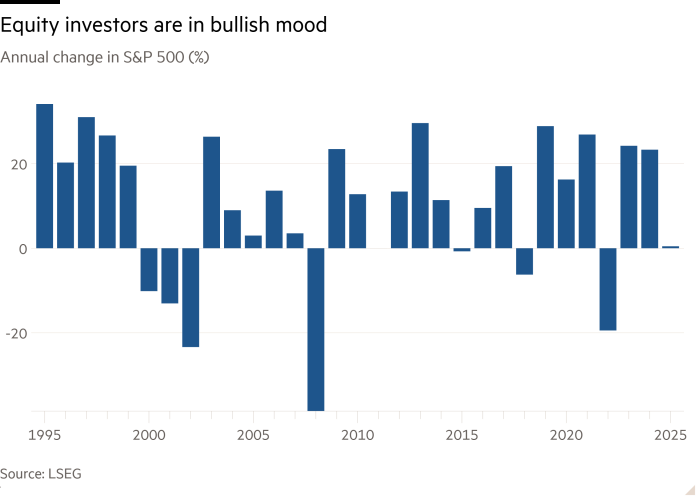

bearish economists or bullish investors?

Stock investors are rejecting economists’ gloomy predictions about US President-elect Donald Trump’s economic policies, betting instead that his plans will boost corporate earnings and bolster the market.

S&P 500 Wall Street’s benchmark took off to a record high last year and, although there has been a recent pullback, equity strategists have expected profits of around 10 percent for the index this year on the back of strong earnings growth.

That bullish tone is in sharp contrast to recent warnings from economists about the likely damage from Trump’s protectionist policies, which they say could hit economic growth, increase inflation and limit the Federal Reserve’s ability to cut interest rates.

Some put the sharp division down to differing views on the extent to which Trump will implement his plans, doubts about the impact of GDP growth on the profits of the big tech groups that drive market growth, and different time frames in which to evaluate the effects of the new president’s policies.

“I think economists are taking a lot of what Trump says he’s going to do as likely to play out,” said Evan Brown, portfolio manager and head of multi-asset strategy at UBS Asset Management. “Investors, rightly or wrongly, are betting Trump won’t follow nearly to the same extent.”

Recently Financial Times polls found that more than half of the 47 economists polled on the US economy predict “some negative effect” from Trump’s policies, while another tenth expect a “large negative effect” and only one-fifth predict a positive effect.

Many have focused on the risks of two prominent Trump policies: trade tariffs and restrictions on US immigration.

“If I were to channel an economist and look at this new era as a glass half-empty, those would be the A and B pieces of evidence I would point to,” said Jurrien Timmer, director of global macro at Fidelity. “But the market is looking at earnings.”

Analysts forecast earnings growth of 15 percent for the S&P 500 in 2025, according to data compiled by FactSet, up from about 9 percent last year. Net profit margins are expected to increase to their highest level in a decade.

A number of fund managers said it was still too early to change their profit forecasts, given the uncertainty over what policies Trump would implement or what effect they would have in practice.

Barry Bannister, chief equity strategist at Stifel, said: “Immigration will initially target border control and criminal elements, but with many new immigrants it actually leans Republican … we doubt there will be mass deportations.”

The tariffs are also likely to be targeted rather than the sweeping ones threatened by Trump, he added, designed to boost U.S. exports and inward investment in U.S. manufacturing.

Contrasting views among economists and investors could also stem from either of Trump’s two main campaign promises — to “make America great again” through tariffs and immigration restrictions, and shrink the federal government — two groups believe will dominate the next four years, said Jason Draho, head of asset allocation for the Americas at UBS Global Wealth Management.

Overall, Maga “benefits labor” while deregulation “favors capital,” he added. “The more [deregulatory] the more Trump 2.0 economic policy ends up being, the more constructive the investment outlook,” he added.

Some also point to the historical lack of correlation between economic growth and stock market returns as reassurance that even if growth suffers, it doesn’t necessarily trigger a bear market.

Kevin Khang, senior economist at Vanguard, said, “There’s a lot that gives you a positive return in the stock market, other than just economic growth.”

Trump’s pro-business stance is expected to encourage companies to invest, potentially helping non-tech sectors boost their earnings as well.

Rick de los Reyes, a portfolio manager at T Rowe Price, said: “You can see that some companies that were previously hesitant to make investment decisions are now more willing to do so.”

Earnings for the Magnificent 7 are forecast to grow 21 percent this year, down from 33 percent in 2024. That’s still ahead of other sectors, but less so this year, with earnings for the other 493 members of the S&P 500 set to rise 13 percent this year, up from 4 percent, according to FactSet.

In the end, both economists and investors could prove to be right – but in different time periods. Investors tend to think more short-term, and the market often looks to upcoming earnings and the potential for looming tax cuts. Over the longer term, economists may still be right to worry about whether lower taxes will worsen the federal budget deficit or the potential damage to GDP growth from tariffs and immigration restrictions.

Mitch Reznick, head of fixed income group in London at Federated Hermes, said: “Loose fiscal policies that support the economy in the short term could also lead to reflation and increased deficits in the medium to long term.”