Bond market selloff jolts global investors as Trump worries grow Reuters

Authors: Amanda Cooper, Yoruk Bahceli and Gertrude Chavez-Dreyfuss

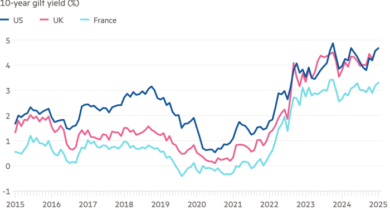

LONDON/NEW YORK (Reuters) – A sharp drop in the world’s biggest government bond markets and a continued rise in the dollar sent shockwaves through financial markets, with the pain deepening as uncertainty grows over the policies of US President-elect Donald Trump.

On Wednesday, the index, which underpins trillions of dollars in daily global transactions, jumped more than 4.7% to its highest level since April, with UK peers hitting their highest levels since 2008.

Yields rise when bond prices fall. There was no obvious trigger for the latest wave of big selling.

Germany’s 10-year Bund yield touched its highest level in more than five months amid accelerating eurozone inflation and increased bond supply. The yield, the eurozone’s benchmark, rose nearly four basis points to 2.524% at the end of Wednesday.

Japan’s 10-year benchmark hit a 13-1/2-year high of 1.185% in morning Asian trading on Thursday.[JP/]

The moves triggered a fresh wave of currency selling against the dollar, particularly for sterling, which slipped more than 1% before recovering slightly, and the euro, which moved closer to the $1 mark.

The index , which rebounded after Trump’s victory, recently started to falter, although it closed more or less unchanged on Wednesday.

At a news conference at Mar-a-Lago on Tuesday, Trump decried high interest rates in the US despite the Federal Reserve being in the middle of an easing cycle.

“Inflation continues to run rampant and interest rates are too high,” the president-elect said.

Central banks have all but declared victory over inflation in 2024, but a number of indicators show that price pressures are rising again.

Trump’s plans for higher trade tariffs, tax cuts and deregulation threaten to increase inflation and strain government finances, also limiting the Federal Reserve’s ability to cut interest rates.

“What it really comes down to is the term premium,” said Chip Hughey, director of fixed income at Truist Advisory Services in Richmond, Virginia, referring to the premium investors demand to hold long-term bonds.

“85% of the rise in yields we’ve seen since mid-September has been in the term premium,” he said. “It’s a reflection that fiscal policy uncertainty continues to grow as we move toward the swearing in of a new administration.”

Hughey noted that the current term premium for the 10-year bond is 54 bps, up from negative 29 bps in mid-September.

This means that 10-year yields are 54 bps higher than what can be justified by Fed policy expectations.

A WAVE OF OFFERS

Other governments are busy repairing their own finances and strengthening their economies, while ramping up bond sales.

Long-term yields, which are usually less sensitive to short-term swings in monetary policy expectations, hit multi-year highs globally, in part due to a tidal wave of new bonds this year.

European bond markets need to absorb large issuances to start the year, with Germany selling €5 billion of 10-year bonds and Italy selling new 10-year and 20-year green bonds through syndication.

Byron Anderson, head of fixed income at Laffer Tengler Investments in Scottsdale, Ariz., noted about $14.6 trillion in national debt maturing in the next two years, meaning there is plenty of debt to extend beyond one year.

Traders say the new Trump administration will need to shift its current focus to a greater reliance on short-term debt.

Yields on 30-year government bonds rose 60 basis points in a month – the biggest such increase since October 2023. They are now perilously close to 5%, a level rarely seen in the last two decades.

That pushed the premium for 30-year yields over two-year yields to the highest level in nearly three years — a dynamic known as a “steepening of the curve.”

“There’s a large pool of bonds that need to be sold, so that gives you a steeper curve as well as a higher premium for longer durations. I think that’s one of the main drivers,” he said. Danske Bank (CSE:) chief analyst Jens Peter Soerensen.

Yields on UK 30-year gilts hit their highest level since 1998 at around 5.4%, raising concerns about the impact of higher borrowing costs on the UK government’s already shaky finances.

Chinese government bonds went in the opposite direction and rallied, pushing yields to record lows as the economy stalls and investors expect a rate cut. But even that rise took a breather on Thursday with 10-year yields at 1.6%.