ECB’s Schnabel requires conversations on speed reduction “

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

The top European Central Bank official signaled that you set up rates almost with a decrease in interest rates in the euro area, warning the risks of inflation are increasingly “distorted to progress”, while the costs of borrowing are much easier.

The monetary guardian of the currency area quickly reduced interest rates from the summer and it was widely reiterated when his governing council meets in early March, due to signs of poor growth.

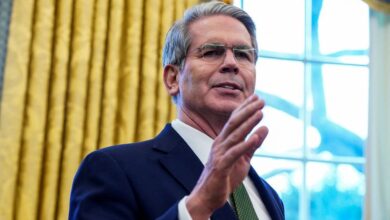

However, ECB Hawk Isabel Schnabel, a member of the six -person executive committee, who sets up a rate of meeting, told the Financial Times that the central bank should “now” start discussing the “pause or stopping” to reduce the rates.

The remarks emphasize the growing tensions within the ECB because of economic appearances and indicate the strongest sign that some of the 26 members of the Governing Council believe that they should slow down soon – or even stop – a reduction of the rate.

“Data show that the degree of limitations is significantly fell, until we can no longer say that our monetary policy is still restrictive,” Schnabel said, adding: “Now we have to start a discussion about how much we should go. No. I say we are still there.

Financial markets are priced in three more decreases in a quarter of the point by the end of the year or two because ECB President Christine Lagarde said at the end of January after the last decrease in the central bank that she was “fully premature” to consider the installation of the course change.

Governor Banque de Frances François Villeroy de Galhau warned this month that the protectionist trade policy of US President Donald Trump is likely to withdraw activity in the region where growth is already weak.

While Schnabel supported the lowering rates last month, she said that, for her, “the direction of travel is no longer so clear.”

Schnabel noted that investors were not fully priced in the second decrease in a quarter of points at the April meeting of the ECB. “So the markets are not quite safe either,” she said. From Tuesday afternoon, markets have reduced 60 percent of the chance of reducing the rate in April.

The ECB has reduced borrowing costs by 125 base points since June, and interest rates are now at a two -year lowest level of 2.75 percent. Annual inflation in the meantime, it has grown a little since the fall, hitting 2.5 percent in January.

He was now above the goal of 2 percent of the central bank for three months.

Schnabel warned that the domestic inflation is “still high” and the growth growth “still elevated”, due to “new shocks to energy prices”.

It was no longer sure that the cost of eurozone borrowing was limiting the demand and dimming of inflation.

“I am not saying that our monetary policy is no longer restrictive [to growth]”Schnabel said.” What I say is that I’m no longer sure if it’s still restrictive. “

Analyst focus on the recent update of ECB staff assessment with a neutral rate – on which demand is neither stronger nor limited – it was “misconception,” she said.

The neutral belt went between 1.75 and 3 percent to between 1.75 and 2.25 percent, which analysts interpreted as giving ECB a lot more space to reduce borrowing costs.

“We know we know very little [about the neutral rate]”She said, adding that these fresh assessments” are not well adapted “for everyday policy creation.

Schnabel said that the central bank should also put greater emphasis on advanced risks on inflation in its upcoming examination of the strategy, saying that its existing frame came “from another world” – the one where the price pressures were too weak.

“Looking forward, we should put the same weight in both directions,” she said.