US watchdog sues Elon Musk over late disclosure of Twitter stake | Technology

The US Securities and Exchange Commission says Musk’s failure to disclose the holdings allowed him to pay less than $150 million for the stock.

Elon Musk is being sued by a US securities regulator for allegedly failing to disclose his stake in Twitter in time before buying the social media platform.

The US Securities and Exchange Commission (SEC) said on Tuesday that Musk failed to disclose within 10 days that he had acquired more than 5 percent of Twitter shares in March 2022.

The Tesla and SpaceX CEO’s failure to notify regulators allowed him to continue buying stock at “artificially low prices,” the SEC said in a filing in the U.S. District Court for the District of Columbia.

Musk’s actions ultimately allowed him to “underpay at least $150 million for shares he purchased after his beneficial ownership report was required to be filed,” the SEC said.

Musk finally notified regulators that he had acquired more than 9 percent of Twitter’s stock on April 4, 2022, 11 days after the announcement was due, the SEC said.

Twitter’s share price rose 27 percent that day from the previous day’s close, according to the regulator.

“Because Musk did not timely disclose his beneficial ownership, he was able to make these purchases from an unsuspecting public at artificially low prices that did not yet reflect undisclosed material information about Musk’s beneficial ownership of more than five percent of Twitter’s common stock and for investment purposes,” the securities regulator said.

“In total, Musk underpaid Twitter investors more than $150 million for his purchases of Twitter common stock during this period. Investors who sold Twitter common stock during this period did so at artificially low prices and thus suffered substantial economic harm.”

US securities regulations require investors who buy more than 5 percent of a company’s stock to disclose their stake so that shareholders can make informed investment decisions.

The SEC has already sued Musk twice, including over a 2018 Twitter post in which he claimed he had secured funding for the possible privatization of electric car company Tesla.

Musk settled that lawsuit by paying a $20 million civil penalty, agreeing to subject some of his social media activities to legal review and stepping down from his role as Tesla chairman.

Musk completed the purchase of Twitter in October 2022 for $44 billion, after signing an acquisition agreement that he later tried to renege on.

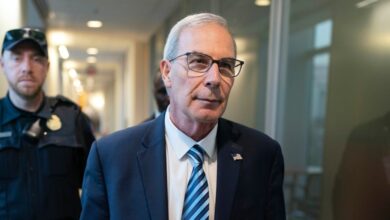

The SEC’s latest enforcement action, which was announced with little fanfare, comes days before Chairman Gary Gensler is due to step down on January 20, the day of US President-elect Donald Trump’s inauguration.

It is unclear whether the trial against Musk, one of Trump’s most influential allies, will continue under Trump, who has named Paul Atkins, a former SEC commissioner, as Gensler’s successor.