Ark’s Cathie Wood calls for tax clarity as she rides ‘Trump race’ Reuters

By Suzanne McGee

(Reuters) – U.S. technology investor Cathie Wood is urging the incoming Donald Trump administration to boost economic growth and policy certainty by rolling back promised corporate and personal taxes to Jan. 1, 2025, she told Reuters.

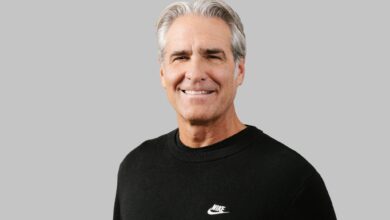

A laggard in recent years, Wood’s flagship ARK Innovation (NYSE: ) exchange-traded fund is up 17% since Trump’s victory, which is expected to bring policy changes that will benefit the fund’s holdings.

Two of its stocks, electric car maker Tesla (NASDAQ: ) and crypto exchange Coinbase (NASDAQ: ) have already risen 54% and 7%, respectively, since Nov. 6, while it has gained about 1.7% in that period.

ARKK’s other biggest holdings include Robinhood (NASDAQ: ) and Block , both of which could also benefit from friendly crypto and AI policies.

Wood has publicly endorsed Trump’s economic platform, arguing that his plan to boost jobs, promote innovation in crypto and artificial intelligence, and cut red tape and government spending will make life easier for corporate America.

Tax policy was also central to the election race, with Trump promising to cut the rate paid by companies that make goods in the United States and extend individual tax cuts passed by Congress in 2017 that are set to expire next year.

That’s a key area Wood said she’s pushing for more clarity.

“I see them saying, okay, we’re going to cut taxes, but we’re going to make them retroactive to January 1, 2025. That would be very helpful, I think, in terms of providing certainty for the markets,” Wood said in an interview.

“If they don’t, you’re going to get companies and individuals who may be holding back. … I try to communicate that pretty regularly to anyone who will listen.”

While Wood said she generally does not support tariffs, which act as tax increases on goods, Trump’s threat to raise them on major trading partners appears to be a negotiating ploy.

TAX REFORM

Analysts expect the new Republican-controlled Congress to push ahead with tax reform next year, but Trump will initiate other key policies with executive orders after his Jan. 20 inauguration. He also announced new regulators that can begin implementing his innovation agenda.

Campaign finance records show that Wood did not financially support Trump in the 2024 election cycle.

She told Reuters she had only met Trump once, earlier this year at his home in Florida, but is in contact with Tesla boss and billionaire Trump backer Elon Musk and crypto-enthusiast Wyoming Republican Sen. Cynthia Lummis, both of whom are helping to shape the deal. Trump’s policies.

Wood has been one of Musk’s top cheerleaders, investing 16% of ARKK’s $6.4 billion in assets in Tesla. That outsized bet reflects her confidence in Musk and her belief that AI, including autonomous vehicles, will be a major driver of investment returns in the future, she said.

“He understands that technologies are converging, that artificial intelligence is the biggest catalyst,” Wood said.

However, it is selling Tesla stock to reinvest in other companies likely to benefit from the same trend, such as Archer Aviation, a developer of autonomous aircraft.

Florida-based ARK is also a leading crypto proponent, launching a spot bitcoin ETF in January. Wood said the crypto crackdown under President Joe Biden has put the United States in a vulnerable position, but the new administration “will not want to lose innovation to the rest of the world.”

Lummis said in a statement that stakeholder engagement is a priority and that “Wood is a leader in digital assets and someone who has shared feedback with me on a range of innovation-related issues.”

While some of the market excitement over Trump’s victory has worn off, Wood said she believes Trump’s surge, which has benefited crypto, small-cap and financial stocks, will eventually spill over into much of the market.

“I think … the market will continue to expand. It will definitely favor innovation and anything that has been held back by policies in the last few years,” she said.

Neither Musk nor Trump’s transition team responded to requests for comment.

‘CONTRARIAN PATTERN’

Wood’s outsized bets on stocks such as Zoom (NASDAQ: ) generated a 152% return at the height of the pandemic and earned it a large number of retail investors, but it has struggled to sustain that outperformance.

Investors have pulled roughly $3.5 billion from ARKK over the past two years, with $300 million flowing out last month, according to data from Morningstar and VettaFi.

“It’s an atypical pattern for most ETFs and mutual funds, but typical of the opposite pattern we’ve seen for Cathie Wood’s funds,” said Morningstar analyst Robby Greengold.

Wood said even the most favorable new policies won’t end that volatility.

“We’re telling people that, hey, we offer highly differentiated exposure to innovation.” As a result, she added, “yes, we will be unstable.”