ADM shareholder pressures CEO to resign as investigation continues Reuters

Author: PJ Huffstutter

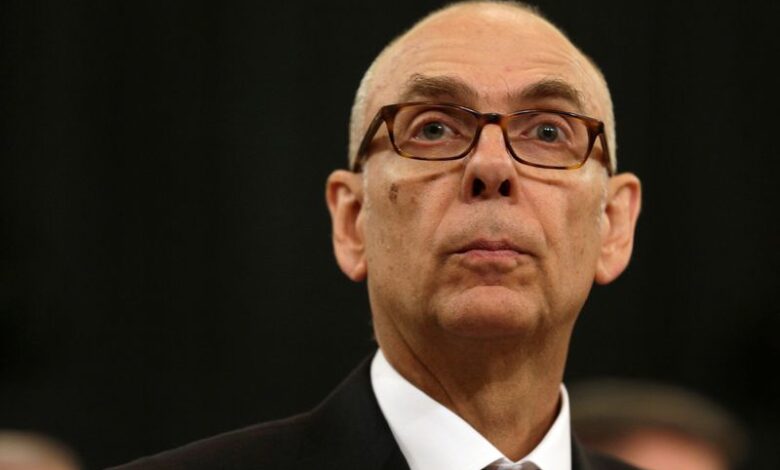

CHICAGO (Reuters) – A shareholder in agribusiness Archer-Daniels-Midland is pressuring the company’s chief executive to resign for failing to make clear to investors about problems with internal accounting practices that prompted a criminal investigation first reported by Reuters.

In a LinkedIn post titled “Investor misery has a name: ADM,” Hartwig Fuchs said ADM was the worst stock in his portfolio this year and blamed ADM CEO Juan Luciano.

Fuchs was chairman of the board of the German trading company Alfred C. Toepfer International when ADM owned a majority stake in the company. Fuchs left Toepfer in 2009 and was acquired by Chicago-based ADM in 2014.

“A German proverb says: A fish always stinks from the head,” Fuchs wrote in his post on Sunday.

ADM declined to comment on Fuchs’ post on Monday. It was not immediately clear how many ADM shares Fuchs owns.

ADM was forced to amend annual financial statements in March and November after it discovered that sales between its food business and other key units were not properly recorded. The company last month cut its profit outlook for 2024, citing policy uncertainty, sluggish demand and “internal operational challenges”.

Federal prosecutors in recent months have expanded their investigations into whether ADM or its employees committed crimes, including securities fraud and conspiracy, according to subpoenas reviewed by Reuters and people familiar with the investigation.

Government investigations are not proof of wrongdoing and do not necessarily result in charges. A spokesman for the U.S. attorney’s office in Manhattan declined to comment on the investigation Monday.

ADM’s share price has fallen nearly 30% over the past year, and ADM shareholders, including Fuchs, are asking questions and pointing fingers at who is to blame.

“If the highly paid CEO of such an important company fails to provide clarity within months – i.e. fully clean up the scandal, communicate (sic) with full Transparency about what went wrong and what will be done going forward, win back investors trust and, above all, protect the company from long-term damage – then he must go,” Fuchs wrote in his post.

ADM faces other headwinds, including low crop prices, uncertainty over biofuel regulations and a possible tariff battle between the United States and China that could affect global trade flows as early as January, after President-elect Donald Trump takes office.