What does Deepseek’s AI actually mean for the market

Unlock free Digest editor

Roula Khalaf, editor of FT, chooses her favorite story in this weekly newsletter.

This article is a version of our careless bulletin on the spot. Premium subscribers can apply here To deliver the newsletter every working day. Standard subscribers can upgrade to premium hereor investigate All ft newsletters

The most important trend of finance in the last 40 years is the appearance of industrial structures in technology. We live in the world of network effects and increase yields to proportions. In the industry with PC software (Microsoft), Internet Search (alphabet), Internet retail (Amazon) and social media (target) to high consumer hardware (Apple), most profits and market stakes have moved to one company. Only moderate exaggeration is to say that everything that was important for investors in the last few decades was on the right side of one or more of these winner stories.

So, it is natural that everyone either assumed, wanted or afraid that the next big technological trend, artificial intelligence, would approximately this economic structure. What happened yesterday in the markets was no surprise, nor panic, nor a bubble. These were prices in little The greater chance of Ai is not the winner’s game.

It was always imaginable that the AI revolution would be like an invention of a car or plane. These revolutions led to the creation of huge, permanent profitable companies, but also a lot of competition, ensuring that much of the values created go to consumers, not shareholders. Now it looks like a significant opportunity for AI.

Most readers will know the news so far. Deepseek, a Chinese AI company, has released Ai model called R1, which is comparable to the best models of companies such as Openi, Anthropic and Meta, but is dressed at radically lower costs and using less than the most modern artist GPUs. Deepseek has also made enough public details of the model that others can run it on their computers (but not necessarily enough for others to recreate it).

This puts three breakthroughs in the theory of AI winner. Defines the idea that the best AI results can only be achieved with Nvidia’s best chips and software; The idea that only the largest technological companies could afford to build and run high quality AI models; And the idea that only companies with their own AI models can offer great AI apps.

What has kept Nvidia’s mission of shares in the last two years has been pure computer superiority. His chips were better miles for AI. Deepseek built R1 with Nvidia’s older, slower chips, which make US sanctions export to China. This suggests that the doors are open to other silicon competitors.

Further, cost. The biggest technological companies looked more or less isolated than the competition on AI, because, alleged, the only way to build a better Ai model was to train with multiple entrances using more computer forces, with huge costs. The finished model would then be controlled by a large company that built it. The obstacle to entry was money – that’s why Big Tech went to the data center. But R1 suggests that less money companies can soon manage competitive models.

Finally, applications. “Conclusion” is a place where the user really fills AI: answers to questions, tasks completed. It was assumed that each application would depend on larger models and servers to conclude. However, models like R1 can do well enough and make a cloning effective enough to start on servers of all kinds of companies that will not need to “rent” from a company like Openi.

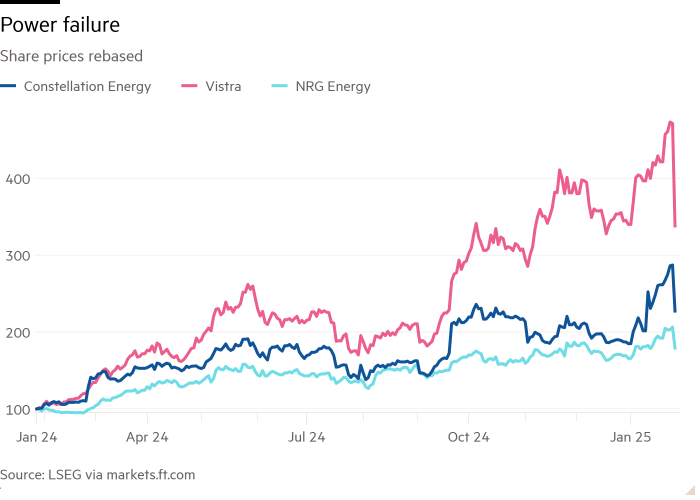

All this has great implications. But besides Nvidia, the big Padua yesterday were not magnificent seven great technologies. AI halos of these companies remain directly in place. The real damage was done with the supplies behind the emerging data center. Constellation, a utility company that covers the center of the Middle Ayatlantic Data Center, Vistra, a large energy supplier in Washington, and NRG, the main player of northeast and Texas, all have become difficult:

Ge Vernova, Eaton and Quanta Services build electricity systems for data centers. Oracle just announced an investment in Big Data Center. Broadcom and Aristo provide non-GPU technology by data centers. They were all broken:

Amazon, alphabet, meta and Microsoft have invested very in AI data centers. They may have lost some of that money – but now they could be free to spend less. Apple and Microsoft, whose natural power could be under construction of apps for AI models, not the models themselves, could even be in a better position.

Nvidia herself is hard on her knees. His ownership language of coding, miracle, is still an industrial standard. And just because the Deepseek model is more effective does not mean that leaner models will not benefit from the greater computer power offered by the best NVIDIA chips. While its shares fell to almost 17 percent yesterday, it only returns to (very, very high) level September:

We should not overestimate the market reaction to R1. Nasdaq fell 3 percent. It was a bad day, not panic. The winning view of Ai was wounded, not dead. Ai the bubble, if that is what it is, maybe it’s pop, but yesterday he didn’t show up. Not even close.

One good reading

Robert.armstrong@ft.com and aiden.reiter@ft.com.

Ft insurmountable podcast

You can’t get enough unexpected? Listen Our new podcastFor a 15-minute dive on the latest news of markets and financial titles, twice a week. Catch in the past editions of the Bulletin here.