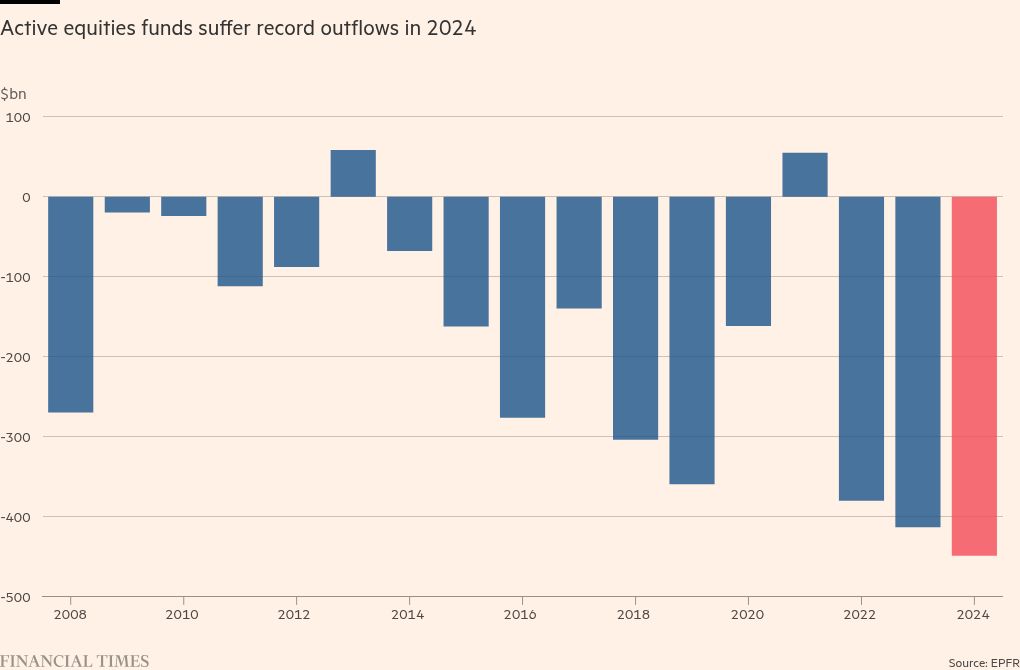

Stockpicking funds suffer record $450 billion in outflows

Unlock Editor’s Digest for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

Investors have pulled a record $450 billion out of actively managed equity funds this year, as a shift to cheaper index-tracking investments reshapes the asset management industry.

Outflows from stock mutual funds surpass last year’s peak of $413 billion, according to EPFR data, and highlight how passive investment and exchange-traded funds are destroying the once-dominant active mutual fund market.

Traditionally fundraising have struggled to justify their relatively high fees in recent years, with their performance lagging the gains of the Wall Street index driven by big tech stocks.

The exodus from active strategies has accelerated as older investors, who tend to favor them, cash out and younger savers turn to cheaper passive strategies instead.

“People have to invest for retirement and at some point they have to retire,” said Adam Sabban, senior research analyst at Morningstar. “The investor base for active equity funds is skewed older. New dollars are much more likely to go into an index ETF than an active mutual fund.”

Shares in asset managers with big stock-picking businesses, such as US groups Franklin Resources and T Rowe Price and Britain’s Schroders and Abrdn, lagged far behind the world’s biggest asset manager BlackRockwhich has a large business with ETFs and index funds. They lost by an even wider margin to alternative groups such as Blackstone, KKR and Apollo, which invest in unlisted assets such as private equity, private credit and real estate.

T Rowe Price, Franklin Templeton, Schroders and the $2.7 trillion privately held Capital Group, which has a large mutual fund business, were among the groups that suffered the biggest outflows in 2024according to data from Morningstar Direct. All declined to comment.

The dominance of US big tech stocks has made it even more difficult for active managers, who typically invest less than benchmarks in such companies.

Wall Street’s so-called Magnificent Seven — Nvidia, Apple, Microsoft, Alphabet, Amazon, Meta and Tesla — led the U.S. market’s biggest gains this year.

“If you’re an institutional investor, you’re assigning yourself to really expensive talent teams that aren’t going to own Microsoft and Apple because it’s hard for them to have real insight into a company that everybody’s studying and everybody owns,” said Stan Miranda, founder of Partners Capital, which provides outsourcing services. director for investments.

“So they generally look at smaller, less followed companies and guess what, they were all smaller than the Magnificent Seven.”

The average actively managed core U.S. large-cap strategy has returned 20 percent over one year and 13 percent annually over the past five years, after accounting for fees, according to Morningstar data. Similar passive funds offered returns of 23 percent and 14 percent, respectively.

The annual expense ratio of such active funds of 0.45 percentage points was nine times higher than the equivalent of 0.05 percentage points for funds that follow the benchmark.

Outflows from stock pool mutual funds also underscore the growing dominance ETFsself-listed funds that offer US tax benefits and greater flexibility for many investors.

Investors poured $1.7 trillion into ETFs this year, pushing total industry assets up 30 percent to $15 trillion, according to research group ETFGI.

The flurry of inflows shows the increasing use of the ETF structure, which offers the ability to trade and price the funds’ shares during the trading day, for a wider choice of strategies beyond passive index tracking.

Many traditional mutual fund houses, including Capital, T Rowe Price and Fidelity, have sought to attract the next generation of buyers by repackaging their active strategies into ETFs, with some success.