessons from our international neighbors is not a bad idea,” he added.

In the US, a “risk-taking culture” and a booming local stock market have driven personal wealth into stocks, said Laith Khalaf, head of investment analysis at AJ Bell.

The S&P 500 index of large US publicly traded companies has risen more than 1,100 percent over the past 30 years, far outperforming similar indexes in the G7. In the same period, the UK’s FTSE 100 rose by just 135 percent.

Khalaf added that in the US, the long-standing trend of “people managing their own retirement” using 401(k) plans has encouraged individuals to actively manage their money and invest in stocks.

The UK tops the pension fund pile in Abrdn’s analysis: 19 per cent of personal wealth in the country is allocated to pensions, compared with 17 per cent in the US and 6 per cent in Germany, the lowest in the G7.

Chancellor Rachel Reeves tried to prevent pension fund investments into UK stocks revive British companies and boost infrastructure projects.

Think-tank New Financial estimates that UK pension funds have cut their allocation to UK shares from just over half of total assets in 1997 to 4.4 per cent today – among defined contribution schemes the share is higher at 8 per cent.

Susannah Streeter, head of money and markets at investment platform Hargreaves Lansdown, said UK pension fund money was flowing into global markets because of higher returns on offer. “That [discourages] companies listed in the UK, and if fewer companies are listing, then there is less opportunity for UK investors because they are not as excited about the gains.”

The chancellor proposed a consolidation pension schemes in November to encourage domestic investment, but the plans have so far failed to force funds to invest in the UK.

About 15 percent of the UK’s personal wealth is held in cash, in line with other European G7 countries, but less than half the share in Japan, where just over a third of total personal wealth is in cash.

“Japan has been scarred from the period from the late 1980s onwards, when the stock and property markets crashed,” said Darius McDermott, director of advisory firm Chelsea Financial Services. “This was followed by a long period of deflation and low interest rates,” which meant savers could hold cash without worrying about its value diminishing, he added.

The recent rise in inflation prompted the Japanese government to introduce higher investment tax breaks last year. In January 2024, the Nippon Individual Savings Account (Nisa) — first introduced in 2014 and based on the UK’s Isa — was expanded with more attractive tax exemptions. The improved Nisa offers individuals a lifetime exemption from tax on equity investments, and contribution limits have been tripled.

The Isa scheme in the UK is now over 25 years old and used by over 22 million people, has been hailed as a success — but advisers point out that two-thirds of them only hold cash, according to analysis by financial platform AJ Bell, the latest data from HMRC, for 2021-22.

Streeter noted that Isa thresholds have not been increased since 2017. “I think it’s a bit of a disincentive, because if there was a bigger tax-free envelope under which equity funds could be bought, it would encourage more investment in the stock market. “

The UK is largely in line with the rest of Europe’s G7 nations when it comes to housing, with around half of personal wealth allocated to the asset class – although in countries where house prices are higher, residents may have no choice but to commit much of their wealth to bricks and mortar and plasters.

In the U.S., only a quarter of personal wealth is in housing, a fact that Abroad’s deputy chief economist, James McCann, suspects is related to “a greater distribution of capital” among American households and “less scarring from the financial crisis,” which hit the U.S. worse than other real estate markets in the G7.

Abrdno’s analysis included the full value of the homes and did not subtract the mortgage debt.

Myron Jobson, senior personal finance analyst at investment platform Interactive Investor, said the UK’s “go-to mindset” coupled with a strong property market had created a generation of landlords. “And there’s the dual benefit of the income that comes from renting out that property and the capital growth on your initial investment,” he added.

Yolande Barnes, president of the Bartlett Institute of Real Estate at University College London, said the country’s “range of wealth” was the most important factor in determining how people’s wealth was distributed.

“Only those in the richest classes tend to use higher risk, higher return investments such as stocks in their property portfolios,” Barnes said, citing research by the Resolution Foundation, a think-tank. “Middle-wealth cohorts use real estate much more — mostly apartments,” she said.

The high allocation to stocks in the US is therefore partially explained by the larger number of wealthy individuals who had a much greater inclination to invest in stocks and other high-risk instruments, she added.

Abrdn said his figures differed from other estimates of wealth distribution – such as the UK Office for National Statistics’ Wealth and Assets Survey – due to differences in data sources, methodological assumptions and the way asset values are aggregated. They say they used national accounts figures because they are “the fairest and best way to compare between countries”.

The asset manager will release the full figures on Monday in its “Tell Sid and Tell Him Again” report on how to boost retail participation in capital markets.