‘America first’ could be the luxury sector’s new refrain

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

Fashion changes. For many years, the growth in the luxury industry could be summed up in two words: “China” and “bags”. Now it’s ‘America’ and ‘bling’. The owner of Cartier Richemont, whose blowout sales fueled a 15 percent rise in shares on Thursday, is modeling this lucrative new look.

The US is gaining luster as a luxury market. This is not an entirely new phenomenon: for many companies, sales of the region’s top status symbols have been a relatively bright spot in 2024. Richemont’s year-end quarterly sales suggest a startling acceleration. Buoyed by a doubling of its US growth rate to 22 percent, the group posted a 10 percent rise in global sales, beating consensus expectations.

In part, this reflects the increased window space. Luxury houses of the Old World rush their own american dream, opening stores far from traditional centers. On top of that, luxury enjoyed its own, gilded, Trump bump. Stock market investors and cryptocurrency fledglings were clearly preoccupied with their holiday shopping.

It looks like this will continue. Expected Trump-era policies — including maintaining favorable tax treatment for bonuses paid to private equity managers and President Joe Biden’s repeal of the tax on stock buybacks — will leave more money in the hands of already big spenders.

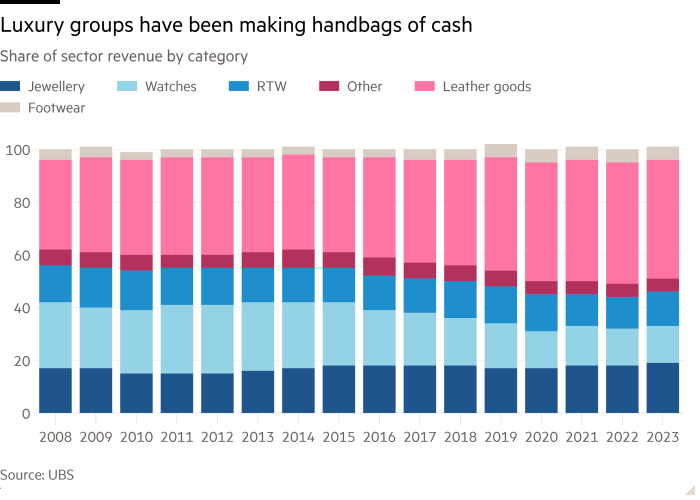

What is sold is as important as where. Leather products have overtaken jewelery for much of the past decade, rising from 34 percent of the sector’s revenue in 2008 to 46 percent in 2022, according to UBS estimates. Handbags have somehow replaced diamonds as luxury shoppers’ best friends.

That seems ripe for reconsideration. Price inflation in some desirable leather products has far outstripped inflation in jewelry. A Chanel jumbo flap bag – which in 2018 cost about the same as a Cartier Love bracelet – is now about 60 percent more expensive. This improves the gem’s — relative — value and the category’s growth prospects.

Luxury investors will be hoping that Richemont’s performance bodes well for the sector’s rebound. The Stoxx European luxury real estate index rose 6.7 percent on Thursday.

To some extent that might be true. There seems to be a general improvement in mood. And elite retailers are increasingly talking about adding space in the US.

But Richemont is more exposed to Americans and bling than most. More than 70 percent of revenue in the last quarter came from jewelry. According to UBS estimates, a third of its sales will come from US consumers at home and abroad in the year ending March 2025, compared with just over a fifth for the industry as a whole. The owner of Cartier may be the brightest jewel in the luxury diadem.