Japanese borrowing costs rose to a high 14-year-old

Be informed about free updates

Simply log in to Sovereign bonds Myft Digest – delivered directly to your arrived mail.

Japan’s borrowing costs have increased to a 14-year maximum because growing interest rates, permanent inflation and potential wave of salary increases this spring encouragement of relentless sale in government debt.

Benchmark 10-year-old yields of Japanese government bonds, which conversely moves on prices, touched 1.31 percent on Friday, after increasing another 0.21 percent point this year after the big jump 2024.

Bank of Japan determined Last month to raise his short-term interest rate at a 17-year maximum of about 0.5 percent. Growing inflation expectations have encouraged bets that the next increase in the rate may come before it was expected, increasing yields on years of maximula. The basic inflation in December increased by 3 percent, which is the fastest annual pace in 16 months.

“[For Japan] Inflation is real for this time, “said James Novotny, an investment manager at Jupiter Asset Management.

“Homemade was guided, not just imported from the rest of the world,” he added, stating wages growth In December, he touched his highest level in 30 years.

“He feels like we are closer to the beginning than at the end of the battle of mountaineering cycles,” he said.

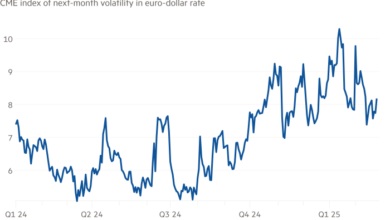

Changing higher in Japanese 10 -year -old yield after years that failed near or below zero broke through in global financial markets, as domestic investors find more attractive to park their money at home. This has increased anxiety that Japanese investors will stimulate sales elsewhere like them to dispel Investments abroad such as eurozone bonds.

Although the moves in the Japanese government bond are attractive, traders say that the fundamental shift is even more historical because the former market has resurrected from years of restraint by the central bank. Fight until last year continued the policy of control of the yield curve, placing a hard limit of 10-year bonds of yields.

Analysts claimed that Japan finally moved into a cycle of increasing rates in decades, and some expect them to be raised later this year and then again in 2026, until the policy rate reaches 1 percent.

But last week, comments from the Board of Boj-One of them are especially hawk-gaps that the central bank could increase the rates in July and that the rate that is expected to stop cut, the so-called terminal rate could be higher than 1 percent .

Since last month’s central bank meeting, the trader replacement has withdrawn their expectations from increasing the rate in the next quarter and increasing 80 percent of the chances of an increase in July, according to levels that mean derivative markets.

Kaspar Hense, a fund manager at RBC Bluebay Asset Management, said the battle was “behind the curve”, following the pressure on wages that he thinks he will continue to be strong this year.

Hense believes that this would “pull” Japanese bonds larger all over the board, but especially a 10-year reference debt.