The ECB was too slow to cut rates, eurozone economists warn

The European Central Bank has been too slow to cut interest rates to help the stagnant eurozone economy, warned many economists polled by the Financial Times.

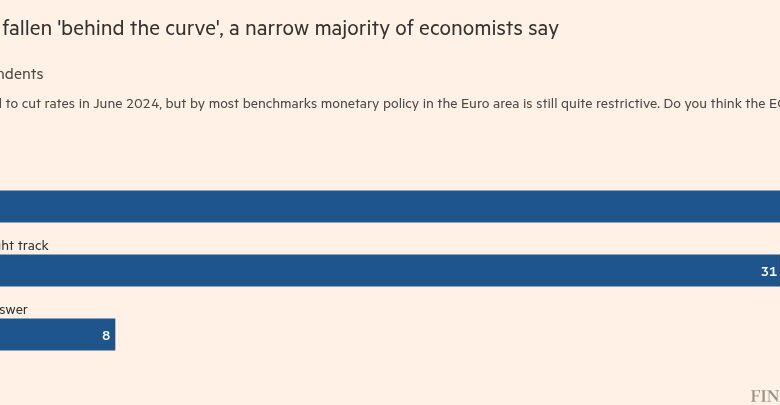

Almost half of the 72 eurozone economists surveyed — 46 percent — said the central bank was “lagging behind” and out of tune with economic fundamentals, compared with 43 percent who believed the ECB’s monetary policy was “on the right track.” “.

The rest said they didn’t know or didn’t answer, while not a single economist thinks so ECB was “ahead of the curve”.

The ECB has cut rates four times since June, from 4 percent to 3 percent, as inflation fell faster than expected. During this period, the economic outlook for the currency area continued to weaken.

ECB President Christine Lagarde has acknowledged that rates will have to fall further next year, amid expectations that they will be weak eurozone growth.

The latest IMF projections show that the currency bloc’s economy will grow by 1.2 percent next year, compared with 2.2 percent growth in the US. Economists polled by the FT are even gloomier for the eurozone, forecasting growth of just 0.9 percent.

Analysts expect the difference in growth to mean that interest rates in the eurozone will end the year well below the cost of borrowing in the US.

Exchange Rate Setters at the Federal Reserve expect a reduction in borrowing costs by a quarter of a point just twice next year. Markets are divided between expecting four to five cuts of 25 basis points from the ECB by the end of 2025.

Eric Dor, professor of economics at the IÉSEG School of Management in Paris, said it was “obvious” that “downside risks to real growth” were increasing in the eurozone.

“The ECB has been too slow to cut interest rates,” he said, adding that this is having a detrimental effect on economic activity. Dor said he saw an “increasing likelihood that inflation could exceed” the ECB’s 2 percent target.

Karsten Junius, chief economist at J Safra Sarasin Bank, said decision-making at the ECB appeared to be generally slower than at the Federal Reserve and the Swiss National Bank.

Among other factors, Junius blamed Lagarde’s “consensus-oriented leadership style” as well as “the large number of decision-makers on the board.”

UniCredit Group Chief Economist Erik Nielsen pointed out that the ECB justified its dramatic increases during the pandemic by saying it had to keep inflationary expectations under control.

“As soon as the risk of withdrawal of inflationary expectations disappeared, they should [have] cut rates as quickly as possible — not in small incremental steps,” Nielsen said, adding that monetary policy remains overly restrictive despite inflation getting back on track.

In December, after the ECB cut rates for the last time in 2024, Lagarde said “the direction of travel is clear” and indicated for the first time that future rate cuts were likely – a view that had long been common sense among investors and analysts.

She gave no guidance on the pace and timing of future cuts, saying the ECB would decide on a meeting-by-meeting basis.

On average, 72 economists polled by the FT expect euro zone inflation to fall to 2.1 percent next year — just above the central bank’s target and in line with the ECB’s own forecast — before falling to 2 percent in 2026, 0, 1 percentage point above the ECB’s forecast.

According to the FT poll, most economists believe the ECB will continue its current rate-cutting path in 2025, cutting the deposit rate by another percentage point to 2 percent.

Only 19 percent of all surveyed economists expect the ECB to continue lowering rates in 2026.

Economists’ forecast for ECB cuts is somewhat more dangerous than those of investors. Only 27 of 72 economists polled by the FT expect rates to fall to the 1.75 percent to 2 percent range expected by investors.

Not all economists believe the ECB acted too slowly. Willem Buiter, former chief economist at Citi and now an independent economic adviser, said “ECB rates are too low at 3 percent”.

He noted the persistence of core inflation — which, at 2.7 percent, is well above the central bank’s 2 percent target — and record low unemployment of 6.3 percent in the currency area.

France has replaced Italy as the eurozone country thought to be most at risk of a sudden and sharp sell-off in government bonds, FT research has found.

In recent weeks, the French markets have been shaken by the crisis surrounding the former Prime Minister Michel Barnierproposed a budget to reduce the deficit, which led to the overthrow of his government.

Fifty-eight percent of respondents said they were most concerned about France, while 7 percent cited Italy. This marked a dramatic shift from two years ago, when nine out of 10 respondents singled out Italy.

“French political instability, fueling the risks of political populism and rising levels of public debt, increases the specter of capital flight and market instability,” said Lena Komileva, chief economist at consulting firm (g+)economics.

Ulrike Kastens, senior economist at German asset manager DWS, said she was still confident the situation would not get out of hand. “Unlike [during] In the sovereign debt crisis of the 2010s, the ECB has the ability to intervene,” she said.

Despite concerns over France, the consensus among economists was that the ECB would not need to intervene in eurozone bond markets in 2025.

Only 19 percent think the central bank is likely to use its emergency bond-buying tool, the so-called Transmission Protection Instrument (TPI), next year.

“Despite the likelihood of turmoil in French bond markets, we think the ECB will have a high bar for triggering TPI,” said Bill Diviney, head of macro research at ABN AMRO.

Additional reporting by Aleksandar Vladkov in Frankfurt

Data visualization Martin Stabe