Debt on the lodging market of falling because older generations pay the mortgage

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

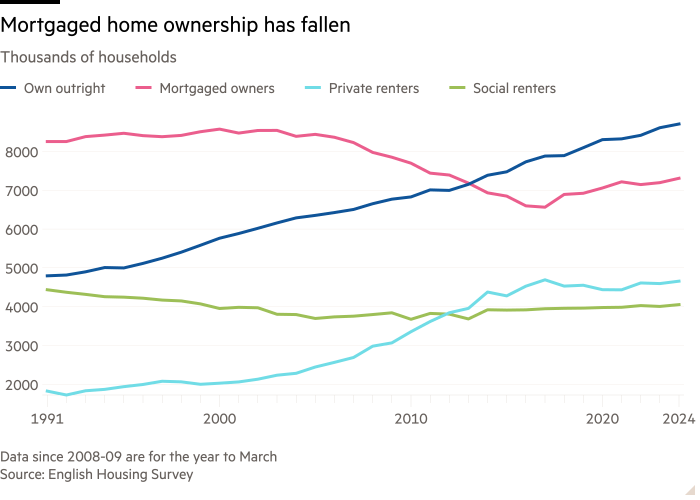

The owners of homes in the UK have become much less in charge of the past decade, as they have been paid more of their mortgages, and fewer buyers have been able to take new loans for the first time.

The collective loan for the value of British private -owned residential space decreased from 23.5 percent in 2014 to 19.4 percent last year, according to the Savills Property Group’s research, which also showed the total value of homes in UK The first time is at the top of the £ 9.

Lower debt levels to British residential wealth reflect a long -term change, and people who own their homes directly control the growing proportion of property and fewer first customers who first received the apartments in the ladder.

“Baby Boomers continued to build a wealth by repaying a mortgage debt,” said Lucian Cook, head of residential research at Savills. “Millennials and Gen Z had many less opportunities to profitably work on the housing ladder.”

High housing costs and a need to save a great deposit have encouraged concern that an increasing number of people are locked from ownership of the home and incapable of collecting property wealth like previous generations.

However, the data also show a shift in the ranks of homeowners, with direct owners, who are prone to older, controlling a larger share in the living space of the nation.

The value of home -owned houses increased by 66 percent over the decade, compared to 55 percent for a mortgage home, Savills reported.

A greater increase in home -owned houses also reflects the number of people paying a mortgage. In England, the number of direct owners has increased faster than the total number of homeowners over the decade, according to an official English residential research.

Broad of the UK, the number of mortgage with the owner-Cup fell from 9.5 million in 2014 to 8.7 million last year, according to the UK Finance.

The new customers were retained because the houses became inaccessible. The average home in England cost seven times the average earnings in 2014, according to ONS. Accessibility has worsened for nine times earnings at 2021, although since then it has improved to 8.25 times in 2023.

Sir Keira Starmer’s government hopes to increase ownership of houses by increasing houses’ construction, she also threw her support behind the proposal for re-examining mortgage regulations to make it easier for people to make loans.

Regulations, mostly made after the 2008 financial crisis, limit how many banks can borrow as multiple persons or property in revenue and require stress tests to check if they can handle borrowers with a future rise in interest rates.

Cook said that much of the shifts owned “reduced to demographics and accessibility to the ownership of a home of different generations. But this also reflects the role that the regulation of the mortgage has played in restricting the growth of prices in the apartment market.”

A sharp increase in interest rates, starting with the year 2022, has further reached the mortgage for many households and encouraged the shortening of houses’ prices.

Savills recorded a decrease in the total value of homes in the UK in 2023 for the first time since he began to follow in 2012. But a hit of £ 22 billion was more than recovered with a profit of £ 346 billion last year.

London and southeast still hold the greatest housing wealth, but in recent years they have increased more slowly, as the prices of limited further gains have already been stretched.

Houses in two London districts – Westminster and Kensington and Chelsea – still worth more than all estates in the northeast 2024.

Last year, there were 341,068 first home purchases, according to Halifax, the lowest since 2017, excluding 2020. When the market frozen Coid Locks.

Last year’s figure marked the improvement of 2023, when the high interest rates were pushed by the number of first customers to the lowest decade. The average customer deposit was £ 61,090 in 2024, increasing in London to £ 124,688.