British manufacturers are increasing pressure on the government over industrial strategy

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

Manufacturers have warned that the UK government must deliver on its promise of an effective industrial strategy to offset rising employment costs imposed by chancellor Rachel Reeves in last October’s budget.

A post-Budget poll of senior manufacturing executives found 57 per cent believed the long-term industrial strategy would lead to increased investment, despite near-universal concerns about higher wages and energy costs.

“Pressure on the upcoming industrial strategy will now be even greater to put investor confidence on a growth path,” warned Make UK, the manufacturers’ lobby.

The high expectations for the industrial strategy come as Whitehall prepares for what government officials will have warned will be a brutal spending overhaul as Britain’s public finances came under increasing pressure from the bond market last week.

One senior Whitehall official said there was now a growing risk of a mismatch between industry expectations of industrial strategy and what could be delivered, given the lack of government money available for initial funding beyond core missions such as reaching net zero or strengthening defence.

“Unless it’s for tanks or windmills, there’s not really any money,” a Whitehall official said.

The survey of 161 manufacturing executives replicated that of other leading business groups, including the CBI and British Chambers of Commercehighlighting the impact of Rachel Reeves’ decision to increase employers’ National Insurance contributions.

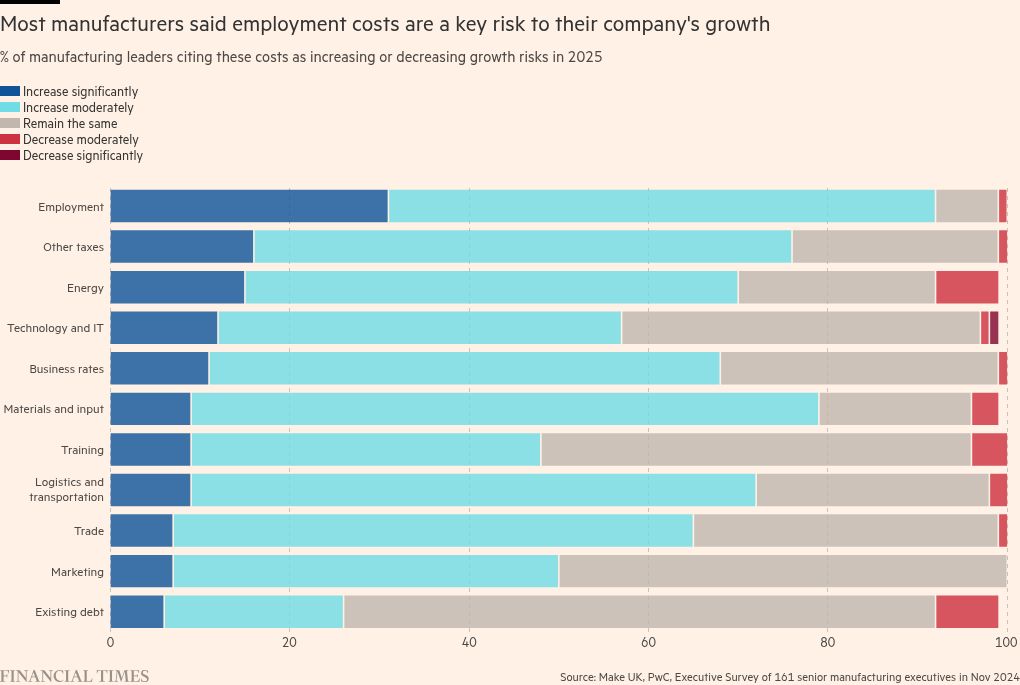

More than 90 per cent of respondents said employment costs would be their biggest expense in the coming year, as a result of NIC increases, expanded employment rights and a rise in the National Living Wage.

As a result, the survey found that companies will look to cut costs and raise prices, adding to inflationary pressures on the economy. “This will be painful for both their customers and their staff,” added Make UK.

However, despite the bleak outlook, the survey identified “increased optimism” that the planned release of the industrial strategy in the spring could prove to be a “game changer for investment”.

Labor government he published his industrial strategy last October, announcing a plan to target eight sectors, including advanced manufacturing, clean energy and life sciences, in an attempt encourage investment and stimulate economic growth.

A senior executive at carmaker Nissan said the industrial strategy announcement was “crucial to the future” of British car design and manufacturing.

“Global competition for investment is at an all-time high and it is clear that UK manufacturing is at an inflection point. Countries that can demonstrate a clear long-term strategy, supported by policies that foster an attractive investment environment, will be first in line,” added Nissan’s CEO.

The strategy will be overseen by a 16-member Industrial Strategy Advisory Council chaired by Clare Barclay, CEO of Microsoft UK. Other members include Rolls-Royce Chair Dame Anita Frew and Greg Clarkformer Conservative Business Secretary.

Whitehall insiders said the consultation on the shape of the industrial strategy, which closed in November, had succeeded it attracted a large response from companieswith more than 3,000 responses submitted to the Department of Business and Trade.

Make UK chief executive Stephen Phipson said more detail was needed in areas such as skills and regional devolution policy.

“The government has taken a big, positive first step, but it must now back it up by setting immediate and meaningful priorities that will include the very clear benefits that manufacturers believe they will bring,” he added.

Industry Minister Sarah Jones said she welcomed the confidence shown in the potential of the industrial strategy. “We will continue to do everything we can to promote the UK’s top industries to global investors,” she added.

Data visualization by Amy Borrett