Can Rachel Reeves increase the weak economic growth of the UK?

On Wednesday, the chancellor will say that the low Green Growth of the UK “is not our destiny” in a speech that has promised to improve the economic potential of the country.

The Rachel Reeves Initiative will include a scheme for better connecting the Oxford and Cambridge High production area, with plans for new railway projects and tanks.

However, the background of her speech is extremely gloomy, after the economy is set in the second half of 2024 and a business trust in the midst of tax price increases in the October budget.

What is a sick economy in the UK since the election?

It is estimated that the UK failed to grow in the second half of last year, after a relatively strong start by 2024. The exit is likely to underline the budget responsibility office for 2025, and the IMF predicted a spread of 1.6 per 1.6 cent in its latest chances.

One of the factors that withdrew growth was a British “very bad international trade effect,” said Andrew Wishart, an economist from Berenberg, and overall exports falling while they were stable in other large economies. High production costs in the UK have weighed in the export sector, he added, because companies face some of the highest electricity costs in the developed world, along with an unusually high increase in labor costs.

At the same time, the leading services sector ceased to contribute to the overall growth. The services increased growth in early 2024, with an extension of 0.9 percent in the first quarter, but did not record growth in three months to September and three months until November, the latest available data.

Alan Taylor, a member of the Committee on the Monetary Policy of the Bank of England, warned of “biting confidence” for “squeezing financial flows” and businesses and households, in the form of increasing taxes and continuation of high mortgage costs.

What was the impact of the first budget of work?

Business groups say that the elements of the work budget in October have worsened this non -inspirational image.

Reeves ‘decision to raise £ 25 billion by increasing their contributions for national employers’ insurance, together with a sudden increase in national life salaries, she added employment costs and abruptly withdrew business feelings.

There are increasing signs that companies will shed some staff while trying to keep the costs under control. S & p Global managers to buy a flash Last Friday’s poll showed that a net share of companies was reduced by the number of staff in January and December the largest of the global financial crisis in 2009, except the beginning of Pandemia 2020.

Sushil Wadhwani, a former Bank of England setting, said Reeves “lost a growth story” in part and as a result of an increase in companies tax, How to quickly reduce interest rates.

“This is a lot about animal spirits, and she damaged the spirits of animals,” Wadhwani said.

What are long -term problems?

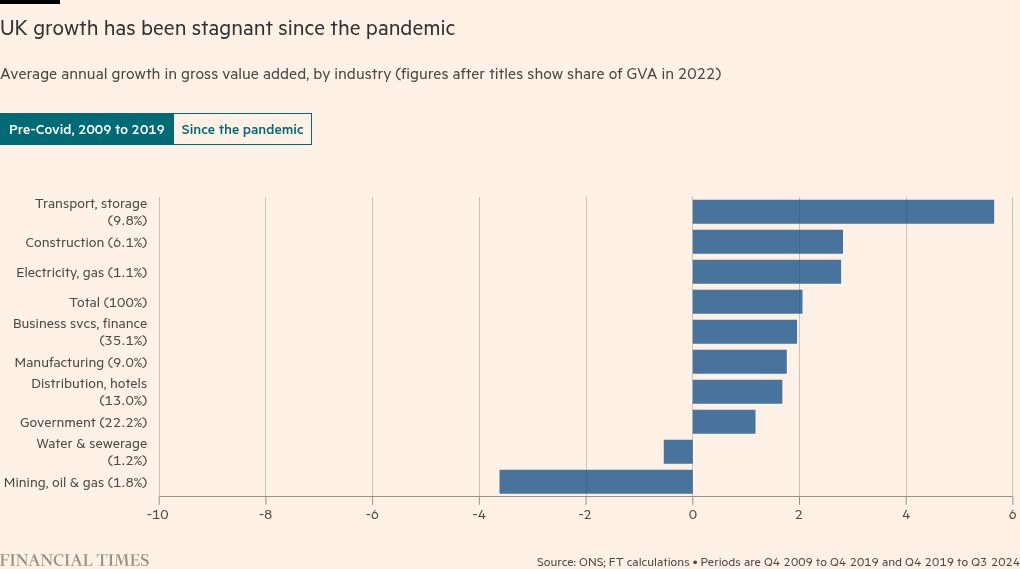

All this comes in the context of a weak long -term image in the UK, especially Moribund productivity. The clock production worked for April to June 2024. It decreased by 0.9 percent compared to the same quarter a year ago, according to ONS.

Compared to the Q4 2019, before the pandemic, production per hour increased by only 0.8 percent, according to the latest data, which is significantly below the previously estimated 2 percent. This is especially poor compared to the US, where labor productivity has increased by 8.3 percent in the same period, in charge of factors, including strong corporate investments and flourishing of the technological sector.

Business investments were bad, especially during a long period of stagnation after the Brexit referendum in 2016.

In three months to September 2024. Business investments increased by 5.7 percent compared to the same period of the previous year, according to official data. But it was the same amount in eight years since the beginning of 2016, which reflected the lack of growth after voting for the abandonment of EU contraction during the pandemic.

This is a much weaker rate than in the US, where private non-residency fixed investments increased by 40 percent since 2016. And at eight before the Brexit referendum, a business investment in the UK increased by about 26 percent.

How will Reeves try to change the narrative?

Reeves promised radical changes in the British planning system to unlock more infrastructure projects and houses’ construction as well as reforms for better Tap on pension savings.

She signaled her support Third runway at Heathrow Airport To increase the connection, with support for so -called Onion Oxford-Cambridge This would amplify the exit in the science rich region.

The industrial strategy focused on key sectors, including advanced production, creative industry such as film and TV, and financial services will follow in the spring.

Since Donald Trump promised to reduce regulation in the United States, the Government of the UK also promises a job that will be refused to bureaucracy, including the mitigation of restrictions on mortgage loans Change of leadership at the competition regulator.

A new national body for transformation of infrastructure and services has been announced to face the endemic delays of the project.

Jim O’Neill, former Minister of Treasury and Economist Goldman Sachs, said it was crucial to the chancellor to convince the private sector that the growth trend in the UK could be abolished, which meant an explanation of the value of its investment strategy.

The bad growth rate reflects poor investment and productivity, O’Neill said. “Its frame, in principle, is designed to deal with the team, but they have to be serious about it and ensure that anyone who will be the co-investor believes that.”

Will they succeed?

Wadhwani said it suspected that a short -term image would improve if Reeves “does not break the expectation” that taxes will need to increase again with regard to the poor state of public finance.

Progress in lowering barriers to trade with the largest market in the UK would provide a positive rush to the mood, he added.

Michael Saunders, from Oxford Economics, said that many of Reeves’ policies about public and private investments make sense, but they didn’t go far enough. The government was supposed to focus on strengthening investment in intangible assets, not just physical, he said.

And he is likely to confront the lack of construction workers with respect to the width of his infrastructure and housing ambitions, he added, which meant designing a convincing workforce development plan plan

“A wider strategy for potential growth is needed,” he said. This means “cases of a case for policies on the side of an offer paid for more than 10 to 20 years.”

Keith Fray data visualization