Chinese technological shares enter the bull market after deepseek breakthrough

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

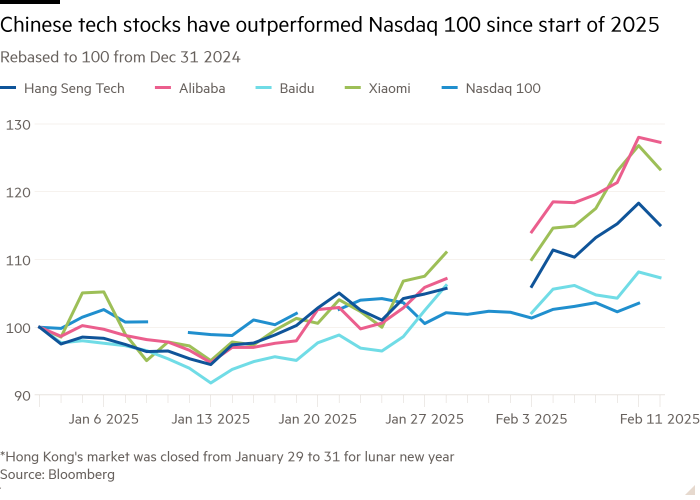

The reference value for Chinese technological shares has increased more than 20 percent in the last month, entering the bull market while investors accumulate in the country’s internet companies after the breakup of Deepseek artificial intelligence.

The Hang Seng Tech Index, which follows the 30 largest technological groups listed in Hong Kong, increased by 25 percent compared to 2025, on January 13th. He inherited an increase in 4.4 percent of Nasdaq, and an increase of less than 0.5 percent less than 0.5 percent for the “magnificent seven” US technological stocks on an equal basis in the last month.

Gains in Hong Kong reflect the renewed interest of foreign investors in China after DeepseekAi model apparently developed with far less computer power than US colleagues, launched a global re -evaluation of Chinese technological companies.

“Only Chinese internet companies are globally competitive and comparable to the American magnificent seven,” said Bush Chu, an investment manager for Chinese shares in Abrdn.

“That improvement of feelings took some streams back to China. We are starting to see some superiority and rally in China in recent weeks.”

A positive movement is a boon in Chinese markets, which were alleviated by concern about US President Donald Trump’s tariff, falling property on land and deflationary pressures in the Chinese economy. In the last month, 4 percent wider the CSI 300 index.

Deepseek Stunned Silicon Valley At the end of January when he published a large linguistic model (LLM), which he said was built on a budget budget, asking questions about the need for huge investments in Ai.

The news brought US technological shares to a sharp drop on January 27. Nvidia has set a record for the biggest one -day loss in market capitalization, with $ 589 billion deleted from its market value.

In contrast, Chinese technological shares flourished. Cloud computing companies and technological hardware benefits from AI innovation have led to a recent gathering.

They include Internet Gigant Alibaba, an consumer electronic group Xiaomi, a BAIDA examiner and a BYD electric car product manufacturer, who have an increase of 45 percent, 35 percent, 15 percent and 38 percent in the last month.

The JD.com and Meituan e-commerce platforms also progressed 24 percent and 11 percent, increased relatively strong data on consumption from lunar New Year’s leave and growing expectations of major fiscal stimuli from Beijing this year.

The wider Hang Seng index increased by 15 percent in the same period. The data from the Connect shares, which allows traders from the mainland to buy shares in Hong Kong, indicate an increased interest among Chinese investors, with an average daily traffic in February two thirds from January and three times higher than February 2024.

Analysts said that investors were enhanced by the belief that Chinese development of LLMMs would progress, and the companies facing the consumers will quickly adopt them.

“Although Deepseek is known for using unique methods for overcoming hardware restrictions in China, we believe that investors in Investment and LLMS investors have underrated investors,” Citi analysts wrote on February 3.

“Now they are strong in terms of innovation of zero to one,” said Chu of Abrdn, “but China is stronger in terms of innovation one to 100, in terms of the expansion of access and adoption of technology.”

Additional reporting zijing wu in Riyadh