‘Trump trades’ start delusions because the dollar weakens

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

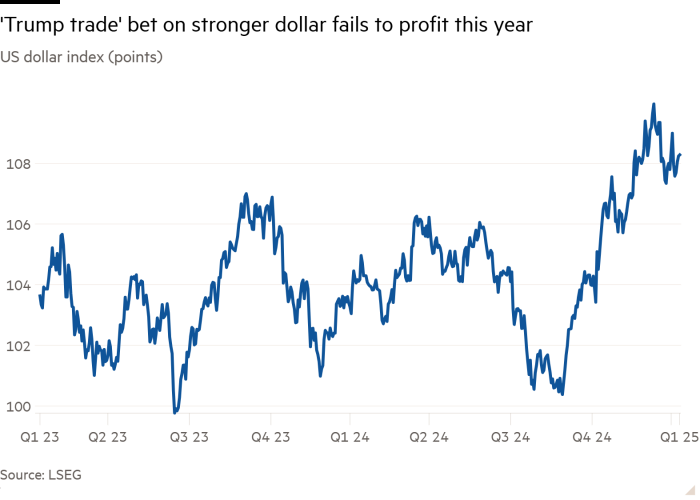

The “Trump’s Store” bets on a stronger dollar and larger bond yields have returned so far this year, as investors take up more bears a view of economic relegation from the global trade war of a new US administration.

The US currency slipped and the treasuries gathered since the beginning of January, confusing wide expectations of investors who are President Donald Trump’s plans for trade tariffs And the reduction of taxes would retain inflation and interest rates high.

“Despite what one feels, if you really zoom up by the beginning of this year, a lot [Trump] Trading failed, “said Jerry Minier, co -headed by the G10 Forex trading in Barclays.” It causes people to redeem. “

Investors withdrew from the popular Trump stores partly because the president’s tariffs so far have been less aggressive than many have afraid. But many also worry that uncertainty triggered by a trade installment for stopping the point of view could begin to harm confidence in the US economy, undergoing a reaction in the market on the market on Trump’s elections in November.

The “average menu” of popular crafts, such as betting against the euro or Chinese Renminbia, did not reward investors this year, Minier said. “You still need the reasons for the dollar [rally] To continue to expand, at least for now, these things have been withdrawn, “he added.

Inflating Trump’s inflation policy to give Federal reserves less space to reduce interest rates and reduce growth of US trade partners, it helped to launch a huge gathering in the dollar. The US currency received 8 percent against baskets of its peers from late September to the end of the year.

Property managers turned to a net long position in December, for the first time in 2017, according to the analysis of the CME Group of Currency Futures Agreement. But so far this year, the US currency has slipped 0.2 percent.

Expectations from greater inflation also helped to encourage ten -year -old fees, which are switched to prices in January in January, at 4.8 percent, which is mostly from the end of 2023.

But now they have returned to 4.53 percent, as the market focus has switched from inflation to fear that the US Economy could collapse under the new president.

“There is a fundamental fear that growth could slow down,” said Torsten Slak, the chief economist at the Apollo investment company, with a trade war “that potentially has some growth consequences.”

The bond market is “caught between fear that inflation could be a little higher due to a trade war and fear that the growth or global growth of the US could be slower,” said David Kelly, the main global strategist in the JPMORGAN Asset Management.

This month, Trump withdrew at the eleventh hour of threats that he would impose festive tariffs of Mexico and Canada, which awarded both countries a 30 -day delay. But he pushed forward with 10 percent of additional imported tariffs on China, and late Friday the President said he could hit Japan with new levies to deal with a trade deficit with the most important American ally in Indo-Pacific.

He also announced plans for 25 percent of steel and aluminum imports.

The emergence market, which is widely expected to be a special victim of a trade war and a stronger dollar, also defied the expectations of recent weeks, after the dark 2024. In which some currencies touched years of age.

From the beginning of Trump’s second term last month, the Chilean Peso has gained more than 3 percent, while Colombian Peso and Brazilian Real have increased more than 6 percent against Greenback.

The strategists of the Bank of America have become positive about the emergency markets in the belief that the bets are on the higher dollar, which is strongest under the actual conditions of an effective course since 1985, overloaded.

“It’s a very extreme positioning, and a lot of tariff noise is already appreciated,” said David Hauner, head of the global emerging market.

“It’s not like it can’t get worse – of course, it could be – but for now, given the rear and back in the last few weeks, we are priced at a fair amount.”

Investors say that central emerging market banks have space to reduce borrowing costs to support economic growth, after aggressive rates have increased in recent years to deal with inflation. Mexico, Czech Republic and India all reduced the rates last week.

Real interest rates – which are adapted to inflation – are also larger in most of the world in development than in the US, which makes profitable borrowing in dollars and investing in emerging markets.

“No matter how you cut or cut it, local currencies have become very, very cheap – even if the dollar does not weaken from here, which is only stabilized,” said the emergency market manager, which has just returned from Brazil looking for cheap property prices.