American customers tighten their belts because economic prospects of mounting

Be informed about free updates

Simply log in to American economy Myft Digest – delivered directly to your arrived mail.

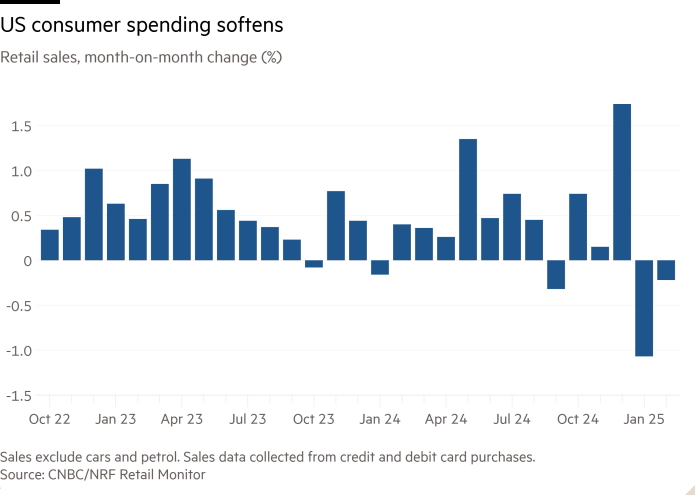

American customers reduce consumption, and the mood slides as President Donald Trump’s tariffs and the market volatility are threatening to undermine one of the key initiators of the world’s largest economy.

Many traders reported on solid sales late last year, but warned about the slower growth of 2025, and the data in the industry shows that their forecasts are already playing.

The base fell 4.3 percent from the US stores compared to the year early March, according to a retail text, consulting – extending the fall that began at the beginning of the year. Placer.ai, which aggregates the signals from the consumer mobile devices, has recorded fewer visits to large boxes, including Walmart, Target and Best Buy in recent weeks.

On Friday The consumer index of the University of Michigan recorded its third consecutive monthly fall and the smallest reading since November 2022. Expectations on inflation have increased, and a poll has shown.

Trump refused to turn off a recessionWhile recent running on the stock market was suffocated by the investment portfolio of richer Americans who encourage US consumption.

“The consumer is banned from so many different elements,” said Marshal Cohen, a major retail analyst from Circun, who assembles a small purchase information. “It is easier for the consumer to just step down and say,” I’ll drive this and wait and see what’s going on. ”

The US federal reserves are expected to retain interest rates at his meeting this week, and Feda Jay Powell’s President recently reduced his growth concerns, saying that the US Central Bank “should not rush” to reduce the rates.

But investors are increasingly concerned that Trump’s embarrassing creation of policies, marked by a series of sudden turns, disrupts businesses and slows down growth. The Wall Street shares reference S&P 500 Index has fallen into the territory of correction this week before returning.

Consumer consumption was a key driver The US economic recovery from Coid-19 pandemi, surpassing Europe and other great economics.

But households are stretched in the next period of high inflation. In response, consumers compared consumption, reducing the amount of sales for the goods companies in consumer packaging. Consumers with lower incomes felt the most stress.

The sale of discretionary general goods fell by 3 percent of the week, which ended on March 8, compared to last year, continuing a series of annual falls in February, data from Circun showed.

Traffic in American fast food restaurants decreased by 2.8 percent in February, according to revenue management solutions, and visits to two -core digits during breakfast. “It’s the easiest meal to make at home or completely skip,” the counseling states.

Four large US airplanes this week warned about Demanding demandpartly due to the withdrawal of passengers for leisure time.

This month Target reported about falling in February and warned of Profit pressures In this quarter partly because of “tariff uncertainty”.

Some consumers are also boycott Seller based in Minneapolis after withdrawing from the obligations of corporate diversity. Target executives refused to confirm whether the boycott had an effect.

Analysts have said that economic anxiety has a greater impact than a boycott on retail sale, for which the official government data should be published on Monday.

Lauren Hobart, Executive Director of Dick’s Sports Rhine, said analysts this week that “it is absolutely not the case” that consumers are weaker. However, its chain forecasts sales growth in the same store from 1 to 3 percent this year, slower than an increase of 5.2 percent in 2024.

“Our guideline only reflects the fact that there is so much uncertainty in the world in a geopolitical environment, the macroeconomic environment. We are just appropriately careful, “Hobart said.

Although inflation has been separated for months on American consumers, their anxiety has not always been translated into lower consumption. It’s over $ 1tn in sale During last year’s holiday shopping season, he exceeded expectations.

“Consumers say they intend to withdraw,” said Tom Kilroy, an older McKinsey partner at the New York Industry Conference this week. “But what we have seen and over the past year is that they have not always followed the intention of action.”