Republicans in Congress weighs the increase in taxes for top university gifts

Unlock Bulletin on White House Hour FREE

Your guide for what American choices 2024 means for Washington and the world

The Republicans seek billions of dollars from the borrowing of top private American universities in Congress by increasing the rates of investment due to a wider attack on the elite academy.

At least three laws proposed since January, they aim to increase the tax rate on the return of investment to as much as 21 percent and currently 1.4 percent. Two laws would also lower Prague to universities with only $ 200,000 in assets per student, compared to a current level of $ 500,000. Increase could collect as much as $ 112 billion During the next decade, according to a non -profit tax foundation.

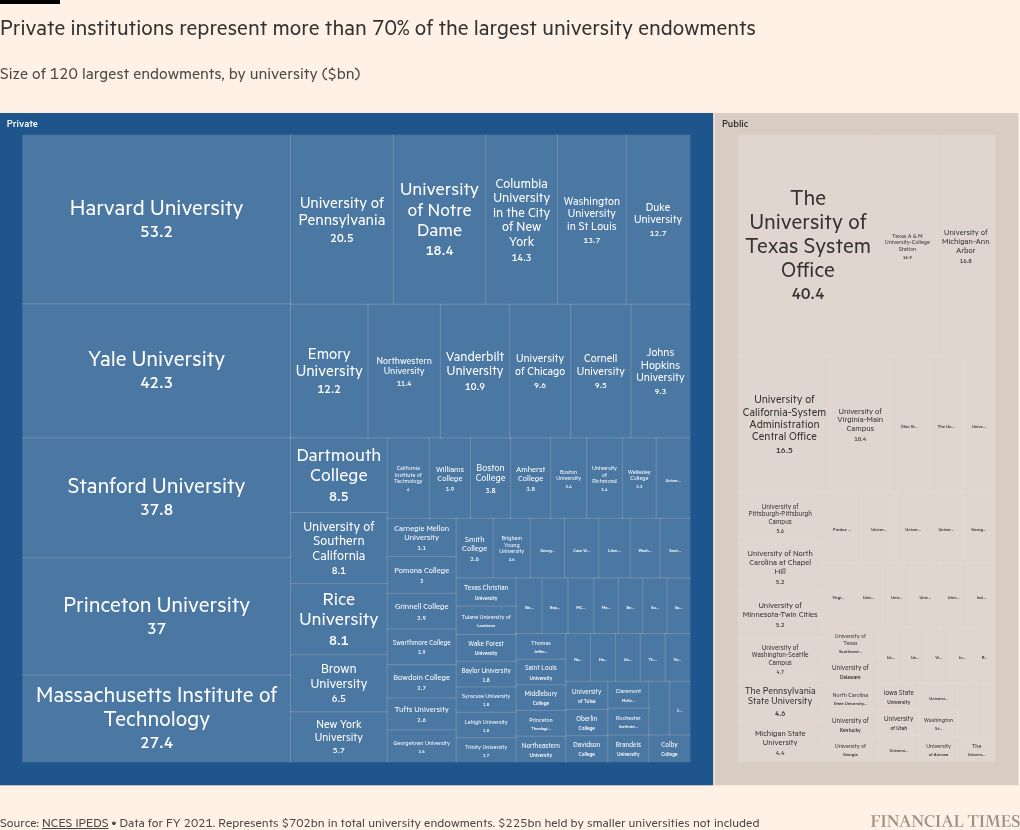

Dozens of richest in the country school They would be subject to call if they were approved, including Harvard, Stanford and Princeton. Universities invest assets for gifts and use gains to finance all kinds of business, including professors’ salaries, financial assistance, student scholarships and campus activities. For some, such as Harvard’s $ 50 billion fund, investment refund is one largest source of school financing, which represents more than a third of revenue.

“It is only structured to take money from institutions and send it to Washington,” said Steven Bloom, Assistant Vice President of Relations with the Government for the US Council for Education, which represents universities and colleges. He added that 48 percent of the spending for endowment went to financial assistance. “If the goal is to provide financial assistance, the tax will undermine it.”

A Republican representative of Troy Nehls from Texas, who proposed a law with a 21 percent tax rate, said that his main goal was to “bring a parity between the tax rates that individuals and companies paid for their investment and taxes paid by the Great University Awards”.

One senior official of the University Association said that the proposals of borrowing tax – together with another reduction of funds and recent attacks on the high education of Trump administration – caused “uncertainty and chaos” in campuses.

The law on the reduction of taxes and jobs from Trump’s first term has imposed 1.4 percent of the donation of the richest private universities in the country for the first time, which is an unusual move given their historical treatment as non -profit institutions. Only 56 institutions had to pay in 2023, a total of $ 380 million.

This time, smaller endowments can also become a victim. One of the proposals of the law presented last month by representatives of Dave Joyce from Ohio and Nicole Malliotakis of New York who sought to impose a tax on capital gain with schools with at least $ 250,000 assets to give students.

“Small schools are simply not financially strong enough to endure more money that is being taken out of their endowment,” said John Griffith, director of Hirtle Callaghan & Co and former chief director on college Bryn Mawr. “They have a much smaller financial flexibility.”

Although the bills are far from becoming a law, universities are panicked because the proposals seem to have the support of the White House. 2023, while the Senator, JD Vance encouraged to raise tax on rich institutions at 35 percent – 14 percentage points higher than the purest proposals from this legislature.

Although the proposals explicitly do not state the liberal ideology of campus or recent protests over the war of Israel-Hamas, some university officials have privately suggested that they are driving motivation.

“This is a way that the current administration punishes some major institutions that they believe are indoctrinated students with alert ideology,” said a university official. “If you look at the projected revenues that such a tax would actually create, it is smiling.. The reduction of resources available to the institutions will disrupt our higher education system.”

Senator Tom Cotton of Arkansas presented the so-called law on the safety tax on Tuesday, proposing a one-off 6 percent fee at 11 richest private schools in the country. “Our elite universities need to know the costs of pushing anti -American and prosthetic programs,” Cotton wrote on Tuesday X.

Fear of major taxes already has an impact. Stanford and Cornell University stated an increase in freezing institutes.

The fees undergo a congress while the White House encourages further pressure on the top funds of the University. Last week, Trump’s administration canceled about $ 400 million of federal grandfathers and a contract at Columbia University in New York.

The return of federal support to Columbia is followed by the fifth of the national health institutes publishing guidelines to plan to reduce federal consumption by as much as $ 4 billion a year for research projects throughout the USA – it reduces that scientists will warn that they will be catastrophic for research universities.

“The accessibility of this university depends on the debit,” said Christopher Eisgruber, president of Princeton, during the City Hall for Staff in February, whose recording saw the Financial Times.

“If borrowing taxes, the consequences must be restrained in some of those things we do.”

Visualization of the Pupil Sam