Ten things you should know about Trump’s tariffs but were afraid to ask

Unlock Bulletin on White House Hour FREE

Your guide for what American choices 2024 means for Washington and the world

Donald Trump has Followed his threats and imposed 25 percent of tariffs on Mexican goods and non -energy products from Canada, 10 percent of tariffs on Canadian energy and further 10 percent on Chinese goods.

“Tariffs say that America is becoming wealth again and that America becomes big again,” Congress said on Tuesday night. “There will be a little disorder, but we are okay. There will be not much.” Such was his confidence that from next month he promised further impositions of imports from Europe, South Korea, Brazil and India.

International macroeconomics is difficult and Obviously realizes TrumpHere are 10 things you should know about your tariffs.

First, they are big. Those in Canada, Mexico and China raise the average tariff to imports of US goods from 2.4 percent in 2024. To about 12 percent if trade flow remains unchanged. This is, therefore, the above estimate, but the result will be US trade barrier Not seen since World War II.

Second, it is important to remember that the importer pays. Tariffs are a tax that is charged on the goods exceeding the border.

Third, although the importer is paid, the question of who has the end cost is more complex. The US supply chain felt pain due to the vast majority of cost after the 2018 tariff and today we should expect something similar.

Fourth, although the tariffs have been imposed so far Collect $ 142 billion for US TreasuryThis is less than a tenth As expected $ 1865 billion dollar deficit of the US Federal Government 2025 and does not assume that no change in behavior. The tariffs do not solve American fiscal incontinence.

Fifth, with the import of goods approximately 10 percent of GDP, an increase in tariff rates by nearly 10 percent points are likely to increase consumer prices by just 1 percent. This rough calculation is similar to more sophisticated estimates, like these from staff to Boston Fed This week.

Sixth, price increase is different from inflation, although consumers will be crippled to my meticulousness. However, there are few doubts that after the great inflation in the last few years there is a higher risk of before the pandemic that companies and households will endeavor to avoid a hit when prices to grow compensation through persistently higher prices and salaries. That’s inflationary.

Seventh, now is a very closed economy that has been a trade in total goods as a share of GDP 19 percent in 2023, For example, compared to 53 percent in Canada. This is despite Trump’s rhetoric that imports kill America and explains why US threats are heard louder abroad than at home.

The eighth, the harmful effects of the tariff to supply the capacity of the American economy are increasing pressure on interest rates. The growth of uncertainty arising from Trump’s procedures, in contrast, reduces the intentions of investment and puts pressure on the footsteps. Investors they are getting worried The latter, but the expectations of interest rates still increased from the choice.

Ninth, tariffs are far from a safe reduction in a trade deficit, which exists because it now persistently consumes more than it produces in full employment. A way to guarantee a fall would be to create a deep recession, a reduction in demand for imports.

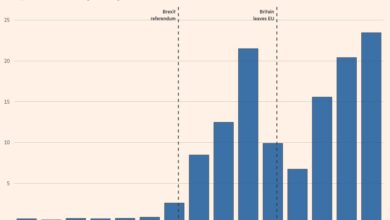

Tenth, tariffs are unlikely to be popular. Price increasing and intercreting the purchase of imports by throwing a grit into a trade system is rarely a winner with public opinion. Brexit, who did the same, is now wildly unpopular in Britain, and Trump realized in his election campaign that the public was hatred of price growth. The public is unlikely to take it as a little disturbance.

One group, however, will be quietly excited about Trump’s tariff obsession are economists. The explanation of the crazy policy is great for business and will generate some wonderful data sets that will be discussed for years.