Has the bond market turned against Rachel Reeves?

Less than three months after delivering her first budget, Rachel Reeves is entering perilous fiscal waters as the UK’s rising borrowing costs reduce her room to manoeuvre.

There is now a real risk that the chancellor will be forced to impose tighter fiscal policy as soon as March, when the Office for Budget Responsibility presents its forecasts, as she tries to meet her self-imposed budget constraints.

The situation is damaging for the Labor government in light of Reeves’ claims that its October fiscal report it marked a turning point in the attempt to “clean things up” when it comes to the UK’s budget woes.

How did the UK get off course?

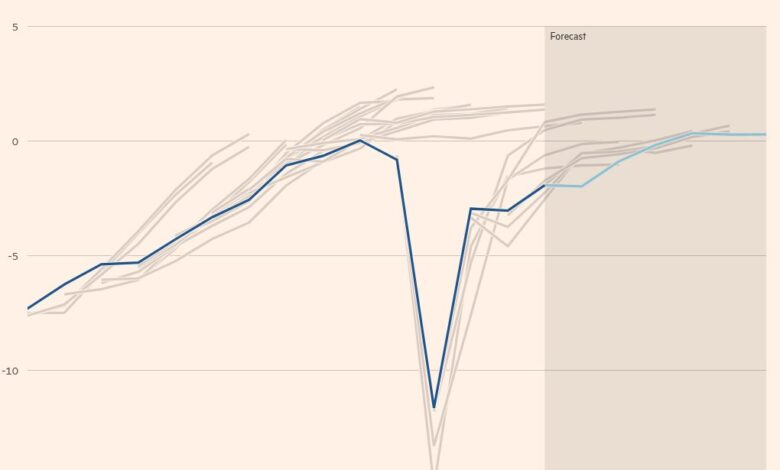

The central problem is constant rise in the cost of government borrowing, in the UK and around the world. The US has been a central factor in the global bond selloff in recent months, fueled in part by expectations that tariffs imposed by US President-elect Donald Trump will boost inflation.

But the UK is particularly affected by fund managers’ concerns that they will economy could enter a period of “stagflation”, where persistent price pressures prevent the Bank of England from cutting interest rates to stimulate them.

Combined with a rise in expected debt sales after the budget, fears of stagflation helped send the UK’s 10-year borrowing costs to their highest level since the 2008 global financial crisis and its 30-year borrowing costs to their highest this century. It also caused bouts of weakness for sterling.

“The mix of gilt and currency pressures suggests the market is becoming concerned about a UK recession or fiscal event,” said Jim McCormick, macro strategist at investment bank Citi.

Why is this so harmful?

The higher cost of borrowing has a direct impact on Reeves’ budget plans, increasing interest payments that already exceed £100 billion a year.

It has set itself the goal of balancing the current budget, excluding investment spending, by 2029-30. October forecasts from the Office for Budget Responsibility, the fiscal watchdog, suggested Reeves would meet the rule with £9.9bn of reserves that year.

But higher interest costs threaten her goal. Long-term gilt yields have been steadily rising in recent weeks, with the 10-year gilt yield climbing as high as 4.82 percent on Wednesday, the highest since 2008.

Ruth Gregory, economist at consultancy Capital Economics, said the developments so far would be enough to more than erase the space against the current budget rule, with the Treasury now on course to breach the rule by almost £1bn.

This estimate is derived from market-implied expectations for the BoE benchmark interest rate and the 20-year yield.

“No one should doubt that compliance with fiscal rules is non-negotiable and that the government will have an iron grip on public finances,” the Finance Ministry said on Wednesday. “Only the OBR’s forecast can accurately predict how much space the government has – everything else is pure speculation.”

Do other factors affect public finances?

The OBR’s forecasts due to be published on 26 March will also set out a revised view of growth, which also has a significant impact on public finances. GDP readings at the end of last year were weaker than expected, and the BoE estimates that the economy failed to grow in the last three months of 2024.

Bad data makes the OBR’s October forecast for economic growth of 2 per cent in 2025 look vulnerable, analysts say.

But the effect of GDP movements on borrowing depends on whether the OBR assesses that the economy can recover and make up the deficit later in parliament or decides that there has been a permanent loss of output.

A downgrade by the OBR to its view on UK productivity and potential growth would be a further blow to the Treasury and public finances.

What can Reeves do?

The deterioration in the UK’s fiscal outlook comes as the government prepares for the next phase of its multi-year spending review, the results of which are expected in June.

The Treasury set its overall spending envelope for Whitehall departments in the October Budget, with daily spending set to rise by 3.1 per cent in 2025-26. before falling sharply to 1.3 percent real growth from 2026-27.

Detailed plans for the first year have been established; the spending review is now looking at the coming years. Officials have signaled that if Reeves needs to make a fiscal policy adjustment this spring, it will likely come through tighter spending plans, not an early tax hike.

That’s because she has promised to hold just one “fiscal event” each year, which would be the time for the tax change and won’t take place until the fall.

Restoring the space back to October’s levels of just under £10bn through tougher spending plans would mean curbing real growth in the department’s day-to-day spending from 1.3 per cent a year to just under 1 per cent, said Ben Zaranko, associate director of the Institute for fiscal studies.

But analysts fear that if the selloff in the bond market continues, Reeves may be forced to go further in an effort to shore up fiscal credibility. Such actions could lead to tax hikes and spending cuts at the start, not just vows for greater discipline at the end of parliament.

“Reeves could soon face the nasty choice of breaking her fiscal rules or announcing new tax hikes and/or spending cuts at a time when the economy is already weak,” said Gregory of Capital Economics.

What other options are there?

The chancellor intends to focus on a “pro-growth” narrative in the coming weeks, and faster economic expansion would pay off in terms of public finances.

Reeves is preparing for a trip to China this week as he looks for ways to boost the economy.

But hopes for a strong turnaround in GDP growth could easily backfire. With the decline in government bond prices intensifying, investors have warned that attempts to lay a strong fiscal foundation for the current parliament are at risk.

Reeves “has no room left, given that the sell-off has been relentless since October,” said Pooja Kumra, UK currency strategist at TD Securities.

Data visualization by Keith Fray