Asian stocks rise, dollar at two-year high as US rates, Trump in focus Reuters

Ankur Banerjee

SINGAPORE (Reuters) – Asian shares rose on Friday, aiming to weather a lackluster start to 2025, while the dollar hit a two-year high against a basket of currencies as investors worried about U.S. exchange rates staying higher for longer .

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.33% higher, but is on course for a nearly 1% drop on the week. The index is up nearly 8% in 2024. Japanese markets are closed all week.

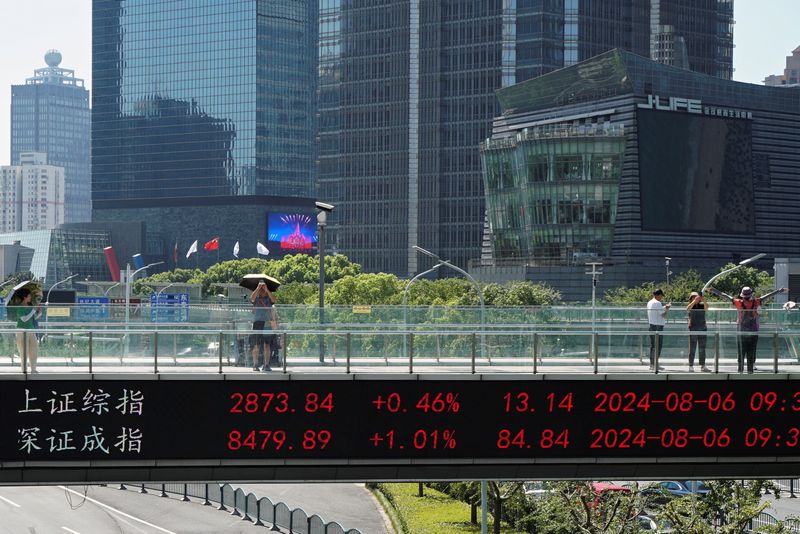

Chinese shares were steady on Friday after falling on Thursday, underscoring growing concerns about China’s economy and a possible looming trade war when Donald Trump takes over as US president this month.

China’s blue-chip CSI 300 index was 0.16 higher in early trade after posting its weakest start to the New Year since 2016 on Thursday. Hong Kong rose by 0.19 percent.

“It’s been a tough time for stocks at the turn of the year, but strange things can happen in illiquid markets,” said Ben Bennett, Asia-Pacific investment strategist at Legal and General Investment Management.

“I don’t think we should extrapolate this performance. Still, a stronger dollar and higher bond yields will weigh on sentiment going forward and equity investors will be hoping that changes soon.”

On Wall Street, US stocks closed sharply lower on Thursday after initial gains failed to hold. Shares of Tesla (NASDAQ: ) sank 6.1% after reporting its first annual decline in shipments, [.N]

The gloomy mood comes after a faltering end to 2024, which disrupted a year-long rally fueled by expectations of artificial intelligence growth, expected rate cuts by the Federal Reserve and, more recently, the likelihood of deregulatory policies by the incoming Trump administration.

But as the Fed rattled markets last month by forecasting a smaller-than-expected rate cut and growing concerns that Trump’s policies could prove inflationary, bond yields rose, boosting the dollar and hurting stocks.

Vasu Menon, director of investment strategy at OCBC, said Trump’s pro-growth and business agenda could boost the US economy, but could prove challenging for the rest of the world due to possible tariffs and a stronger dollar.

“So there is a degree of caution and anticipation in the markets, especially after the strong investment in the last two years,” Menon said.

Overnight data showed that the number of Americans filing new claims for jobless benefits fell to an eight-month low of 211,000 last week, pointing to small layoffs in late 2024 and consistent with a healthy labor market.

That’s a good sign for the US economy, with payrolls and inflation data later this month likely to be the focus of investors as they gauge how measured the Fed’s rate-cutting approach is likely to be.

Traders are pricing in 44 basis points of easing this year, below the 50 basis points the US central bank projected in December.

That left the currency, which measures the US currency against six other units, at 109.2, just below the two-year high of 109.54 it touched on Thursday. The index rose 7% in 2024 as traders adjusted their interest rate expectations.

The euro, meanwhile, was among the biggest losers against the rising dollar, having fallen 0.86% in the previous session to a more than two-year low of $1.022475. It was at $1.0269 in Asian hours on Friday, down 1.6% for the week, the worst since November. [FRX/]

The yen strengthened slightly to 157.295 to the dollar, but was not too far from the five-month low of 158.09 to the dollar reached in December. The yen fell more than 10% last year, the fourth consecutive year of losses.

On the commodities side, oil prices rose on optimism about China’s economy and demand for the fuel following President Xi Jinping’s pledge to promote growth.

futures rose 0.16% to $76.05 a barrel, while US West Texas Intermediate crude rose 0.18% to $73.25 a barrel.

Gold prices were steady at $2,658 an ounce, after rising 27% in 2024, its strongest annual performance since 2010. [GOL/]