UK Mali caps ‘favorite’ sections in the world

Be informed about free updates

Simply log in to Investments Myft Digest – delivered directly to your arrived mail.

The shares of small British companies are the “favorite” in the world, according to Abrdn analysis, as investors have established their stakes in the UK and invested in US technological giants.

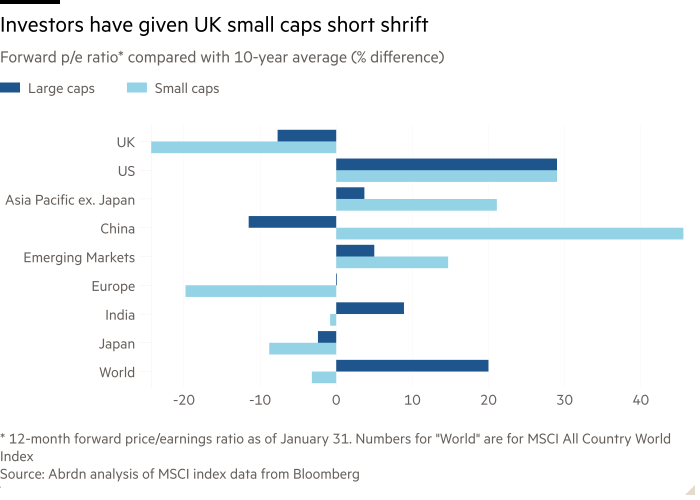

The price/earning ratio for the MSCI small caps for the MSCI caps has dropped to 24.3 percent below the 10-year average at the end of January, the largest discount for any larger region in the world, according to the property manager.

Investors use the ratio of price/earning ratio – which compares the value of the company to the expected profit – as a benchmark of how expensive shares are historically or against other shares.

The findings come because Chancellor Rachel Reeves seems to increase retail and institutional investment in the UK after a period of sustainable outflows from domestic shares.

“These discounts reflect the negative feelings we have seen lately according to smaller companies in the UK,” said Abby Glennie, co-founder of the ABRDN smaller fund. She added that, although there were “a difficult period for the sector”, there were “many great smaller companies outperformed global and much greater rivals in terms of earning growth” in the UK.

Although investing in fewer companies may be unstable, Glennie said that “for those who are willing long -term view, the current scale of discounts could provide an attractive opportunity.”

Abrrdn compared the ratios of the Index in the main global market markets and found that small capital supplies are the cheapest in historical standards, followed by European small caps, with a ratio of P/E ratio 19.8 percent below the 10-year average.

Throughout the world, P/Eeeeeee ratios for small companies were 3.2 percent below their 10-year average, while larger companies were 20 percent above their historical average.

“If you think about this period coming from a covid, when we saw the growth of interest rates and an increase in inflation, we saw that markets really change in terms of their risky attitude,” Glennie said. “People just didn’t want to own the risk property and they saw small caps as almost the bottom of that store.”

MSCI indexes with small drops make up approximately 14 percent of market capitalization adapted to the fleets in each country.

Darius McDermott, CEO of Chelsea Financial Services, said he could “absolutely see the opportunity” to buy small caps in the UK. “Everyone is sold from Brexit,” he said, explaining that smaller companies suffered more than outflows in the UK than more peers with business abroad.

“In the funds we advise, we are overweight of smaller companies in the UK,” McDermott said. The “Details of the capital distribution of capital than it used to be,” and increased the purchase of stakes and yields of dividends, he said.

Global Stock Exchange gains over the last few years have dominated the “magnificent seven” American technological supplies, which have increased in value and launched the S&P 500 Index of the US large restrictions on the highest top -notch.

Large US caps traded with 29 percent of premiums to 10-year average, based on their ratio of P/E at the end of January, according to Abrdn’s analysis.

Chinese small caps were the most expensive compared to historical levels, as the fall in their profit was pushed by investors’ expectations from their future earnings, causing an increase in their ratio of P/E.

Jason Hollands, Director General of the Bestinvest Investment Platform, said reinforced appearance for a trade agreement Between the United States, the UK “” should be considered as encouraging news that could also help restore some optimism in British shares. ”

He added: “The United Kingdom is not currently our best selection market, but it does not deserve to be completely neglected,” noting that the magnificent seven shares have been reduced by 3 percent since the beginning of the year, while the “boring old FTSE 100” increased by 6 percent.

Evangelos Assimilakos, director of investment in Rathbones investment Management, sounded a warning: “There is no challenge that smaller companies in the UK in recent years have been seriously disparaged and represented a persuasive value compared with their historic long -term average.”

However, he warned that investors must be “aware of all changes that could have occurred in recent years that could be permanent in their effects or need a long time to be canceled.” He quoted the “significantly harmful effect” of Brexit in capital markets in the UK and withdrawing institutional investors in the UK from domestic shares, which “removed the key source of demand” for small limitations.

UK pension funds held only 4.4 percent of their funds in domestic shares, According to the study Last year by Think-Tank New Financial-Pad of 15 percent in 2015.

“Whether the impact of any of the [this] In the coming years, the turnaround is likely to play a key role in how quickly we will see a catalyst for revaluation in smaller companies in the UK, “said Asimakos.