Investors in currency become careful in bets on Trump’s tariffs

Unlock Bulletin on White House Hour FREE

Your guide for what American choices 2024 means for Washington and the world

Currency markets are increasingly rejected by Donald Trump tariff threats, which increases the risk of big swings if the US president follows his promise to hit China, Canada and Mexico next week.

Trump’s proposal to make Charges against the EU And China disordered the euro and currency of other American trade partners on Thursday. But the downs were less dramatic than some reverses seen in recent weeks when he started writing his plans.

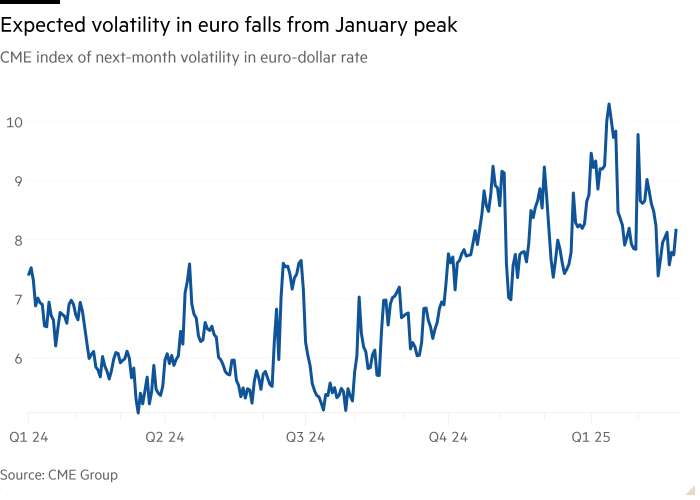

Measures expected short -term volatility in currencies such as the Euro and Mexican Peso fell from inauguration in January.

“Since they have already been burned on tariff stores this year, investors are less reactive to incoherent tweets” and political rhetoric, said Jerry Minier, Co -head of the G10 Forex trading in Barclays.

The courses were pufted tariff headlinesGiven that the dollar suddenly strengthened the currency of the main shopping partners on February 3. After Trump announced Tariff against Mexico, Canada and China. But the moves reversed until the end of the commercial day after the president delayed the introduction of the levy against the first two countries.

Since then, market movements in response to his announcements have been less. After falling after the number on Thursday, the euro stopped on Friday with respect to the dollar and just below $ 1.04 remains significantly above low than less than $ 1.02 in early February.

Akshay Sangal, a global boss of short -term interest rates in Citigroup, said that after “trust and believed” Tariffs, the currency market “wants to see them in action”.

He added, “Earlier it was” I believe what you tell me, “and now it’s” Show me. ” The announcement, and then the delay of the tariff against Mexico and Canada, shook the confidence of the investor that the tariff titles could be trusted, Singal said.

The expectation of investors from rocking in Euro-Dolar during the next month has been reduced by a five-year peak in mid-January, according to the CME group index based on the prices of options.

His index of the expected volatility in Mexican Peso has also fallen since January – and now almost half of the level of the US election last year – while the equivalent measure for the Canadian dollar is also reduced from the peak of the beginning of February. This is despite the continuation of the deadlines like Tariffs to Mexico and Canada who should go to place next week.

“Our models show that Tariff Premium has been relaxed in recent weeks with a little price in the key [currency pairs]”, Goldman Sachs said in a note on Friday.

A currency retailer at a large European bank said working days have become “strangely slow” in recent weeks.

“Trump will yell about some tariffs, reciprocating from these announcements, the White House will say something completely contradictory, and then Trump could publish the opposite on the truth of Social 10 minutes later,” the merchant said. “You can’t trade it.”

Analysts said that this inertia also crept into the market markets, where fears from encouraging inflation from Tariff brought yields at the end of last year.

Ice Bofa Move Index, a measure of experts in investors from the volatility of the treasury market, is significantly below the high achievements of reach to the United States.

“You would think that volatility would be greater considering how small the market is, but the market has become stunned, as long as [investors] In fact, look at the way forward, “said Gennadiy Goldberg, head of the US Price Strategy in TD Securities.

However, some investors and analysts say that there is a growing risk that the market no longer understands the potential economic outburst from the tariff serious enough, with “scriptures”, Barclays’s Minier reports.

Some believe that expectations of lower volatility make a big sale more likely if significant trade taxes are applied in the end.

The day of the day follows [on blanket tariffs]There would be a reaction to their knees, because most people think that they don’t appreciate it, “said Finn Nobay, a merchant at the Payden & Rygel investment company.